The New York University (NYU) professor who developed one of thebest-known formulas for predicting corporate bankruptcies has awarning for U.S. credit investors: This year's spate of "mega"insolvencies is just getting started.

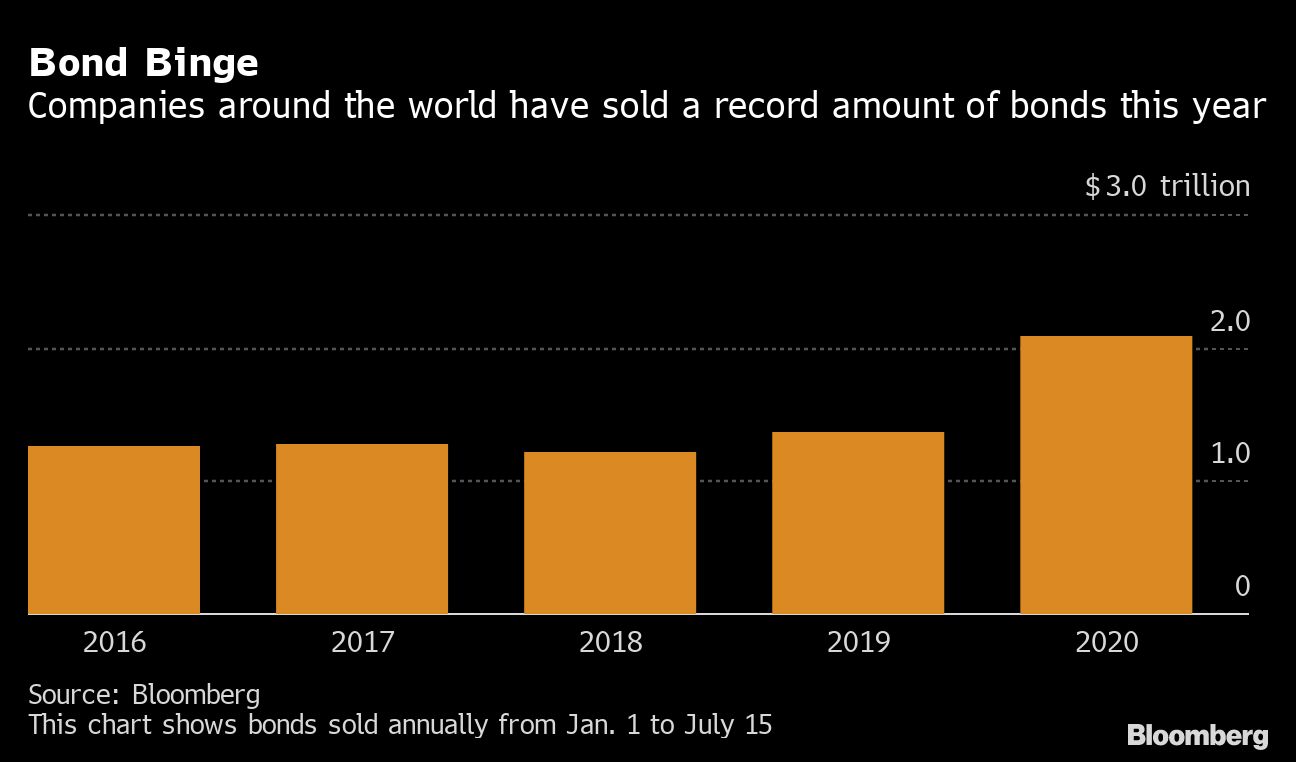

|More than 30 American companies with liabilities exceeding $1billion have filed for Chapter 11 since the start of January, andthat number is likely to top 60 by year-end after companies piledon debt during the pandemic, according to Edward Altman, creator ofthe Z-score and professoremeritus at NYU's Stern School of Business. Global firms have solda record $2.1 trillion of bonds this year, with nearly half comingfrom U.S. issuers, according to data compiled by Bloomberg.

|

While the stimulus-fueled rally in credit markets since Marchhas helped borrowers stay afloat during the coronavirus crisis, Altman and others havewarned that many companies are just delaying an inevitablereckoning. Fitch Ratings estimates that worldwide corporate bonddefaults this year could exceed levels reached during the globalrecession in 2009.

|"There was a huge buildup in corporate debt by the end of 2019,and I thought the market would gain some much needed deleveragingwith the Covid-19 crisis," said Altman, who is also director ofcredit and debt market research at the NYU Salomon Center. "Now, itseems like companies again are exploiting what seems to be a crazyrebound."

||

'Deeper Recession'

As new waves of the coronavirus keep planes from flying and curbconsumer spending, pressures on the global economy are increasing.The International Monetary Fund (IMF) downgraded its outlook forthe world economy in June, projecting a deeper recession and slowerrecovery than it previously anticipated.

|Chesapeake Energy Corp., the pioneer of the shale gasrevolution, and retailer Brooks Brothers Group Inc. have filed forbankruptcy in the U.S. in recent weeks. Defaults in theAsia-Pacific region include Virgin Australia Holdings Ltd. andShanghai-headquartered Hilong Holding Ltd., an oil equipment andservices firm.

|

See also:

- A Tsunami of Loan Modifications Is on theHorizon

- Managing Shareholder Value Through Covid-19—andBeyond

- World Economy in 2020 to Weaken More Sharply ThanForecast

- Risk on the Rise in Southeast Asia

|

Man Group Plc, the world's largest publicly listed hedge fund,has warned of the risk tobond buyers. The World Bank has also forecast that more than 90percent of economies will experience contractions this year, higherthan the rate seen at the height of the Great Depression.

|"The speed and magnitude of the increase in corporate debt thisyear poses various risks to an already fragile global economicoutlook," said Ayhan Kose, director of the World Bank Group'sProspects Group. Countries where a large proportion of theborrowings are in foreign currencies or for shorter periods areparticularly vulnerable, as they face risks of fluctuating exchangerates and also having to roll over the debt more quickly, hesaid.

|Xavier Jean, senior director for corporate ratings at S&PGlobal Ratings, said some firms are being proactive, as they areuncertain if they can raise funds during the second half. But forthose that face tremendous stress in their operations, theincreased borrowing heightens risks if things don't turn around asquickly, he said.

|In the U.S., the Federal Reserve has provided unprecedentedsupport, such as buying corporate bonds, including the debt offirms that were cut from investment-grade to junk. For Altman, someof the debt sold "kicks the can down the road" for firms that don'tdeserve support. Companies are doing the opposite of what theyshould be doing, which is to deleverage as the banks did after theglobal financial crisis of 2008, he said. "When there is anincrease in insolvency risk, what you do not need is more debt. Youneed less debt."

||

|

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.