It's rarely been a better time for borrowers with good credit totap into the bond market. In fact, the same is true for borrowerswith dodgy credit.

|It's not just U.S. Treasuries that are seeing near-historic-lowyields. Once-radioactive sovereign markets like Greece, high-taxU.S. states like New York and California, and corporate borrowersfrom investment grade to junk are being rewarded with yields thatare barely above benchmarks.

|With the record-long U.S. economic expansion on course to entera 12th year, a swollen supply of investor capital flooding intomarkets is shrinking or eliminating risk premiums throughout thefixed-income landscape. It's not that investors are oblivious tothe eye-popping valuations. In fact, "bond bubble pops" was thesecond-most-cited risk in Bank of America's latest survey of fundmanagers. Regardless, many investors ask: What choice do they havebut to keep on buying?

|"Things are frothy right now," said Jude Driscoll, head ofpublic fixed income at MetLife Investment Management, whichoversees $586 billion in assets. "Risk assets are definitely pricedat the tight end. In what world would you lend money to some of theprofiles in high yield at 4 percent? That doesn't make any sense tome from a historical basis. People are getting in because theydon't want to miss out."

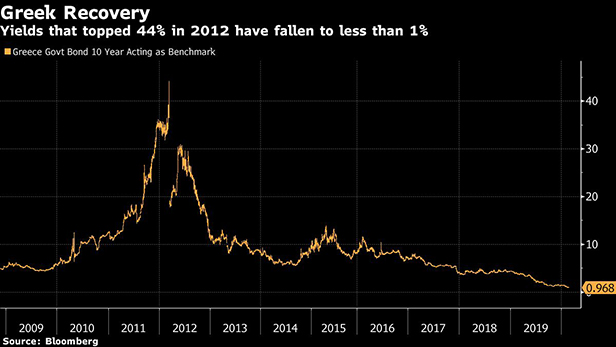

|Sovereign bonds from some of the most-indebted European nationshighlight how far the situation has gone. Ten-year Greek bondyields topped 44 percent at the height of the nation's financialcrisis in 2012. These days, they yield less than 1 percent, and thespread above negative-yielding bunds is about 140 basis points(bps). That's near the narrowest it's been since 2009, just beforethe country was thrown into a multiyear crisis that brought it tothe brink of default. Italian 10-year yields have fallen from 7.49percent in 2011 to less than 1 percent these days. Ireland's30-year rate reached an all-time low of 0.61 percent yesterday.Even Ukraine, which skirted a default five years ago, has seen itssovereign yields drop to record lows.

|

Even though they may not be priced in, risks are increasing.Countries and companies are already reducing their expectations forhow productive they'll be in light of the spreading coronavirus, with Singapore planning itsbiggest budget gap in more than two decades, while Apple Inc. haswarned it won't meet sales expectations.

|In credit, Kraft Heinz Co. became the largest fallen angel ofthe current cycle last week, losing twoinvestment-grade ratings. Macy's Inc. and Renault SA also just received theirfirst high-yield ratings, re-igniting fears that a slowing economycould tip more companies over the edge. UBS Group AG strategists,led by Matthew Mish, predict there could be as much as $90 billionof investment-grade debt downgraded to high yield this year,dwarfing a two-decade low set last year at just under $22billion.

|"It's been a resumed search for yield, with Greece and Italyalong for the ride," said Richard Kelly, head of global strategy atToronto-Dominion Bank in London. "You have less fears of systemicissues from the virus, but more acceptance that this means growthand inflation should be lower for longer."

|The hunt for yield shows no sign of slowing down, so rates andspreads may decline further. Flows into fixed-income assets nearlydoubled last year, to $1 trillion, according to data fromMorningstar Inc., and bond funds are on track to exceedthat amount this year. U.S. corporate investment-grade borrowingcosts have never been lower, while high-yield rates are close totheir lows.

