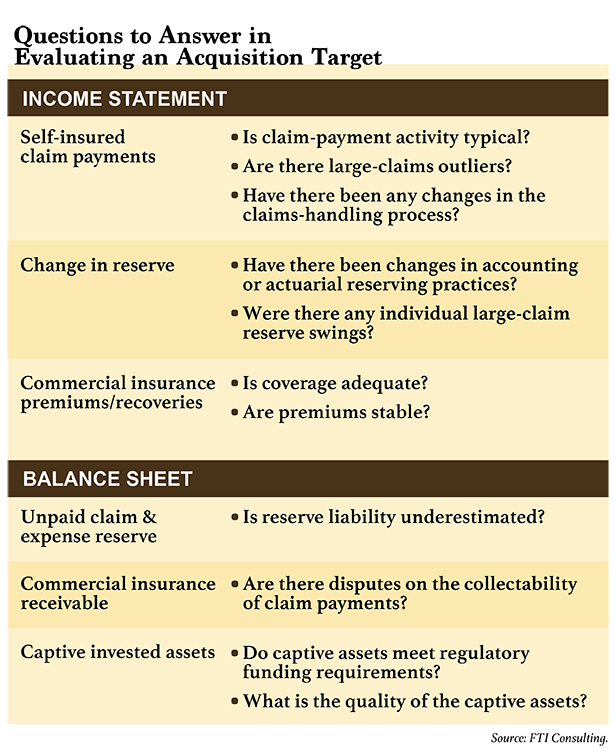

1. Understated Claim Reserve Liability

Risk 2: Changes in Reserving Practice

|

Risk 3: Large-Claim Volatility

|Risk 4: Inadequate Captive Funding

Following a Transaction

- Gauge the combined company's riskappetite. Post-acquisition, the combined company willbe larger and likely more diverse. Thus, it may be smart to raisethe newly combined company's self-insured retention or insurancelimits. Working with an actuary or a broker to explore the bestcoverage options will help the newly formed company determine itsoptimal retention levels.

- Expedite systems integration. After amerger or acquisition, the new organization will need to determinehow to handle claims and manage risks as one company. It's notuncommon for two claim systems to run concurrently during atransition period, but the company will want to develop bestpractices over time to eliminate redundancies. Bringing in a thirdparty can help expedite the process.

- Consider unwinding the captive. Themerged company may want to consider consolidating the target'scaptive into its own or running off the existing claims.Consolidation generally reduces costs; running multiple captives atonce would be costly. Also, as there are fewer claims leftoutstanding, the ratio of variable claims payments to fixed captiveoverhead expense makes running a separate captive less and lessattractive. Because existing claims could take years to run off,the company may want to perform a loss-portfolio transfer of theremaining outstanding claims.

Jim Tooleis amanaging director at FTI Consulting, where he leads the life andhealth actuarial team in the Global Insurance Services practice. Heis also a contributor toFTI Journal.Toole has more than25 years of management and technical experience in the life,health, P&C, and captive-insurance industries, including avariety of roles leading consulting firms and insurancecompanies.

Jim Tooleis amanaging director at FTI Consulting, where he leads the life andhealth actuarial team in the Global Insurance Services practice. Heis also a contributor toFTI Journal.Toole has more than25 years of management and technical experience in the life,health, P&C, and captive-insurance industries, including avariety of roles leading consulting firms and insurancecompanies. Robert Stewartis adirector at FTI Consulting in the Global Insurance Servicespractice, and is also a contributor toFTIJournal.He is a credentialed property-casualtyactuary with more than 10 years of insurance and reinsuranceexperience.

Robert Stewartis adirector at FTI Consulting in the Global Insurance Servicespractice, and is also a contributor toFTIJournal.He is a credentialed property-casualtyactuary with more than 10 years of insurance and reinsuranceexperience.Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.