Federal Reserve policymakers lowered their main interest ratefor a second time this year while splitting over the need forfurther easing, caught between uncertainty over trade and globalgrowth and a domestic economy that's holding up well.

|The benchmark rate was lowered by a quarter percentage point, toa range of 1.75 percent to 2 percent, "in light of the implicationsof global developments for the economic outlook as well as mutedinflation pressures,'' the Federal Open Market Committee (FOMC)said in a statement onWednesday in Washington. It continued to characterize the U.S.labor market as "strong" with "solid" job gains.

|Treasuries held on to gains, the dollar rallied, and U.S. stocksextended losses after the Fed's announcement. The decision didn'talter expectations among futures traders for another 25 basis point(bps) cut this year. Chairman Jerome Powell has been underrelentless public pressure from President Donald Trump to slashrates.

|"Although household spending has been rising at a strong pace,business fixed investment and exports have weakened,'' the FOMCsaid. Officials maintained their pledge to "act as appropriate tosustain the expansion."

|Five officials wanted to keep rates unchanged, while five saw aquarter point as appropriate this year and seven wanted a halfpoint.

|

The Fed Board also took a separate step to calm this week'sstrains in money markets and avert harm to the economy, loweringthe interest rate on excess reserves to 1.8 percent. EarlierWednesday, the Fed injected $75 billion of liquidity to ease acrunch, and key rates pulled back from elevated levels.

||

Global Risk

Powell is trying to sustain the expansion despite slowing globalgrowth that's been chilled by uncertainty over U.S. trade policy,fanning fears of recession. Manufacturing has been hit hard,particularly in Germany, which prompted the European Central Bank(ECB) to ease policy last week.

|While the chairman has pointed to global risks, Trump blames theFed: "Jay Powell & the Fed don't have a clue,'' he said on September16.

|Kansas City Fed chief Esther George and Boston's Eric Rosengrendissented against the reduction, as they did in July, preferring tokeep rates unchanged. There was a new dissent by James Bullard ofSt. Louis, who preferred a half-point cut.

|Powell's committee is split between those who don't think cutsare needed because domestic spending is solid and those worried byglobal weakness and inflation running persistently under their 2percent goal.

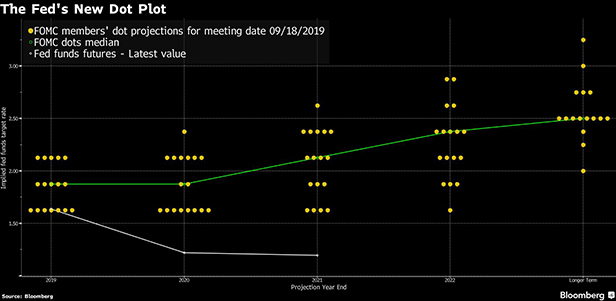

|Fed officials also released new quarterly forecasts:

- The median estimate saw the benchmark rate hold steady aftertoday's move, at 1.9 percent, and remain there until the end of2020, then rise to 2.1 percent in 2021 and 2.4 percent in 2022.That's just under the Fed's longer-run "neutral'' federal fundsrate estimate, which was unchanged at 2.5 percent.

- The unemployment rate was forecast to end this year at about3.7 percent, up a tenth from June, and finish 2020 at that level.The longer-run estimated jobless rate remained at 4.2 percent.

- Participants continued to forecast that they wouldn't reachtheir 2 percent inflation goal until 2021.

The Fed's back-to-back rate cuts reverse the tightening of last year and follow a wave ofeasing this year by other central banks. In addition to the ECB,some analysts expect the Bank of Japan to act at its meetingThursday.

|U.S. central bankers, who added the reference to exports, worrythat uncertainty over trade is denting investment and could slowhiring. Private-sector job growth has slowed from last year.

|At the same time, consumption—which accounts for most of theeconomy—appears strong, with retail sales rising 0.4 percent inAugust and sentiment indicators relatively solid. Financialconditions have remained easy since the July meeting, although thedollar has resumed gains against major currencies.

|–With assistance from KatherineGreifeld and Nancy Moran.

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.