|

Even heavy issuance of corporate debt and Treasuriesmay not be enough to meet investor demand. While more than $1trillion of investment-grade credit is expected to be issued thisyear, gross supply is forecast to be down slightly and net supplywill be almost 40 percent lower than it was in 2019, according toJPMorgan Chase & Co. All else equal, that should drive spreadseven tighter, especially as high-grade funds continue to reapinflows from investors seeking income assets amid $13 trillion ofnegative-yielding debt, Western Asset Management portfolio managerKurt Halvorson said in a Feb. 13 blog post.

|

See also:

- Financing Growth in Uncertain Times

- Rock-Bottom Borrowing Costs Lure U.S. Companies toEuro Market

- Taking Advantage of the Low Interest RateEnvironment

|

Companies have taken advantage of investor appetite to refinancedebt, with some high-yield issuers like HCA Inc. and Post Holdingsmanaging to set record-low coupons for their respective ratings andmaturities last week. Exuberance in the high-yield market isletting even some of the lowest-rated issuers sell new debt. HuskyInjection Molding sold a rare pay-in-kind toggle bond last week tofund a dividend to its private-equity owner. So-called PIK notesare particularly risky because they give companies the option todefer interest payments.

|Elsewhere in the junk markets, Zayo Group Holdings Inc. isshopping $2.58 billion of high-yield bonds to fund part of itsleveraged buyout. The planned debt package includes $1 billion ofunsecured CCC+ rated notes being marketed to investors at a yieldof around 6.25 percent, well below the 10 percent average level fordebt rated that deeply into junk.

|Investment-grade companies are reaping the benefits as well,with deals from cuspy credits many times oversubscribed, oftenresulting in lower borrowing costs. FirstEnergy Corp. tapped themarket Tuesday for the first time since spinning off its bankruptsubsidiary at a record low rate. Deutsche Bank sold a perpetual AT1bond last week, the riskiest form of bank debt. It borrowed $1.25billion at a 6 percent rate, lowering its funding costs by 75bps,according to data compiled by Bloomberg. At the peak, investors hadplaced orders more than 11 times the offering size.

|Alarm bells are ringing. The Bank of America fund-manager surveyfound that owning U.S. Treasuries and investment-grade corporatebonds were considered the second- and third-most crowded trades,respectively, after U.S. technology and growth stocks. Itsstrategists have recommended owning less high-grade bonds asvaluations are too tight. Still, what else is a fixed-incomeinvestor supposed to do but hunt for yield?

|"What do you do with your cash?" said Luke Hickmore, investmentdirector at Aberdeen Standard Investments in Edinburgh, where hehelps run a number of bond funds. "Leaving it standing there makesno sense, and the experience over the last 10 years is that thereis no pain in buying bonds. Learnt behavior is that it is safe.Inflation is nowhere, and central banks start buying every timeyields go higher."

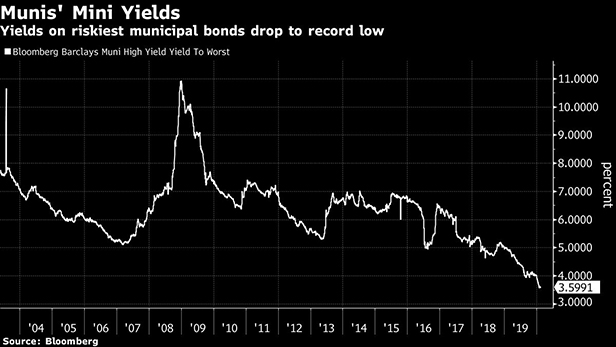

|Heavy demand for tax-exempt income drove yields on even theriskiest municipal bonds to 3.58 percent on Friday, the lowestsince Bloomberg's records began in 2003. The influx has compressedspreads across the country and caused some debt in high-tax stateslike California and New York to yield less than top-rated benchmarksecurities. On February 13, municipal mutual funds reported inflowsfor the 58th straight week.

|

Investors keep adding to municipal bonds amid concerns aboutpotential volatility in the equity market, according to NishaPatel, a director of portfolio management at Parametric PortfolioAssociates, which offers separately managed accounts.

|"Even at these yields, we hear all the time from advisers andclients that 'I don't want to buy bonds, but I have to,'" she saidat a Bloomberg News panel last week.

|–With assistance from Danielle Moran.

||

|

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.