On Wednesday, the United States and China signed the first phase of a deal that has been three years in the making. The deal remains vague on what happens next, simply stating that "the parties will agree upon the timing of further negotiations."

However, here is what the deal has to say around five key points of contention:

1. Intellectual property

"The U.S. recognizes the importance of intellectual property protection. China recognizes the importance of establishing and implementing a comprehensive legal system of intellectual property protection and enforcement as it transforms from a major intellectual property consumer to a major intellectual property producer. China believes that enhancing intellectual property protection and enforcement is in the interest of building an innovative country, growing innovation-driven enterprises, and promoting high quality economic growth."

Why it matters: This is at the heart of the U.S.'s 301 case against China that started the trade war.

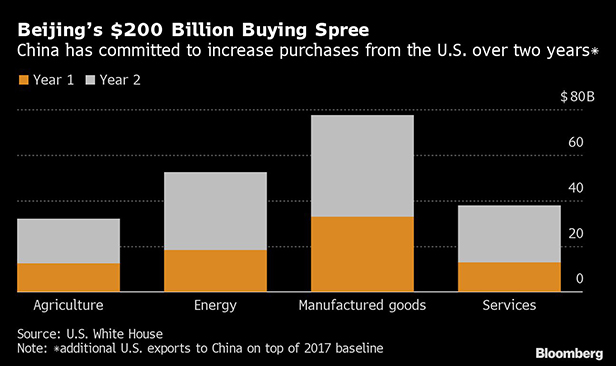

2. Chinese purchases of U.S. goods and services

"During the two-year period from January 1, 2020 through December 31, 2021, China shall ensure that purchases and imports into China from the U.S. of the manufactured goods, agricultural goods, energy products, and services identified in Annex 6.1 exceed the corresponding 2017 baseline amount by no less than $200 billion."

Why it matters: This is key relief for farmers and other businesses that have been hobbled by tit-for-tat tariffs.

3. Tech transfer

"The Parties affirm the importance of ensuring that the transfer of technology occurs on voluntary, market-based terms and recognize that forced technology transfer is a significant concern. The Parties further recognize the importance of undertaking steps to address these issues, in light of the profound impact of technology and technological change on the world economy."

Why it matters: This addresses some of the complaints American companies have about doing business in China.

4. Currency enforcement

"Enforcement Mechanism

1. Issues related to exchange rate policy or transparency shall be referred by either the U.S. Secretary of the Treasury or the Governor of the People's Bank of China to the Bilateral Evaluation and Dispute Resolution Arrangement established in Chapter 7 (Bilateral Evaluation and Dispute Resolution).

2. If there is failure to arrive at a mutually satisfactory resolution under the Bilateral Evaluation and Dispute Resolution Arrangement, the U.S. Secretary of the Treasury or the Governor of the People's Bank of China may also request that the IMF, consistent with its mandate: (a) undertake rigorous surveillance of the macroeconomic and exchange rate policies and data transparency and reporting policies of the requested Party; or (b) initiate formal consultations and provide input, as appropriate."

Why it matters: The U.S. just removed China from its list of currency manipulators, and this part of the deal gives them another way to enforce market-based principles of foreign exchange rates.

5. Financial services

"China shall allow U.S. financial services suppliers to apply for asset management company licenses that would permit them to acquire non-performing loans directly from Chinese banks, beginning with provincial licenses. When additional national licenses are granted, China shall treat U.S. financial services suppliers on a non-discriminatory basis with Chinese suppliers, including with respect to the granting of such licenses."

"No later than April 1, 2020, China shall remove the foreign equity cap in the life, pension, and health insurance sectors and allow wholly U.S.-owned insurance companies to participate in these sectors. China affirms that there are no restrictions on the ability of U.S.-owned insurance companies established in China to wholly own insurance asset management companies in China."

"No later than April 1, 2020, China shall eliminate foreign equity limits and allow wholly U.S.-owned services suppliers to participate in the securities, fund management, and futures sectors."

"China affirms that a wholly U.S.-owned credit rating services supplier has been allowed to rate domestic bonds sold to domestic and international investors, including for the interbank market. China commits that it shall continue to allow U.S. service suppliers, including wholly U.S.-owned credit rating services suppliers, to rate all types of domestic bonds sold to domestic and international investors. Within three months after the date of entry into force of this Agreement, China shall review and approve any pending license applications of U.S. service suppliers to provide credit rating services.

Each Party shall allow a supplier of credit rating services of the other Party to acquire a majority ownership stake in the supplier's existing joint venture."

Why it matters: Banks, insurers, and credit rating companies have tried for years to gain more access to the Chinese market.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.