The Federal Reserve raised borrowing costs for the fourth timethis year, looking through a stock-market selloff and defyingpressure from President Donald Trump to hold off, while dialingback projections for interest rates and economic growth in2019.

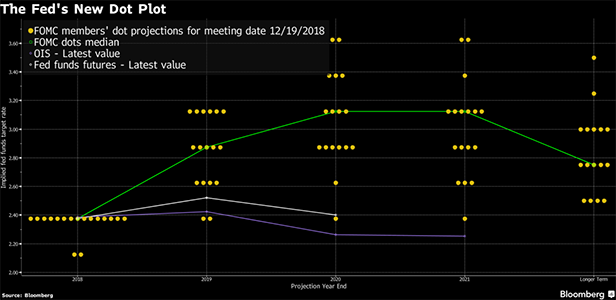

|By trimming the number of rate hikes they foresee in 2019 totwo, from three, policymakers signaled they may soon pause theirmonetary tightening campaign. Officials had a median projection ofone move in 2020.

|

Following the Fed decision, stocks erased gains, 10-yearTreasury yields fell, and the dollar bounced off its lows of theday. Investors may have been swayed by the Fed's generally upbeatanalysis and expectation of more rate increases than marketsanticipate.

|Chairman Jerome Powell, speaking at a press conference after thedecision, stressed that policy was not on a preset course.

|“There's significant uncertainty about the—both the path and theultimate destination of any further rate increases,” Powell toldreporters. “Inflation has still remained just a touch below 2percent. So I do think that gives the committee the ability to bepatient in moving forward.”

|Powell and his colleagues said “economic activity has beenrising at a strong rate,'' according to a statement following thetwo-day meeting in Washington. While officials said risks to theiroutlook “are roughly balanced,'' they flagged threats from asoftening world economy.

|The Federal Open Market Committee (FOMC) “will continue tomonitor global economic and financial developments and assess theirimplications for the economic outlook,” the statement said. The10-0 decision lifted the federal funds rate target to a range of2.25 percent to 2.5 percent.

|The quarter-point hike came after Trump assailed the Fed onTwitter for two straight days, urging it to hold rates steady inthe most public assault on its political independence in decades.Investors are also fretting over the economy, with the S&P 500Index falling significantly in recent weeks.

|Answering questions during the press conference, Powell saidpolitical considerations play no role in Fed policymaking. “We'regoing to do our jobs the way we've always done them,” he said whenasked about White House pressure. The Fed will do its analysis and“nothing will cause us to deviate from that,” he added.

|Officials also altered key language in their statement, sayingthe FOMC “judges that some further gradual increases” in rates willlikely be needed, a shift from previous language saying the FOMC“expects that further gradual increases” would be required.

|In addition, the median estimate among policymakers for theso-called neutral rate in the long run fell to 2.75 percent, from 3percent in the previous forecasts from September. The medianprojection is for the benchmark rate to end 2021 at 3.1 percent,down from a prior estimate of 3.4 percent.

||

Possible Pause

Those are more acknowledgments that rates are moving closer tothe point where policymakers will at least take a break from thequarterly procession of hikes they pursued throughout 2018. Whentaken together, the latest quarter-point move, language changes,and shift in rate projections indicate both continued confidence inthe economy and greater caution over how far and fast the Fedexpects to move with future hikes. As Powell has said, the Fed isnow feeling its way forward and will act in line with how theeconomy performs.

|Investors have had a more pessimistic view than the Fed,foreseeing one increase at most in 2019, according to interest-ratefutures prices.

|In a related move, the Fed lifted the interest rate it pays onbank reserves deposited at the central bank by just 20 basispoints, instead of the usual 25 basis points that would match thequarter-point increase for the fed funds target range. As with asimilar move in June, the action was aimed at containing theeffective fed funds rate inside the target range.

||

Careful Balance

Powell is aiming to strike a careful balance, expressing astill-positive view on the U.S. economy without telegraphing apolicy outlook that investors might view as too aggressive for aneconomy that appears somewhat more fragile than just a few monthsago. His task is complicated by the repeated attacks from Trump

|While job creation has slowed slightly, over the past severalmonths it has still easily outstripped the number needed toaccommodate population growth. Unemployment in November remained at3.7 percent, its lowest since 1969. That has helped lift wages buthasn't provoked any serious signs of excessive inflation.

|Still, many forecasters expect growth to slow in 2019 and into2020, and the Fed's median estimate for gross domestic productexpansion in 2019 fell to 2.3 percent from 2.5 percent.

|Previous hikes and a stronger dollar will gradually bite intothe economy just as fiscal stimulus fades and foreign economiesfrom China to Europe also cool. Meanwhile, the ongoing tradedispute with China and a potentially chaotic exit for the U.K. fromthe European Union represent significant additional risks.

|Financial markets have been turbulent for weeks, with theS&P 500 Index of U.S. stocks dropping 13 percent from the endof September through Tuesday. Yields on 10-year U.S. Treasurieshave also been volatile, dropping to 2.82 percent this week afterhitting a seven-year high of 3.26 percent in October.

||

From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.