World Vision International iscommitted to doing good around the world, and doing it in a bigway. The organization, which has annual revenue of nearly US$3billion, operates in remote and rural areas within about 100different countries.

World Vision International iscommitted to doing good around the world, and doing it in a bigway. The organization, which has annual revenue of nearly US$3billion, operates in remote and rural areas within about 100different countries.

“We are a child-focused organization,” explains Ashwin Ramji,the global assistant treasurer for WVI. “We work with communitiesto identify what work is needed to improve the well-being ofvulnerable children in those communities, then we commit tolong-term projects that meet those needs. We may go in for 10 to 15years with projects that focus on education, water and sanitation,irrigation, or housing—whatever the local community needs.” WVIfunds these projects through child sponsorship and other donationprograms.

|In addition, Ramji says, “working with communities and ourpartners, we are advocates for child well-being outcomes, both atthe U.N. and in our work with local governments. For example, weare very active throughout Southeast Asia in advocating againstchild slavery and sex trafficking.”

|Operational decision-making in this environment tends to bedecentralized. “When you're targeting specific communities inremote areas, you can't really make the operational decisions fromheadquarters,” Ramji says. This approach makes sense, but it cancreate challenges for support functions such as treasury andfinance.

| “We operate in many locationswhere the banking structure is weak or even nonexistent,” reportsPeter Dong, WVI's director of global cash management. “At onepoint, World Vision was using more than 200 banks, and properlymanaging the controls on all those accounts was unwieldy. Given theexternal emphasis on KYC [Know Your Customer] and sanctionscompliance issues, it made sense for us to start centralizing manyof our banking functions.”

“We operate in many locationswhere the banking structure is weak or even nonexistent,” reportsPeter Dong, WVI's director of global cash management. “At onepoint, World Vision was using more than 200 banks, and properlymanaging the controls on all those accounts was unwieldy. Given theexternal emphasis on KYC [Know Your Customer] and sanctionscompliance issues, it made sense for us to start centralizing manyof our banking functions.”

First, global treasury used an RFP process to select eight largebanks that were financially stable, had strong correspondentbanking networks, offered the right mix of cash management productsand services, and had a global footprint similar to WVI's. Toensure that each banking relationship encompassed as broad ageographical reach as possible, the organization grouped most ofthe countries in which it operates into “clusters” and instructedthe banks to bid on clusters rather than on individual countries.This prevented the banks from cherry-picking only the mostdesirable markets. For example, in order to win WVI's business inhigh-value Kenya, a bank would also have to be competitive incountries such as Somalia and South Sudan.

|The RFP process was time-consuming but worthwhile. WVI was ableto divvy up the banking business for 58 of its 67 offices among theeight participating banks. “The bank rationalization projectexcluded only countries like Ethiopia and Nicaragua,” Ramjiexplains. “These are markets in which only very local banks canoperate.”

|Next, the organization undertook the “solutioning” phase of thebank rationalization, with multiple goals in mind. “Obviously, wewanted to reduce the number of banking relationships and the numberof accounts we had,” says Kimberly Floyd, WVI's senior analyst,global cash management, who served as project lead. “We also wantedto convert payments from cash and check to electronic formats asmuch as possible, in order to improve efficiency for our staff. Wewanted the banks to have a contingency process in place to helpensure that business would continue even in a disaster scenario.And in countries where it was feasible, we asked the banks toprovide employee benefits.”

|Finally, Dong adds, WVI aimed to implement cash managementdiscipline throughout its operations around the globe. “We workedwith our banks to ensure that we have the most efficient cashmanagement system in place in each region, whether that means a ZBA[zero-balance accounts] structure, interest optimization, or takingadvantage of payments-related services.”

|Each bank that won a cluster of business through the RFP processmatched members of its own local staff with select local WVIemployees. Together, they performed extensive due diligence on thepayment and cash requirements for each country within the bank'scluster. “The WVI staff who would ultimately be using the serviceswere the liaisons to the banks, as the banks were trying to craftsolutions,” Dong says. “For more than two years, these liaisons metwith their banks on a weekly basis. We asked the banks to resolveany cash management issues our staff was having difficulty with. Insome cases, their answer was that they couldn't do exactly what werequested, but they would come up with an alternative solution.Transparency was crucial in both directions, and this extensivecommunication was the key to success.”

|WVI global treasury had to overcome several challenges beforeachieving this free-flowing communication. “Challenges includedeverything from language barriers to cultural differences toinconsistencies in the meaning of certain cash management terms,”Floyd says. “In some cases, we had miscommunications aroundproducts, services, and capabilities simply because staff came fromdifferent cultural and educational backgrounds. We overcame thesetypes of challenges by making sure we had a communication line thatwas always available.”

|To that end, Floyd and global treasury analyst Michael Lawsonserved as global project managers who were available to answerquestions from either banks or local WVI staff.

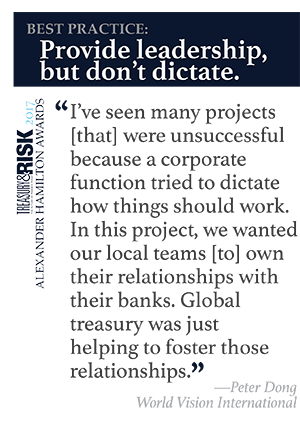

|“I've seen many projects like this, from the perspective of boththe bank and the nonprofit organization,” Dong says. “Many wereunsuccessful because a corporate function tried to enter eachcountry and dictate how things should work. In this project, wewanted to make sure our local teams would own their relationshipswith their banks, and global treasury was just helping to fosterthose relationships.”

|Now the 58 WVI offices that participated in this project haveconsolidated their accounts into eight banks, down from the 200 theorganization used previously. Global treasury estimates that thisconsolidation is saving World Vision between $10 million and $15million per year by reducing fees charged on unnecessary accounts,reducing staff resources required to manage myriad bankingrelationships, and increasing WVI's negotiation position by havingbanks bid on clusters of countries at once.

|“Some of the countries that World Vision operates in aredifficult,” Ramji says. A system that works smoothly, so thatcontractors are paid on time, helps ensure the safety and securityof the organization's field operations.

| “It's important to have theglobal treasury function at the center of a project like this,”Dong adds. “Treasury understands what the banks can provide. Thetreasury team should also understand what banking products theorganization's local operations require.

“It's important to have theglobal treasury function at the center of a project like this,”Dong adds. “Treasury understands what the banks can provide. Thetreasury team should also understand what banking products theorganization's local operations require.

“For World Vision, the bank rationalization project has raisedthe profile of the global treasury team because the project touchedso many parts of the organization,” Dong concludes. “Now when othergroups within World Vision have an upcoming project, they may cometo us and ask how that project will impact their bankingrelationships. Or they may have a need for funding and come totreasury to find out where that funding can come from. Theorganization now sees treasury as a strategic partner.”

2017 Alexander Hamilton Awards — Best Practices inRestricted/Emerging Markets

- Gold: Honeywell | Opening the Credit Umbrella in China

- Silver: Pfizer | Transition to the CNY

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.