“We would have fewer choices,potentially less quality, less productivity, and higher prices ifwe reversed globalization,” said Timothy Adams, president of theWashington-based Institute of International Finance, who'sdiscussed the chart and its implications with Fed policymakers.Justas globalization has been a headwind holding back inflation, itsunraveling could end up being a tailwind in the years ahead,pushing costs higher as countries and companies retreat from the internationalmarketplace. That would be on top of the one-time effect thatTrump's tariffs will have on prices of selectedimports, putting pressure on the Fed to raise interest rates at afaster pace than the gradual path it has currently mapped out.Thepresident has already imposed import duties on a wide range ofproducts, from steel and aluminum to washing machines and farmequipment. He's taken particular aim at shipments from China,levying $34 billion in tariffs on goods from thatcountry last week. China, Canada and some of the other nationsaffected have responded in kind.Administration officials argue thatTrump's tariffs are designed to convince other countries todismantle trade barriers, not erect new ones. Yet experts areskeptical, pointing to the president's focus on getting rid ofAmerica's bilateral deficits and his repeated attacks on the NorthAmerican Free Trade Agreement (NAFTA), which eliminated manytariffs among the U.S., Canada, and Mexico.“We're not gettingconcessions from other countries,” said Dartmouth College professorDouglas Irwin, author of the recently published “Clashing overCommerce: A History of U.S. Trade Policy.” “We're getting other countries angry at us, andthey're retaliating.”For years, globalization has “imparted asteady disinflationary bias” on open economies such the U.K. andU.S. because of competition from lower-cost foreign producers andlower paid foreign workers, Bank of England Governor Mark Carneysaid last September. Now there are small hints of what could happenif that goes into reverse.National Association of Home BuildersChairman Randy Noel said last month that record-high lumber priceshave added nearly $9,000 to the price of a new single-family homesince January 2017. The U.S. in November imposed average importduties of 21 percent on Canadian shipments of timber.Prices ofwashing machines sold in the U.S. have also surged after theadministration acted to restrict imports earlier thisyear.

“We would have fewer choices,potentially less quality, less productivity, and higher prices ifwe reversed globalization,” said Timothy Adams, president of theWashington-based Institute of International Finance, who'sdiscussed the chart and its implications with Fed policymakers.Justas globalization has been a headwind holding back inflation, itsunraveling could end up being a tailwind in the years ahead,pushing costs higher as countries and companies retreat from the internationalmarketplace. That would be on top of the one-time effect thatTrump's tariffs will have on prices of selectedimports, putting pressure on the Fed to raise interest rates at afaster pace than the gradual path it has currently mapped out.Thepresident has already imposed import duties on a wide range ofproducts, from steel and aluminum to washing machines and farmequipment. He's taken particular aim at shipments from China,levying $34 billion in tariffs on goods from thatcountry last week. China, Canada and some of the other nationsaffected have responded in kind.Administration officials argue thatTrump's tariffs are designed to convince other countries todismantle trade barriers, not erect new ones. Yet experts areskeptical, pointing to the president's focus on getting rid ofAmerica's bilateral deficits and his repeated attacks on the NorthAmerican Free Trade Agreement (NAFTA), which eliminated manytariffs among the U.S., Canada, and Mexico.“We're not gettingconcessions from other countries,” said Dartmouth College professorDouglas Irwin, author of the recently published “Clashing overCommerce: A History of U.S. Trade Policy.” “We're getting other countries angry at us, andthey're retaliating.”For years, globalization has “imparted asteady disinflationary bias” on open economies such the U.K. andU.S. because of competition from lower-cost foreign producers andlower paid foreign workers, Bank of England Governor Mark Carneysaid last September. Now there are small hints of what could happenif that goes into reverse.National Association of Home BuildersChairman Randy Noel said last month that record-high lumber priceshave added nearly $9,000 to the price of a new single-family homesince January 2017. The U.S. in November imposed average importduties of 21 percent on Canadian shipments of timber.Prices ofwashing machines sold in the U.S. have also surged after theadministration acted to restrict imports earlier thisyear. Fed policymakers have signaledthat they'll consider such direct price impacts as temporary andnot necessarily indicative of a shift in underlying inflationtrends.But distinguishing between the two might not be that easy,given that inflation is already on the rise and the economy isbeing juiced by fiscal stimulus late in an expansion, said EllenZentner, chief U.S. economist for Morgan Stanley in New York.In asign of the difficulties the central bank might face, St. Louis FedPresident James Bullard told reporters last month that somesuppliers were using the threat of new tariffs as a reason to raiseprices, even when new tariffs would not directly target theirbusiness.“The risk is the Fed could make a policy mistake” byincreasing interest rates more aggressively in response, Zentnersaid, though she doubts that will happen.Consumers, for their part,appear convinced that the Fed will be able to hold the line oninflation. The monthly reading on consumer prices for June will bereleased at 8:30 a.m. on Thursday in Washington.

