Sponsored by:

Foreign exchange (FX) volatility is a recurring problem affecting many multinational organizations.

Unexpected, volatile movements in currency valuations can negatively impact the earnings of unsuspecting, and under-hedged, companies. And in the aftermath, treasury teams are often left without a full understanding of the impact currencies are having on their financial performance or what their actual exposures are.

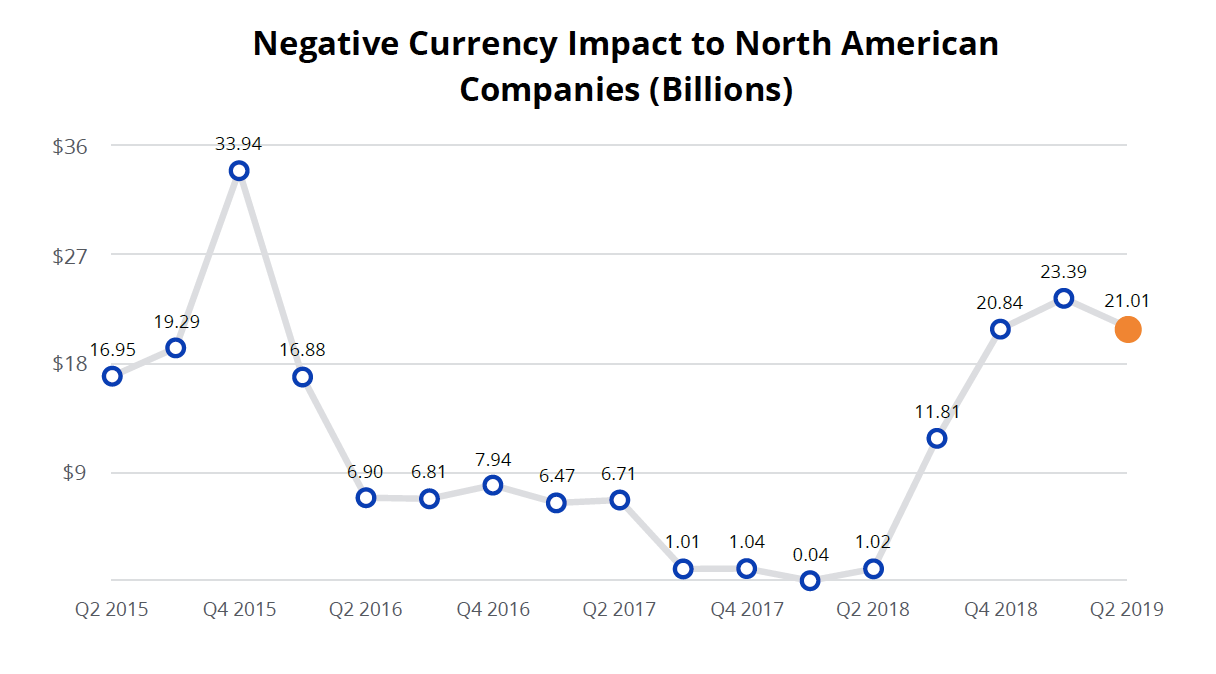

This has never been truer than it is now. With a whirlwind of geopolitical events occurring all around the world — including the U.S.-China trade war, Brexit and a looming impeachment inquiry — changes in the political climate are also changing currency valuations, leaving North American companies alone susceptible to nearly $1 million in FX-related losses each day.

So how can companies protect themselves from unexpected FX impacts?

(Source: Kyriba October 2019 Currency Impact Report)

An FX Problem for the Ages

In order to properly manage FX risk, treasury and finance teams need to analyze their currency exposures and make risk-mitigating decisions based on their predetermined risk thresholds. Historically, the currency analyses done by treasury and finance are completed in spreadsheets, and although spreadsheets can be flexible, they are limited in their functionality and are susceptible to human error.

Additionally, the data that is needed to facilitate these analyses is oftentimes siloed in systems or lies with other departments. And the cross-functional collaboration, time needed to make strategic decisions and necessary tools for full visibility aren't readily available. This means that organizations are often making decisions on which exposures to hedge based on inaccurate, incomplete and out-of-date data.

