After a year of chest thumping, President Donald Trump hasfinally delivered the type of trade blow his political base hasbeen craving.

|Trump slapped tariffs on imported solar panels and washingmachines on Monday in his first major move to level a globalplaying field he says is tilted against American companies. Thedecision came two days after the one-year anniversary of hisinauguration as he prepares to travel to the World Economic Forumin Davos, Switzerland, where his “America First” stance is likelyto be at odds with the global business and political elite.

|

The key now is whether the shift from protectionist rhetoric tohard action will disrupt the broadest global recovery since theworld was pulling out of the financial crisis. The initial verdictfrom markets: probably not. Even those directly affected, such asLG Electronics, pared losses in Tuesday trading. JinkoSolar,China's biggest panel maker, said the outcome is “ better thanexpected.”

|“The economic impact is not material,” Trinh Nguyen, a senioreconomist at Natixis SA in Hong Kong and former consultant to theWorld Bank, said Tuesday in a Bloomberg Television interview. “Theconcern really is whether or not this is a trend with more tocome.”

|Much will depend on how China responds. While officials inBeijing voiced displeasure Tuesday, saying the tariffs were a“misuse” of trade measures, their response was restrained, for now.But there's a list of things the world's second-largest economy cando if the U.S. ratchets up the pressure further.

||

China Has Targets Aplenty to Retaliate Against U.S. TradeAction

Eleven Pacific nations led by Japan agreed on the text of theirown trade accord Monday and are aiming to sign the deal in March,Singapore's trade ministry said. The Trans-Pacific Partnershipdoesn't include China, however, and Trump pulled the U.S. out ofthe talks shortly after taking office last year.

|There are also still several key files remaining on thepresident's desk that could lead to further tension between theworld's two biggest economies. Trump has about three months todecide whether to impose tariffs on imported steel and aluminum,while his top trade official is probing China'sintellectual-property practices.

|U.S. negotiators are hunkered down in Montreal this week withtheir Canadian and Mexican counterparts, trying to fashion anupdate to the North American Free Trade Agreement (NAFTA). A toughline there could suggest Monday's actions are just the start.

|In Europe, governments are following the Trump administration'smoves closely. Germany, which has been the subject of Trumpcriticism for its trade surplus with the U.S., is seeking talkswith the administration on the tariffs, said acting FinanceMinister Peter Altmaier.

|“Our position is that the fewer the tariffs, the lessprotectionism, the better it is for the people in our countries,”Altmaier told reporters in Brussels.

|Portugal's Economy Minister Manuel Caldeira Cabral said in aninterview in Davos that the European Union has a chance to step inand promote itself as defender of free trade. “By sending thismessage, the EU is going to differentiate itself from other regionsin the world that are having doubts about gains from trade,” hesaid.

||

What Our Economists Say…

“Coming ahead of Trump's Davos trip, the solar and washingmachine tariffs are striking but still fall into the narrowcategory,” said Tom Orlik, Bloomberg Economics chief Asia economistin Beijing. “The big question on U.S. tariffs heading into 2018 isif new measures will be narrow and bad news just for targetedsectors or broad and risk tipping over into a drag on overallgrowth.”

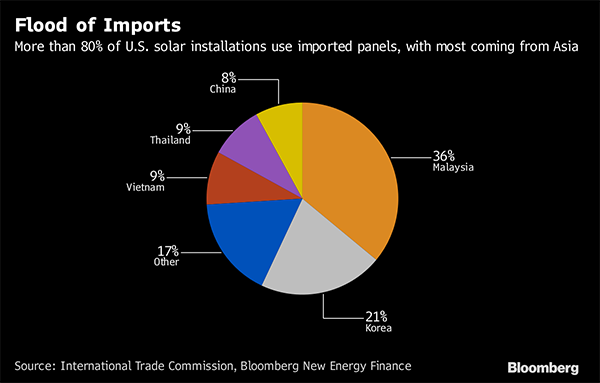

|For now, the countries and companies on the receiving end of theTrump tariffs are not declaring crisis. Through its subsidiaries inneighboring Asian nations or directly, the biggest impact ispotentially in China, the world's largest producer of solarpanels.

|The nation is also a major exporter of washing machines, selling21 million units abroad worth just under 19 billion yuan ($2.9billion) globally from January through November 2017, according tocustoms data.

|Chinese solar manufacturers have been figuring out how to dealwith the ups and downs of the trade outlook with the U.S. foryears, and most recently since the U.S. International TradeCommission ruled that the influx of cheaper foreign panels washurting domestic producers.

|The president approved four years of tariffs that start at 30percent in the first year and gradually drop to 15 percent. Thefirst 2.5 gigawatts of imported solar cells will be exempt from thetariffs, USTR said in a statement Monday. The solar tariffs arelower than the 35 percent the ITC recommended in October. The bodywas responding to a complaint by Suniva Inc., a bankrupt U.S. panelmaker that sought duties on solar cells and panels.

|In the washing-machine case, Trump was responding to an ITCrecommendation in November of tariffs following a complaint byWhirlpool Corp., which accused Samsung Electronics and LGElectronics Inc. of selling washing machines in the U.S. belowfair-market value.

|Trump opted for the most punitive recommendation by ITC judgesfor residential washers. He ordered a 20 percent tariff on importsunder 1.2 million units, and 50 percent on all subsequent importsin the first year, with duties lowering in the next two years.

|From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.