Traders around the world are forging ahead with bets on negativeinterest rates, even as central banks mount a vocalcounter-offensive.

|Fed funds futures reflected bets for a negative U.S. policy ratefor a fifth day, despite Federal Reserve Chairman Jerome Powell'sattempts to challenge the prospect Wednesday with assurances thatsuch a move is unlikely. While expectations for a shift moderatedslightly after Powell's speech, traders are still prepared for amove during the first half of next year.

|

Global investors are factoring in a long, difficult road forpolicymakers trying to get their virus-damaged economies back ontrack. U.K. traders became the latest to price in sub-zero ratesthis week, in what would be the first move below zero in Britishhistory. Investors in New Zealand also see the benchmark fallingthrough zero—something policymakers in Wellington have openlycontemplated—and, in the United States, negative-rate expectationshave stayed in place since May 7.

|"By reiterating that he and the Fed are not in favor of negativerates, but not ruling them out, Powell left room for thoseexpectations to keep building," said Tony Farren, managing directorat broker-dealer Mischler Financial in Stamford, Connecticut. "Themarket firmly leads the Fed before the Fed leads the market, so Iwouldn't be shocked if the market takes us to negative first." Thatwould show up initially in Treasury bills and two-year yields, hesaid.

|Markets are increasingly fixated on the growing list of evidencethat shows just how badly the coronavirus has hurt global growth. Powellacknowledged the pain in remarks prepared for a virtual event inWashington by saying the U.S. economy faces unprecedented downsiderisks that could do lasting damage to households andbusinesses.

|U.S. President Donald Trump said Tuesday the U.S. should receivethe "gift" of negative interest rates, after three Fed officialssignaled the central bank isn't keen on the idea. Trump has longexpressed his desire for the U.S. to be paid to borrow, likeGermany.

||

British Woes

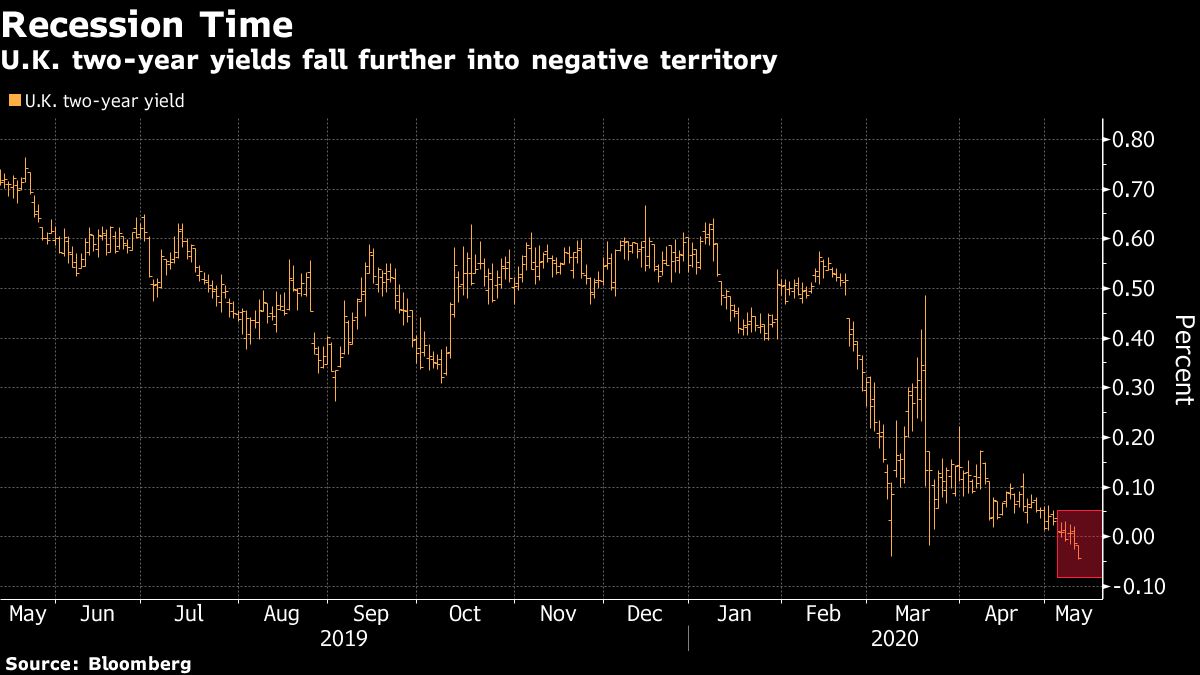

In the U.K., Wednesday's bets were spurred by gross domesticproduct (GDP) data that showed the nation may be headed for thedeepest recession in three centuries. That triggered a surge indemand for U.K. government bonds, or gilts, which are seen as someof the safest assets available. The spree drove two-year giltyields deeper into negative territory, to a record low.

|

"There is no compelling reason why yields shouldn't go modestlynegative given the parlous economic outlook," said John Wraith,head of U.K. and European rates strategy at UBS Group AG. "Moreeasing is certainly possible."

|Money-market swaps, which are used to bet on interest-ratemoves, are signaling negative rates in the U.K. for March 2021,after falling almost 2 basis points (bps) to minus 0.007 percent.Two-year gilt yields fell as much as three bps, to minus 0.046percent.

|But there are many reasons why central banks are hesitant tofollow the lead of places like the Eurozone and reduce rates belowzero.

|For example, there's evidence that the European Central Bank's(ECB's) minus-0.5 percent interest rate has eaten into bankprofits, and this policy could have a similar effect elsewhere.

|"Negative rates would require a bailout of small U.K. banks,"said Marc Ostwald, a global strategist at ADM Investor Services."The same applies in the U.S."

|—With assistance from EdwardBolingbroke

|Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.