President Donald Trump said that he "protested" U.S. interestrates that he considers too high relative to other developedcountries in a meeting on Monday with Federal Reserve ChairmanJerome Powell.

|Powell met with Trump and Treasury Secretary Steven Mnuchin atthe White House residence in the morning at the president's requestto discuss the economy. It was the second face-to-face encounterthis year between Trump and Powell amid the president's relentlesscriticism of the U.S. central bank.

At my meeting with Jay Powellthis morning, I protested fact that our Fed Rate is set too highrelative to the interest rates of other competitor countries. Infact, our rates should be lower than all others (we are the U.S.).Too strong a Dollar hurting manufacturers & growth!

|— Donald J. Trump (@realDonaldTrump) November 19, 2019

Powell's comments "were consistent with his remarks at hiscongressional hearings last week," the Fed said in a statement releasedafter the meeting, pointing out that the gathering was at thepresident's invitation.

|Trump, who has made his economic record the centerpiece of hisbid for re-election next year, has maintained a drumbeat of attackson the Fed for not easing monetary policy faster or deeper.

|His barbs, including an August tweet asking "Who is our biggerenemy, Jay Powell or Chairman Xi?"—referring to China'spresident—have shattered a decades-long White House tradition ofavoiding public comment on monetary policy out of respect for theFed's independence. In September, Trump called the central bankers"boneheads" for not slashing rates.

|Powell "did not discuss his expectations for monetary policy,except to stress that the path of policy will depend entirely onincoming information that bears on the outlook for the economy,"the Fed said.

|The statement added that Fed policymakers will set policy "tosupport maximum employment and stable prices, and will make thosedecisions based solely on careful, objective, and non-politicalanalysis."

|Trump also tweeted that they'd had a "very good & cordialmeeting" and had discussed a range of issues including "interestrates, negative interest, low inflation, easing, Dollar strength& its effect on manufacturing, trade with China, E.U. &others, etc." He followed that with another tweet late Mondaynight, referring to his "protesting" of rates.

Just finished a very good& cordial meeting at the White House with Jay Powell of theFederal Reserve. Everything was discused including interest rates,negative interest, low inflation, easing, Dollar strength & itseffect on manufacturing, trade with China, E.U. & others,etc.

|— Donald J. Trump (@realDonaldTrump) November 18, 2019

The dollar dropped to a session low amid gains in the euro afterthe news hit that negative interest rates had been among theirtopics of conversation.

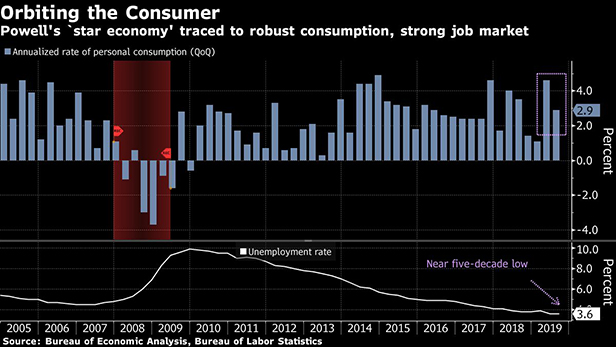

|Powell last week called the U.S. economy a "star" performer andvoiced solid confidence that its record expansion will stay ontrack. He and other Fed officials have consistently said thatEuropean or Japan-style negative interest rates would not beappropriate in the United States.

|The chairman's remarks on the economy reinforced a sense thatofficials judge they have done enough to keep the economy on trackafter three rate cuts this year, and monetary policy is now on aprolonged hold as long as the outlook remains favorable.

|Trump has publicly raged against Powell and the Fed for months,complaining about its rate increases during 2018 and continuing topound the central bank this year, even as it has cut rates to keepa record U.S. expansion on track, as the president seeks to deflectblame for slowing growth that many have pinned on his trade warwith China.

|

With less than a year until the 2020 vote, the world's largesteconomy has been generally holding up this year on resilientconsumption. Gross domestic product (GDP) increased at a 1.9percent annualized rate in the third quarter, though that was downfrom 2 percent in the second quarter and 3.1 percent in the openingthree months of the year.

|Powell had dinner with Trump in February, and the two have sincespoken by telephone. Monday's get-together lasted about 30 minutes,according to a person familiar with the gathering.

|Meetings between a president and the leader of the FederalReserve are rare but not unprecedented. Former Fed chiefs includingAlan Greenspan, Ben Bernanke, and Janet Yellen sat down from timeto time with the president of the day, particularly during periodsof economic stress.

|The most recent presidential summoning of Powell, though, comesamid repeated public criticism by Trump of the Fed chair. Bloombergreported at the end of last year that Trump had even discussedfiring the man he picked to lead the central bank. That directthreat to Fed independence—an article of faith among investors inU.S. assets—contributed to already steep stock market losses thatturned the month into the worst December for U.S. equities sincethe Great Depression.

|In addition to public browbeating, the president also has theopportunity to pick people for the Fed's policy-setting committee.He chose four of the five current members of the Fed's Board ofGovernors in Washington, and two vacancies remain open. Despiteannouncing his intention to nominate several people for thosejobs—most recently in July, when he named a supporter, JudyShelton, and St. Louis Fed research chief Christopher Waller—Trumphas yet to actually nominate either.

|–With assistance from SalehaMohsin.

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.