Fed policymakers have signaledthat they'll consider such direct price impacts as temporary andnot necessarily indicative of a shift in underlying inflationtrends.But distinguishing between the two might not be that easy,given that inflation is already on the rise and the economy isbeing juiced by fiscal stimulus late in an expansion, said EllenZentner, chief U.S. economist for Morgan Stanley in New York.In asign of the difficulties the central bank might face, St. Louis FedPresident James Bullard told reporters last month that somesuppliers were using the threat of new tariffs as a reason to raiseprices, even when new tariffs would not directly target theirbusiness.“The risk is the Fed could make a policy mistake” byincreasing interest rates more aggressively in response, Zentnersaid, though she doubts that will happen.Consumers, for their part,appear convinced that the Fed will be able to hold the line oninflation. The monthly reading on consumer prices for June will bereleased at 8:30 a.m. on Thursday in Washington.What Bloomberg Economists Say About CPI

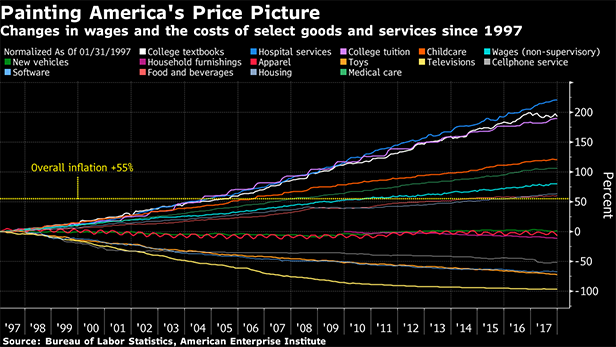

June CPI will show both headline andcore inflation pushing further above 2% in year-on-year terms Whileinflation pressures have been building of late, May CPI showed asignificant rollover of the three-month rate of change. This bearswatching, as it could be an early indication that the recent pickupin inflation pressures could be losing some momentumWhilehouseholds see inflation ticking up over the next year due totariffs and higher energy prices, they seem to believe that therise will be temporary. —Richard Curtin, Director, Universityof Michigan consumer surveysThat's allowing policymakers to focusmore of their attention on the potential impact of the tariffbattles on growth than on inflation.At their meeting last month,most Fed officials voiced concern that trade uncertainty“eventually could have negative effects on business sentiment andinvestment spending,” according to the meeting's minutes releasedlast week.The economic fallout would spread if multinationalcompanies scale back their decades-long drive to build up globalsupply chains and instead concentrate on making more at home.“Therewould be long term effects on the efficiency of production in theglobal economy,” said chart author Perry, who is an economicsprofessor at the University of Michigan.And potentially oninflation.The increased use of global supply chains in recent yearshas tended to hold down prices, according to research byMassachusetts Institute of Technology professor Kristin Forbes.“Soif this went into reverse, this could boost inflationarypressures,” the former Bank of England policymaker said in anemail.

Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.