London's dominance of the derivatives market is under threat,with European firms at risk of being blocked from usingclearinghouses in London within six months.

|Industry groups fear that contingency measures already acceptedby Brussels officials to grant access until the end of March 2020don't defuse the threat posed if the political storm inWestminster pushes the U.K. out of the bloc without a deal onOct. 31. At risk are derivatives contracts with a notional value ofas much as 60 trillion pounds (US$74 trillion).

|"We again find the relief ending next spring with no solutionfor continued access," Walt Lukken, chief executive officer of theFIA, which represents banks, brokers, and other firms in thederivatives markets, said in Frankfurt on Tuesday. "These measuresare critical because we don't want this regulatory uncertainty toexacerbate the market volatility that may come with Britain leavingthe EU."

|Crucial political talks between the U.K. and the European Union(EU) could yet result in a divorce deal. But with the outcomeunclear, Lukken said FIA, along with other trade groups, will askthe EU for an extension next month. A solution for clearing needsto be found "well in advance of the end of this year," said OliverMoullin, managing director of Brexit at the Association forFinancial Markets in Europe.

|Clearinghouses stand between the two sides of a derivative wagerand hold collateral, known as margin, from both in case onedefaults. At issue is a so-called equivalence decision that the EUadopted late last year, which allows EU firms to use derivativesclearinghouses in the U.K. on a temporary basis even in the eventof a no-deal Brexit. A sudden loss of access to thiscritical pillar of the market could pose financial stability risks,officials in Brussels said at the time.

|LCH Ltd., a unit of London Stock Exchange Group Plc, may needlegal certainty before the end of the year or it could be forced tonotify EU clients to close their positions. Meanwhile, barely anybusiness has moved out of London, as firms hope that the EUexecutive will solve the problem for them again, according toMarkus Ferber, a German lawmaker in the European Parliament.

|"I have the impression that the volume of contracts that havebeen transferred to the EU in recent months is limited," Ferbersaid in an email. "But if there's a hard Brexit, there can't be'business as usual' in clearing."

|

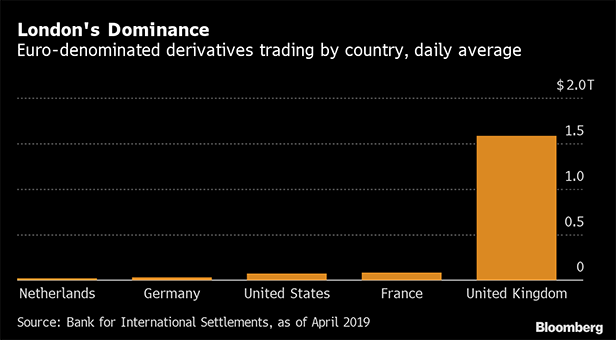

The issue gained prominence immediately after the Brexitreferendum because the U.K.'s departure would take the bulk ofeuro-denominated derivatives outside the EU, limiting the reach ofthe bloc's regulators.

|As of the end of 2018, EU-based firms held derivatives contractswith a notional value of 60 trillion pounds in those venues,according to Bank of England (BOE) data. In July, the BOE said the EU's grantof temporary equivalence resolved the problem for now.

|The European Commission, the EU's executive arm, said it doesn'tthink any additional measures to prepare for a hard Brexit arenecessary, adding that it will "continue to assess the situation inthe markets after the withdrawal date and decide on the appropriatecourse of action on the basis of the EU legislation in force at therelevant point in time."

|But Robert Ophele, chairman of the Autorite des MarchesFinanciers, said in an interview last week that Europeanpolicymakers should reach a decision on granting an extension inmid-November to avoid creating a cliff-edge situation that woulddisrupt the market.

|"It should be discussed for how long, under which conditions.Should every instrument be covered?" Ophele said of a possibleextension. "There are quite significant details to discuss."

|Elisabeth Roegele, the deputy president of German financialsupervisor Bafin, warned companies that they shouldn't take anextension of the equivalence finding for granted. Firms mustn't"rely on a seamless transition," but need to be prepared "for allpossible situations," she said in Frankfurt.

|–With assistance from NicholasComfort.

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.