The global credit machine is grinding to a halt.

|The US$2.6 trillion international bond market, where the world'sbiggest companies raise money to fund everything from acquisitionsto factory upgrades, has come to a virtual standstill as thecoronavirus spreads fear through company boardrooms.

|Today, Wall Street banks recorded their third straight daywithout any high-grade bond offerings—a rarity outside of holidayand seasonal slowdowns, and European debt bankers had their firstday of 2020 without a deal. Bond issuance in Asia, where the virusfirst emerged, has slowed to a trickle.

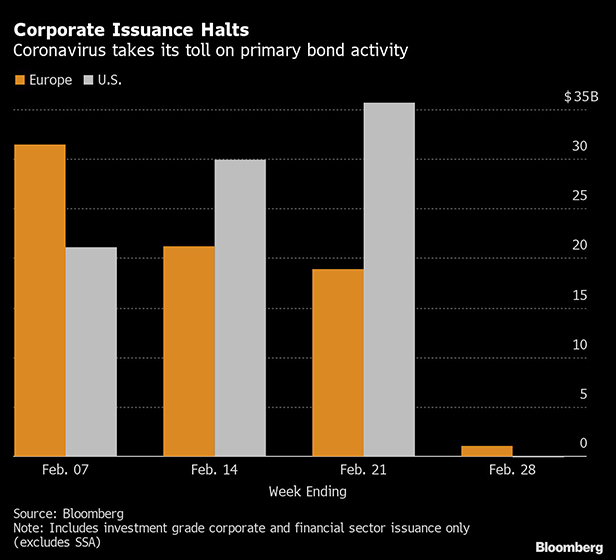

|This is a remarkable turn of events for a market where investors had been snapping up almost anythingon offeramid a global dash for yield. Europe had been enjoying itsstrongest-ever start to a year for issuance, and sales of U.S. junkbonds have been on the busiest pace in at least a decade.

|With so many borrowers having postponed their issuance plans, acalming in global markets could kickstart debt sales again. Aninformal survey of U.S. high-grade bond dealers today indicatesthat strong companies with good name recognition among investorsmay try to sell debt tomorrow if conditions improve. Buyers havebeen there all along and will be ready to digest the new supply ifcompanies proceed, dealers said.

|Credit investors have been rattled by the potential impact oncompany earnings from disruption caused by the virus, which hasseen huge parts of global supply chains shutting down. Whilemarkets have yet to see any panic selling, a derivatives index thatgauges credit market fear in the U.S. had its biggest jump in morethan three years on Monday as investors rushed to hedge against awider selloff.

|"It's a coin toss as to what tomorrow will look like, or eventhe rest of today," said Tony Rodriguez, head of fixed incomestrategy at Nuveen. "You have to respect the fact that when youdon't have an information advantage to not make any significantmoves."

|

Honeywell International Inc., Virgin Money UK Plc, and Transportfor London were among the European borrowers readying deals beforefinancial markets turned hostile. Before the slowdown, Europe hadseen 239 billion euros ($260 billion) of bonds sold in Januaryalone.

|The U.S. investment-grade market was expecting around $25billion of sales this week before virus fears froze the market onMonday. Excluding the December holiday season and typical two-weeksummer hiatus in late August, there hasn't been that long of abreak to start the week since July 2018.

|Offerings also came to a halt in the U.S. junk-bond market,where $67 billion of sales had been running at the fastest pacesince at least 2009, data compiled by Bloomberg show. Miningcompany Cleveland-Cliffs Inc. sought to break the issuance freezelate today, testing investor demand for a $950 million offering ofsecured and unsecured notes to refinance an acquisition target'sdebt. And the Canadian market remained open for business as utilitycompany Hydro One Ltd. raised CAN$1.1 billion (US$827 million) inthe largest Canadian dollar bond from a non-financial company thisyear.

|It's a sharp turnaround for primary corporate bond marketsaround the world, where demand has triggered supply against thebackdrop of $14 trillion of negative-yielding debt globally. In theU.S. investment-grade market, $220 billion had priced this yearthrough last week, running about 19 percent ahead of last year'space. Until this week, European issuers had brought at least 30billion euros worth of sales for the past six weeks in a row.

|While a dearth of supply is usually a positive technical for themarket, all else equal, spreads have widened as demand has fallenoff as well. Borrowing premiums on euro-denominated debt jumped to95 basis points more than government bonds this week, the highestin 2020, according to a Bloomberg Barclays index. The U.S. indexclimbed to 107 basis points, the most since November.

|

U.S. high-yield bonds haven't been this cheap on a spread basissince October, but they're still not an attractive buy, givencaution on earnings calls, according to Citigroup strategists ledby Michael Anderson. The market now trades at 417 basis points overTreasuries, more than a full percentage point wider than on January13, according to Bloomberg Barclays indexes.

|Overall borrowing costs remain very low, however. A rally inU.S. Treasuries has sent all-in yields on U.S. investment-gradedebt to record lows. U.S. investment-grade funds have reapednear-record inflows each week this year, as investors seekhigh-quality income assets. High-yield and leveraged loan funds,however, have seen more outflows.

|The number of coronavirus cases continues to climb, with theglobal death toll nearing 3,000. U.S. health officials have warnedcitizens to prepare for an outbreak, while South Korea has emergedas a hot spot, with more than 1,000 reported cases there.

|The worsening crisis is already taking a toll on companies'balance sheets, with drinks maker Diageo Plc set to book as much asa 325 million-pound (US$422 million) hit to organic net sales. Inthe U.S., United Airlines Holdings Inc. withdrew its 2020 profitforecast Tuesday, as it can't guarantee its earlier earningsgoal.

|Some investors are already planning to put money to work oncethe market reopens, as any sign that the epidemic is stabilizingmay prove a fillip for sales, according to Luke Hickmore,investment director at Aberdeen Standard Investments in Edinburgh.And many issuers had planned to tap the market before next week'sSuper Tuesday, in which several American states will hostpresidential primary elections and caucuses, so there still is thepotential for new deals, said Carl Pappo, chief investment officerof U.S. fixed income at Allianz Global Investors.

|"This will likely present some nice opportunities to put cash towork, as the market will demand concessions in this environment,"Pappo said.

||

|

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.