Tesla Inc. has more money in the bank than ever, which could bejust the assurance credit raters have been waiting for to upgradethe company's bonds.

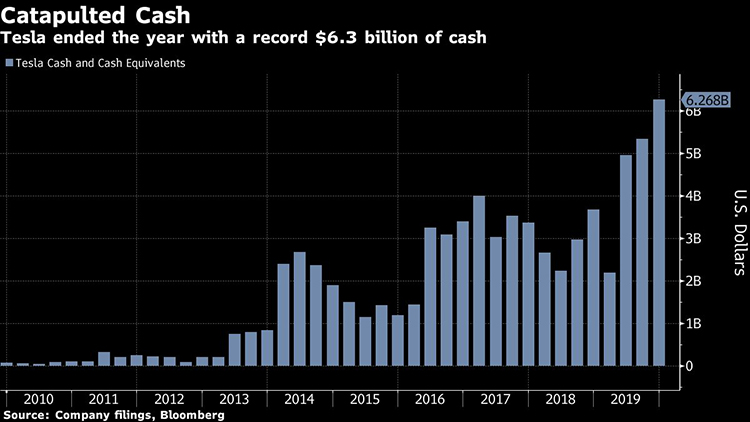

|The electric-carmaker ended the fourth quarter with a record US$6.3 billionof cash, up nearly $1 billion from the third quarter. It's alsostrung together three straight quarters of positive cash flow. Thatfigure topped $1 billion in the latest quarter, helping to send itsshares to record highs, which in turn could make more than $4billion of its bonds eligible to convert to equity.

|S&P Global Ratings rates Tesla B-, six steps belowinvestment-grade, with a positive outlook. It said in November itcould upgrade the company if—among other factors—free cash flow isat least around break-even and cashis $2.5 billion or more. Moody's Investors Service has outlinedsimilar upgrade criteria.

|"It's possible raters may act," Bloomberg Intelligence analystJoel Levington said in a January 29 report. Tesla could end 2020with debt between 3.5 times and 4 times a measure of earnings,which would potentially be enough for S&P to upgrade, he saidearlier this year.

|Tesla is coming off of its second consecutive quarter of blowoutearnings, extending an unprecedented surge for its heavily shortedstock and bonds. It's now turned a profit in four of the last sixquarters, and CEO Elon Musk again accelerated the expectedintroduction of the new Model Y crossover vehicle, which hepredicts will outsell all other Teslas combined.

|Prices on Tesla's unsecured bonds, which are rated Caa1 byMoody's, have been rising as the company's prospects in China arelooking up and its battery business with Panasonic Corp. turnedprofitable last quarter. The 5.3 percent notes are trading at arecord high, while the cost to protect its debt against default hasdropped to all-time lows.

|The bonds now yield around 4.2 percent, between the averages ofbonds rated B and BB, according to Bloomberg Barclays indexes.That's in the range of fair value, according to CreditSightsanalyst Hitin Anand, so it's possible an upgrade may not boost thedebt much more.

|

Since the Palo Alto, California-based company reported earningsafter the stock market close on January 29, its shares have alreadydoubled this year and broken through $900. That's put $4.3 billionof its convertible bonds maturing over the next four years "in themoney," meaning they could be converted to equity uponmaturity.

|Taking that much debt off Tesla's balance sheet could improveleverage, a metric both S&P and Moody's watch closely, possiblyspurring upgrades. However, the next convertible bond doesn't comedue until December, still a ways away.

|If Tesla sold 500,000 cars at an average price of $55,000 each,leverage would decrease to 3.6 times in 2020, from 4.3 times in2019, Anand wrote in a January 30 report. If its convertible bondswere no longer in the picture, that metric would look even better,he said.

|"It would change their leverage dramatically—that's why Teslaissues something like this, for that option," said Chris Hartman, asenior portfolio manager who specializes in convertible arbitrageat Aegon Asset Management. "It would get their ratings moving veryquickly in the right direction."

|For Tesla's bonds to be converted to equity, the stock wouldneed to sustain a high enough level in the days leading up to maturity, whichis still months if not years away for some of the debt. Tesla'sstock has been extremely volatile, and in the past too low to makesome of its debt eligible for conversion. But it's had enough cashon hand to settle those maturities anyway.

|–With assistance from Dana Hull.

|Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.