Jerome Powell, chairman of the U.S.Federal Reserve, speaks during a news conference in Washington,D.C., today. Photographer: Andrew Harrer/Bloomberg

Jerome Powell, chairman of the U.S.Federal Reserve, speaks during a news conference in Washington,D.C., today. Photographer: Andrew Harrer/Bloomberg

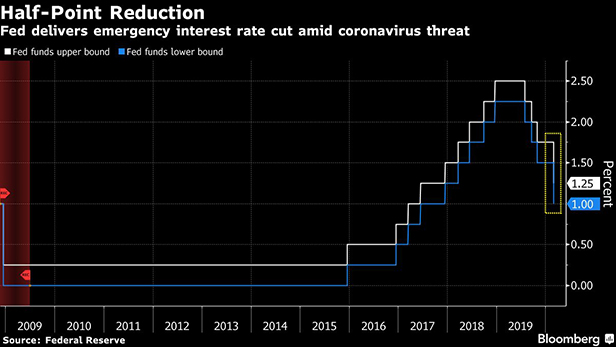

The Federal Reserve slashed interest rates by half a percentagepoint in the first such emergency move since the 2008 financialcrisis, amid mounting concern that the coronavirus outbreak threatens to stall therecord U.S. economic expansion.

|The rate cut, which came between the central bank's regularlyscheduled meetings, was announced hours after Group of Seven (G-7)finance chiefs held a rare teleconference to pledge they'd do allthey can to combat the fast-moving health crisis.

|"My colleagues and I took this action to help the U.S. economykeep strong in the face of new risks to the economic outlook," FedChairman Jerome Powell told a hastily convened press conference inWashington on Tuesday. "The spread of the coronavirus has broughtnew challenges and risks."

|

See also:

- Global Credit Market Seizes Up

- Coronavirus May Not Be Mere Blip inMarkets

- How Are Global Companies Dealing with theCoronavirus?

- For Businesses Suffering from Coronavirus Losses,Insurance Coverage May Offer a Remedy

- The Limits of Fed Policy, per Its Chairman

|

Investors weren't impressed by either the G-7 promise or theFed's move. After rallying earlier in the week on anticipation ofaction, the S&P 500 index fell more than 3 percent, while the10-year Treasury yield plunged below 1 percent. Traders are bettingthat the Fed will have to do more, with the futures markets pricingadditional easing later this year.

|Powell left the door open to further action by the central bankat its next scheduled meeting, on March 17 and 18. "In the weeksand months ahead, we will continue to closely monitordevelopments," he said.

|

The Fed chief acknowledged that the Fed doesn't have all theanswers, adding that it would take a multi-facetedresponse from governments, healthcare professionals, centralbankers, and others to stem the human and economic damage.

|"We do recognize a rate cut will not reduce the rate ofinfection; it won't fix a broken supply chain. We get that," Powellsaid. "But we do believe that our action will provide a meaningfulboost to the economy."

|The vote for the rate cut to a range of 1 percent to 1.25percent was unanimous, even though the Fed said in a statement thatthe "fundamentals of the U.S. economy remain strong." Powell hasstaked his chairmanship on sustaining the U.S. economic expansion,now in its record 11th year.

|"The Fed has very little ammunition, and the ammunition that itdoes have is not at all suited to the task of managing apotentially large adverse supply shock," said Jonathan Wright,economics professor at Johns Hopkins University and a former Fedeconomist. "They have taken the view that they should do what theycan with the tools that they have."

||

G-7 Coordination

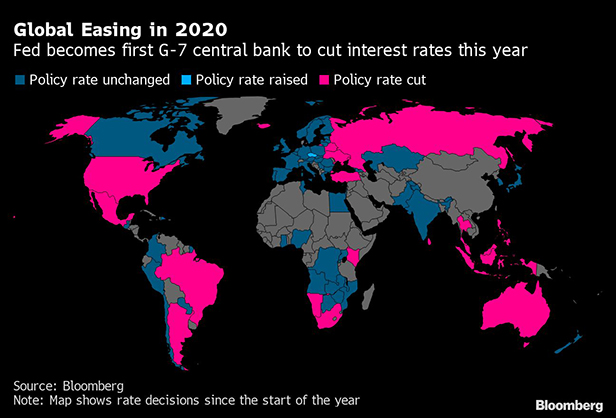

The Fed's decision could presage a wave of easing from othercentral banks around the world, although those in the Eurozone andJapan have less scope to follow, with rates already in negativeterritory.

|The Fed move also followed public pressure for a cut byPresident Donald Trump, whose stewardship of the economy is centralto his re-election campaignthis year.

|After today's shift, he called for more, demanding in a tweetthat the Fed "must further ease and, most importantly, come intoline with other countries/competitors. We are not playing on alevel field. Not fair to USA."

|

Tuesday was the first time the Fed had cut by more than 25 basispoints (bps) since 2008, and the reduction marks a stark shift forPowell and his colleagues. They had previously projected no changein rates during 2020, remaining on the sidelines during theelection year, after lowering their benchmark three times in2019.

|In a public health emergency, lower rates do little forfactories lacking needed materials from abroad and are unlikely tospur consumers to shop or travel if they're scared of infection.But they should support consumer and business sentiment, as well asease financial conditions by making debt payments easier to manageand by calming market volatility.

|U.S. lawmakers are also working on a $7.5 billion virus responsebill, another reminder that critical fiscal policy can take weeksto move through Congress.

|

What Bloomberg's Economists Say…

"We now anticipate an additional 50 bps of easing by midyear, intwo consecutive 25 basis point cuts. Headlines related to thecoronavirus will determine whether these begin in March orApril."

|— Carl Riccadonna, Yelena Shulyatyeva & Andrew Husby

|

One lesson Fed officials will take away from this moment is howrapidly their policy space is used up in a crisis.

|Total cuts of one percentage point this year, which several WallStreet firms are now forecasting, would bring the bottom range ofthe Fed policy rate down to 0.5 percent. If the virus impact isworse than expected, or if the economy is hit by a separate shock,the policy rate could strike zero.

|At that point, Fed officials are left with unconventional tools,such as purchases of longer-dated Treasuries—known as quantitative easing. The effectiveness of suchtools, when longer-term rates are already low, remains to beseen.

|The Fed is in the midst of a review of its toolkit to achieveits goal of maximum employment and stable prices. They areconsidering policies such as outcome-based forward guidance, wherea policy change would be linked to some tangible metric such asachieving an inflation rate, and yield curve caps.

|Wherever the discussion lands, the virus has highlighted theneed for better fiscal and monetary policy coordination in a timeof exceptionally low interest rates, says Julia Coronado, thepresident of MacroPolicy Perspectives.

|The Fed is "carrying the domestic burden and the global burden,"Coronado said. "The fiscal policy response has been lacking. Thereare people that are going to be struggling to pay their bills andcertain workers are going to lose incomes. This is the shock thatneeds to be insured, and we are really behind the curve."

||

|

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.