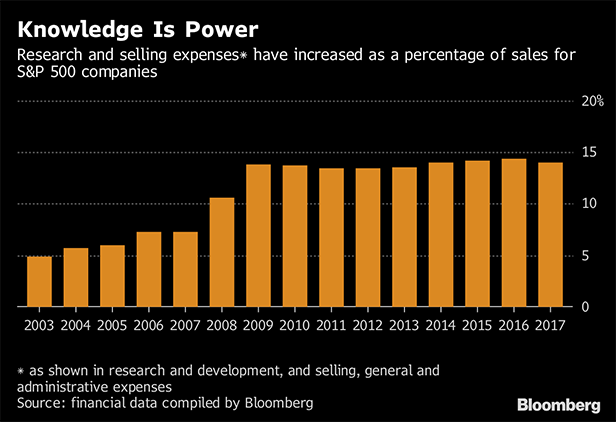

Here's how it works. When acompany splurges on developing software, accounting treats it likerenting office space: You're spending money to keep the businessgoing, but not acquiring anything with future benefits. If you buya building, however, that becomes an asset on the balance sheet,its cost spread over a long time.Not recognizing intangible assetscan push down both profits and book value in businesses that dependon research and marketing, which are increasingly important in theglobal knowledge economy. Just think Tesla Inc., Nike Inc., orGilead Sciences Inc.“You've got all these assets that don't showany value in their financial statements that are just becoming moreand more valuable in today's society,” said Travis Fairchild, afund manager at O'Shaughnessy Asset Management in Stamford, Conn.“We've moved from an industrial marketplace to much more of atechnology and intangible asset industry, and that's just creatinglarger and larger distortions.”Intangible investments—everythingfrom employee expertise to customer data—are on the rise. Spendingon research and sales as a percentage of revenue rose to 14 percentin 2017 for S&P 500 stocks, compared with 7 percent a decadeago, data compiled by Bloomberg show.Yet under accounting rules inplace since the 1970s, intangibles are expensed rather thancapitalized, unless they were acquired. There are also minorexceptions, such as costs of developing a software that's ready tobe sold.This matters for metrics used to determine whether a stockis cheap or pricey, such as price-to-book or price-earnings, whichare often used to compile indexes tracking investment styles suchas value. Fairchild believes unreliable book values mean somecompanies classified as growth stocks are actually value stocks.For investors, the question is whether it's worth tweaking themeasures at the risk of introducing subjectivity into cold, hardnumbers.Some fund managers are already making the move.O'Shaughnessy Asset Management is developing a proprietary bookvalue factor that would take into account intangibles. State StreetGlobal Advisors' models adjust for them, according to Olivia Engel,chief investment officer of active quantitative equities at thefirm.“In the world of today, we need to customize, sector bysector, the most useful multiple given the difference in accountingand, of course, the intangible side, which has changed a lot,” saidAngelo Meda, Milan-based head of equities at value investor BanorSIM SpA. “What was useful in the past is now a little bit morecomplicated.”But with global stocks just a few months off ahistoric high, there's the risk that adjusting for intangibles,which are especially hard to value, becomes an excuse to justifybuying pricey tech shares. Book values also remain useful for somesectors, such as financials or industrials, Meda added.“Investorsneed to be quite conservative not to try to be too cute or toocreative in trying to value each individual company in a way thatsupports their idiosyncratic thinking,” said Vitali Kalesnik,London-based head of equity research at Research Affiliates LLC,which pioneered smart-beta investing.One of the effects of the riseof intangibles is that companies with negative book value,traditionally a red flag for investors, have become more common.There are now 187 stocks worldwide with negative net assets and amarket value of at least half a billion dollars—with an averagereturn of 27 percent in the past year—compared with 90 a decadeago, data compiled by Bloomberg show. The list includes McDonald'sCorp., GlaxoSmithKline Plc, and Lockheed Martin Corp.To NYU's Lev,the rise of intangibles means the focus on earnings is pointless.In his 2017 paper, he argued that predicting earnings don't produceinvestment gains because they no longer represent value creation.He points to the example of Kite Pharma Inc., which had posted aloss every quarter since its public debut when Gilead Sciences Inc.bought it for $12 billion last year. What was Gilead after? Kite'scancer therapies.“Investors are becoming much smarter—some, atleast—and they are desperately looking for some information inthose intangibles,” he said. “You capitalize, you amortize, and youhave an income statement that says something, unlike today.”