Not only does this lack of accurate, complete and timely data leave treasury at a disadvantage when it comes to hedging, but it also often leaves them without enough time to manage their entire basket of currencies. This is a common mistake for many companies, as they assume that the currencies they transact in the most are likely to impact them more. But managing FX risk in this manner leaves companies surprised when small movements in the currencies they do less business in (often smaller currencies that are more susceptible to volatility) results in more substantial impacts than significantly bigger movements in the currencies they work with the most. This is due to the fact that inaccurate, old data leaves treasury and finance teams with an incomplete picture of their entire basket of currency pairs and exposures, resulting in a hole in the program for headwinds to occur.

However, with a combination of business intelligence (BI) tools and currency analytics, the entire organization can benefit from newfound access to accurate, complete and timely currency data. With such technologies, treasury and finance can make meaningful sense of their data in an easily consumable, visual format and better determine how much currencies are impacting revenues, the cost vs. risk of hedging individual currency pairs, what can be expected moving forward and even help make sourcing and selling decisions.

BI and Currency Analytics – A Power Couple

Utilizing business intelligence and currency analytics does more than just help companies see how their hedging program is performing. Together, these two pieces of technology can also enable organizations to solve varying problems within the risk management process by giving them the ability to identify gaps in corporate FX programs, assess the impacts of currency movements (often as a result of political events), and increase business and shareholder value.

While only one piece of the puzzle, implementing business intelligence tools can help treasury teams better visualize currency risk and simplify the management of that risk.

Bl tools can aid in monitoring and tracking KPls with the use of dashboards and reports; however, with this technology alone, many organizations are still unable to facilitate any sort of required logic or derivation of data. They are left only with visual representations of their exposure and risk with no way to explain what is behind the results.

To make sense of the metrics delivered from BI tools, modern treasury teams have been looking to currency analytics as the other piece needed to run a more successful program. Currency analytics effectively walk treasury and finance teams through the income statement, giving them a better understanding of how currencies are impacting the business by mining detailed currency data and providing intuitive and comprehensive analytical views.

By utilizing this combination of data and logic delivered by currency analytics and visualizations generated by Bl tools, treasury and finance have the opportunity to not only lead risk management processes more effectively but also to answer any FX-related questions that may arise from the CEO, CFO and board.

An End-to-End Solution for Managing the Entire Lifecycle of Risk

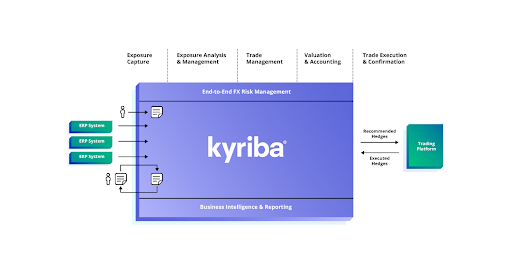

While finding and implementing BI tools and currency analytics may sound like a daunting task, it doesn't have to be. Kyriba's FX risk management solutions take BI-enabled currency analytics to the next level, creating a seamless and scalable solution for treasury and finance that takes the complex task of managing currency risk and makes it easy by enhancing the way companies handle pre- through post-trade FX risk management activities.

Kyriba's analytics offerings help multinational companies of all sizes maintain best practices over time and improve the economics and efficiencies of their FX risk management programs.

BI-enabled currency analytics enable organizations to manage their entire basket of currencies to the point where geopolitical events and currency volatility result in little to no impacts to their earnings. Such analytics include:

- P&L Analytics allow companies to see how currencies are impacting them throughout the income statement.

- Data Integrity Analytics help companies know they have the right data, that the data can be trusted, and enables treasury to run varying risk scenarios given the changing geopolitical landscape.

- FX Gain/Loss Analytics help explain how and where things went wrong and identify gaps in the program.

- The Cost and Risk Efficiency (CoRE) Analysis brings together a true story of the economics of a company's program and helps weigh the cost vs. risk of hedging individual exposures.

As Brexit proceedings continue to go unresolved, the U.S.-China trade war heightens and the 2020 presidential election in the United States ensues, there is no way of knowing how the currency market will react — or, how those volatile reactions will impact corporate earnings. The only thing a company can be certain of is the ability of its own treasury team to manage corporate currency exposures and mitigate the resulting risk. And increasing hedge ratios, reducing EPS at risk and avoiding FX impacts can only be achieved with the 100 percent exposure visibility that comes from combining the power of business intelligence and currency analytics.

1 "Kyriba October 2019 Currency Impact Report."

Also from the October 2019 Special Report:

Read the Full Article: Technology is Time: The Case for FX Automation

View the Digital Edition Here: Technology is Time: The Case for FX Automation

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.