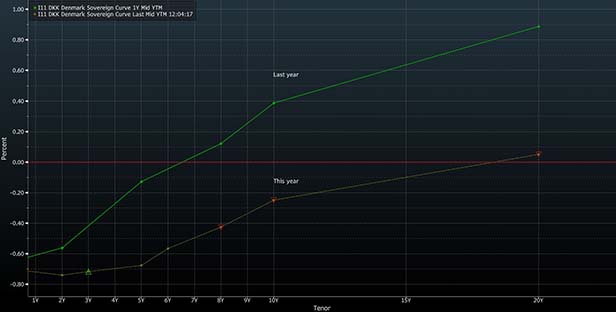

The entire government yield curve in Denmark is a hair's breadthaway from turning negative, setting a milestone in the history ofinterest rates as investors wager on more monetary stimulus inEurope.

|The benchmark yield on Denmark's debt due 2039, the longestmaturity for government securities, dropped to a record low of0.028 percent on Tuesday after dovish comments by European CentralBank (ECB) President Mario Draghi. Denmark pegs its krone to theeuro, forcing the central bank in Copenhagen to closely track theECB's every step.

|

The amount of bonds globally with negative yields surged to arecord $12.5 trillion this week. Danish two-, five- and ten-yearsecurities are already trading with below-zero yields, while30-year Swiss obligations fell into negative territory Tuesday.

|Drivers for the global fixed-income rally include tradetensions, tumbling inflation expectations, and anxiety overeconomic growth, prompting central banks to talk up the prospect oflooser policy—juicing bonds anew.

|While the Federal Reserve is expected to keep its interest rateunchanged on Wednesday, the market has already priced in more thanone rate cut for this year.

|Danish government debt is the top performer among top-ratedEuropean bonds so far in 2019. The 5.7 percent return beatsGermany, the Netherlands, Norway, Sweden, and Switzerland. Thecountry's monetary authority cut rates below zero back in 2012.

|— With assistance from FrancesSchwartzkopff.

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.