The drab world of derivatives clearing, the financial plumbingdesigned to deliver $400 trillion of annual trades safely, wasnever supposed to be an emotive issue.

|But that depended on regulators preserving the post-2008 spiritof global cooperation. With Brexit inflaming rhetoric between theUnited Kingdom, United States, and Europe, banks and exchanges aredoing their best to prepare for the worst. The risk of the world'sfinancial plumbing breaking down along national lines, triggeringextra cost and disruption, is becoming real.

|Clearing has become a battleground. A no-deal Brexit doesn'tonly threaten the ability of London-based firms to seamlesslytransact business in the European Union (EU). It could also stopthe clearing of trillions of dollars of euro trades on British soilif EU regulators refuse to recognize the U.K.'s rules asadequate.

|That might seem draconian, but London's outsized dominance ofeuro clearing has always rankled on the Continent. Brexit is anopportunity to redress the balance. Doing so could cost firmsbillions of euros—but the move enjoys political support.

|It's unsurprising, then, that Deutsche Bank AG was one ofseveral firms that on Friday announced plans to sell their stakesin London Stock Exchange Group Plc's (LSE's) clearing subsidiary,LCH. Germany's number-one bank is already shifting its primarybooking hub to Frankfurt from London, potentially relocating 300billion euros of its balance sheet. It's possible that the stake inLCH—which could end up unable to clear over-the-counter derivativesfor EU firms in a worst-case Brexit—no longer seemed strategic. Thesale will also bring in some much-needed cash, but it sends abigger message that major Eurozone banks have different prioritiesnow.

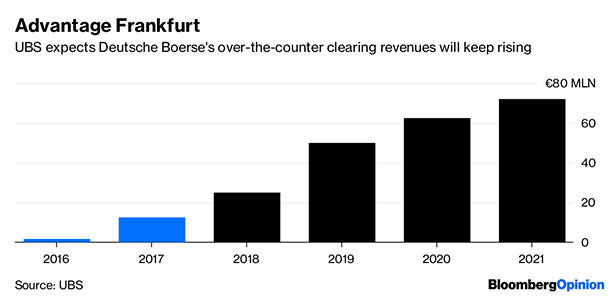

|Even before Brexit happens, the clearing business is voting withits feet. LSE's German archrival Deutsche Boerse AG is profitingfrom this uncertainty. The notional outstanding amount ofover-the-counter contracts cleared at Deutsche Boerse surged to 8.4trillion euros at the end of August, up from 1.8 trillion euros atthe end of 2017, according to UBS. The German exchange is steppingup competitive pressure with a new revenue-sharing model, and isdetermined to win business after several abortive attempts to mergewith the LSE. Brexit is an advantage on home ground.

See also:

- Brexit Financial-Market Threat

- Risk of Messy Brexit Mobilizes Corporate Europe andIts Bankers

- Stockpiling Blood and Food

- Brexit Is Reality

Disaster could always be averted. An optimist might view thecurrent situation as a minor, zero-sum game that won't up-endglobal finance, especially if regulators decide to cooperate forthe sake of stability. If the euro clearing market escapes anightmare scenario of fragmentation, the end result could be a 25percent market share gain for Deutsche Boerse and a manageable 2percent to 3 percent hit to LSE's earnings, according to UBS.Cooler regulatory heads could yet prevail.

|But the febrile atmosphere isn't helping, and now the U.S. iswading into the fight. Commodity Futures Trading Commission (CFTC)head J. Christopher Giancarlo this week lashed out at Europeanplans to step up oversight of non-EU clearinghouses after Brexit,saying he could not subject U.S. firms to “conflicting or overlyburdensome regulation from abroad.” He threatened to block Europeanfirms' access to American clearinghouses.

|If cross-border financial ties between the U.S., Britain, andEurope are ripped apart by Brexit, the $400 trillion market willnever be the same again. Regulators would do well to recapture someof the spirit of unity that followed the 2008 crisis—or risktriggering something worse.

|

|

From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.