Here's how it works. When acompany splurges on developing software, accounting treats it likerenting office space: You're spending money to keep the businessgoing, but not acquiring anything with future benefits. If you buya building, however, that becomes an asset on the balance sheet,its cost spread over a long time.Not recognizing intangible assetscan push down both profits and book value in businesses that dependon research and marketing, which are increasingly important in theglobal knowledge economy. Just think Tesla Inc., Nike Inc., orGilead Sciences Inc.“You've got all these assets that don't showany value in their financial statements that are just becoming moreand more valuable in today's society,” said Travis Fairchild, afund manager at O'Shaughnessy Asset Management in Stamford, Conn.“We've moved from an industrial marketplace to much more of atechnology and intangible asset industry, and that's just creatinglarger and larger distortions.”Intangible investments—everythingfrom employee expertise to customer data—are on the rise. Spendingon research and sales as a percentage of revenue rose to 14 percentin 2017 for S&P 500 stocks, compared with 7 percent a decadeago, data compiled by Bloomberg show.Yet under accounting rules inplace since the 1970s, intangibles are expensed rather thancapitalized, unless they were acquired. There are also minorexceptions, such as costs of developing a software that's ready tobe sold.This matters for metrics used to determine whether a stockis cheap or pricey, such as price-to-book or price-earnings, whichare often used to compile indexes tracking investment styles suchas value. Fairchild believes unreliable book values mean somecompanies classified as growth stocks are actually value stocks.For investors, the question is whether it's worth tweaking themeasures at the risk of introducing subjectivity into cold, hardnumbers.Some fund managers are already making the move.O'Shaughnessy Asset Management is developing a proprietary bookvalue factor that would take into account intangibles. State StreetGlobal Advisors' models adjust for them, according to Olivia Engel,chief investment officer of active quantitative equities at thefirm.“In the world of today, we need to customize, sector bysector, the most useful multiple given the difference in accountingand, of course, the intangible side, which has changed a lot,” saidAngelo Meda, Milan-based head of equities at value investor BanorSIM SpA. “What was useful in the past is now a little bit morecomplicated.”But with global stocks just a few months off ahistoric high, there's the risk that adjusting for intangibles,which are especially hard to value, becomes an excuse to justifybuying pricey tech shares. Book values also remain useful for somesectors, such as financials or industrials, Meda added.“Investorsneed to be quite conservative not to try to be too cute or toocreative in trying to value each individual company in a way thatsupports their idiosyncratic thinking,” said Vitali Kalesnik,London-based head of equity research at Research Affiliates LLC,which pioneered smart-beta investing.One of the effects of the riseof intangibles is that companies with negative book value,traditionally a red flag for investors, have become more common.There are now 187 stocks worldwide with negative net assets and amarket value of at least half a billion dollars—with an averagereturn of 27 percent in the past year—compared with 90 a decadeago, data compiled by Bloomberg show. The list includes McDonald'sCorp., GlaxoSmithKline Plc, and Lockheed Martin Corp.To NYU's Lev,the rise of intangibles means the focus on earnings is pointless.In his 2017 paper, he argued that predicting earnings don't produceinvestment gains because they no longer represent value creation.He points to the example of Kite Pharma Inc., which had posted aloss every quarter since its public debut when Gilead Sciences Inc.bought it for $12 billion last year. What was Gilead after? Kite'scancer therapies.“Investors are becoming much smarter—some, atleast—and they are desperately looking for some information inthose intangibles,” he said. “You capitalize, you amortize, and youhave an income statement that says something, unlike today.”Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.