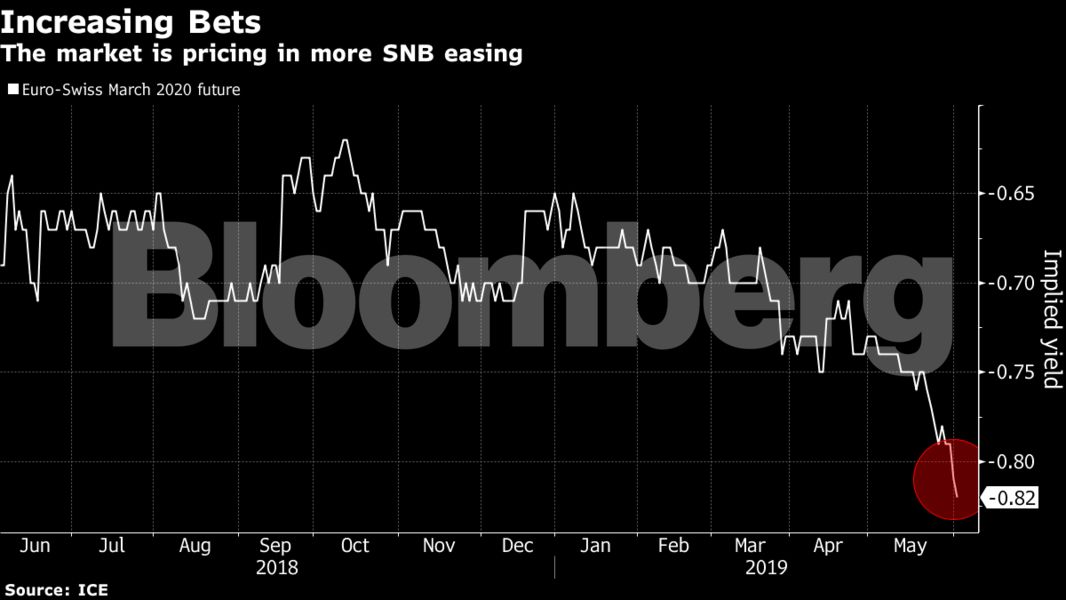

Investor expectations are building that the Swiss National Bank(SNB) will take its key interest rate even further below zero as itfaces a renewed franc appreciation.

|Amid escalating trade tensions and market jitters, the Swisscurrency has gained about 2 percent against the euro in the pastmonth. Futures for March 2020 are now putting an almost 50 percentprobability of a 25 basis-point-cut in the SNB's deposit rate. It'scurrently at minus 0.75 percent, the lowest rate among the world'smajor nations.

|

The franc's gain buttresses the case of SNB President ThomasJordan and fellow officials, who declined to move off theirultra-low rates last year, even as the currency weakened and theeconomy expanded at a strong pace. They stressed that markets werestill fragile, and Jordan has repeatedly said the current policyremains necessary. He's also said that rates can go lower still ifneeded.

|The franc is moving along with other haven assets, which haverallied amid a decline in stocks on concern about the outlook forglobal growth. The German 10-year bond yield fell to a record lowon Monday.

|

Futures also show investors betting on rate cuts by U.S. Federal Reserve and theEuropean Central Bank (ECB), where a gauge of inflationexpectations has plummeted.

|ECB policymakers meet this week and are likely to reiteratetheir promise that Eurozone interest rates will remain at recordlows until the end of the year.

|The SNB, whose deposit rate has been unchanged since 2015, holdsits policy meeting a week later. It considers the franc highlyvalued, and will probably reiterate that stance on June 13.

|— With assistance from RichardJones.

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.