The amount of offshore cash U.S. corporations have returned homeso far this year is just a fraction of what President Donald Trump had promised.

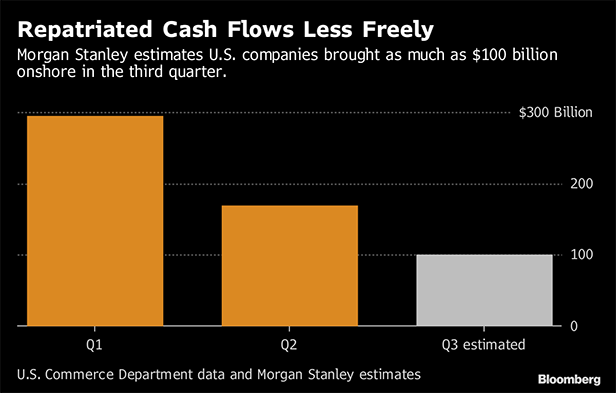

|A Morgan Stanley report released Thursday estimates thatcompanies brought back between $50 billion and $100 billion in thethird quarter—which would place the total amount repatriated backto the U.S. at around $514 billion. Companies repatriated $294.9billion in the first quarter and $169.5 billion in the secondquarter, according to previously released Commerce Departmentdata.

|

The tax overhaul signed into law by Trump in December givescompanies incentives to bring money back to the U.S. by offering alow one-time tax on repatriated profits. Under the new law,companies pay a repatriation tax of 15.5 percent on cash and 8percent on non-cash or illiquid assets, whether or not they'rebrought back onshore.

|Trump has said, without specifying his source, that he expectsmore than $4 trillion to return to the U.S., which would helpcreate jobs and increase investment.

|However, even though companies are less restricted in movingtheir offshore profits under the U.S. tax overhaul, many arechoosing to keep earnings in foreign subsidiaries, according to ateam of Morgan Stanley analysts led by Todd Castagno.

|“The sharp drop and trend trajectory [are] surprising—and mayrequire analysts and investors to rethink their near-term capitaldeployment and return expectations,” the note said.

|Johnson & Johnson, EBay Inc., and Cigna Corp. are amongcompanies that have disclosed in regulatory filings that they planto keep their foreign profits offshore. Onerous taxes imposed byforeign jurisdictions when the money leaves their borders create adisincentive for companies to move profits, according to thenote.

||

Looking Ahead

The U.S. Commerce Department is scheduled to release the thirdquarter repatriation numbers on Dec. 19. Second-quarter figurescould also be revised in that same release. The Internal RevenueService is expected to issue final rules detailing when therepatriation tax applies and how to pay it.

||

From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.