Federal Reserve Chairman Jerome Powell showed he will be guidedby the U.S. economy's performance, rather than the theories andmodels his predecessors have relied on to set monetary policyfor the past three decades.

|Fresh from overseeing his first policy-setting meeting and itsfirst interest rate hike of 2018, Powell signaled he won't try toguess the limits of the labor market or the growth-boosting effectsof Republican tax cuts.

|His message: He'll know the economy is changing when he sees it.“There is no sense in the data that we are on the cusp of anacceleration of inflation,” Powell told reporters on Wednesday inWashington. “We have seen moderate increases in wages and priceinflation, and we seem to be seeing more of that.”

|Shortly before Powell spoke, the Federal Open Market Committee(FOMC) raised interest rates for the sixth time since December2015. Financial markets largely took the move in stride. The targetrange for the federal funds rate was increased by a quarterpercentage point, to 1.5 percent to 1.75 percent, the highest sincethe 2008 collapse of Lehman Brothers Holdings Inc. froze creditmarkets worldwide.

|“This decision marks another step in the ongoing process ofgradually scaling back monetary policy accommodation—a process thathas been under way for several years now,” Powell said in openingremarks to reporters that signaled policy continuity with hispredecessor, Janet Yellen.

|Policy similarities aside, there were stylistic differences. Inaddition to keeping his remarks short—the press conference was ascant 43 minutes compared to Yellen's somewhat longer performances— he also declined to be drawn deeply into professorial discussionsabout the economy.

|

What Bloomberg Economists Say

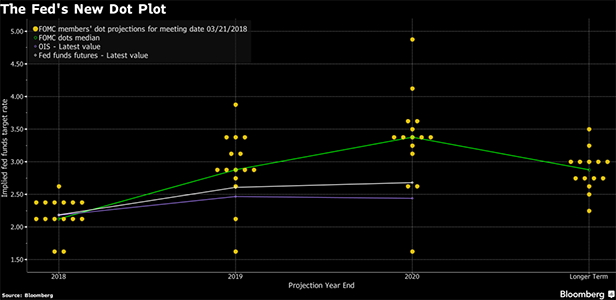

“The Powell Fed is proceeding with asimilar sense of gradual deliberation, at least for now. The dotplot revealed policymakers shifting toward a faster pace oftightening in outlying years, consistent with Bloomberg Economics'expectation for them to 'backfill' rate hikes into 2019-2020.” —Carl Riccadonna & Yelena Shulyatyeva, Bloomberg Economics

Powell, 65, is a former private-equityexecutive, the Trump administration appointee brought up todescribe how businesses consider tax policy when making investmentdecisions. Asked whether tax cuts will deliver supply-sidebenefits, he concluded, “the whole thing is very uncertain.”

|His lack of economic formalism camethrough again as he backed away from being specific about thechanging relationship between labor market slack and inflation—acritical issue now for the pace of Fed tightening. “He may be evenless constrained than Chair Janet Yellen in his thinking,” saidJulia Coronado, president of Macropolicy Perspectives LLC in NewYork. “He is not as tied to models or theory and may be moreinclined to take signals from incoming data.”

|The economic data are improving in several areas, including thejob market. The median FOMC estimate in the March forecasts for theunemployment rate show it averaging 3.8 percent in the finalquarter of 2018 and 3.6 percent in 2019 and 2020—below the 4.1percent rate reported in February.

|Overshooting Full Employment

|That would represent a three-year overshoot of the Fed's 4.5percent estimate for the unemployment rate that keeps labor supplyand demand in balance. Still, the committee's response was not toshift to a faster pace of rate increases this year. Officialscontinued to project two more rate hikes in 2018, followed by threemoves in 2019 and two further increases in 2020.

|The moderate path is partly a result of the heavyinertia in the economy that Fed officials see holdingback inflation. They forecast headline inflation of 1.9 percent forthis year, 2 percent in 2019, and 2.1 percent in 2020. They havebeen under their 2 percent target for almost every month sinceApril 2012.

|A median forecast above the Fed's 2 percent target is a “dovishdevelopment,” Roberto Perli, a partner at Cornerstone Macro LLC inWashington, wrote in a research note. “The FOMC is telling us thatPCE inflation will not hit 2 percent any time soon, and when itdoes the Fed won't get too excited,” he said.

|“The theory would be if you get below the sustainable rate ofunemployment for a sustained period, you would see an accelerationof inflation,” Powell said in response to a question. “We are veryalert to it. But it's not something we observe at the present.”

|Powell noted that labor market supply was responding to jobmarket strength. He said the amount of people participating in thelabor force moved higher in February and has remained roughlyunchanged for the past four years despite a demographic pulldownward.

|“That is a sign of improvement, given that the aging of ourpopulation is putting downward pressure on the participation rate,”said Powell, who indicated he's willing to consider more than thefour press conferences that the Fed currently schedules after itseight policy meetings a year. “We expect that the job market willremain strong.”

|Perli said Powell's “tone was very balanced, and he deliveredthe message as clearly as anyone could have hoped. He seemsdefinitely ready for having a press conference after everymeeting.”

|From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.