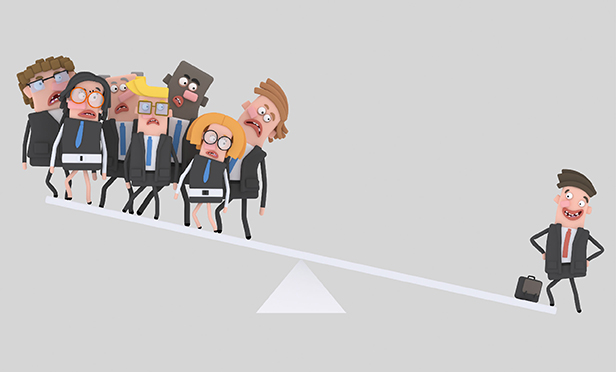

U.S. companies must soon begin disclosing what many would rather keep secret: The ratio between the CEO's compensation and the paycheck of the company's median worker. The mandate was included in the 2010 Dodd-Frank Act to shed light on the growing income gap between executives and workers. Opponents say it's only meant to embarrass executives and won't be useful to investors. One critic called it an example of “bigotry against the successful.”

U.S. companies must soon begin disclosing what many would rather keep secret: The ratio between the CEO's compensation and the paycheck of the company's median worker. The mandate was included in the 2010 Dodd-Frank Act to shed light on the growing income gap between executives and workers. Opponents say it's only meant to embarrass executives and won't be useful to investors. One critic called it an example of “bigotry against the successful.”

1. What are we likely to learn?

The disclosures will provide a first-ever glimpse into how thousands of U.S. companies compensate their workers, plus a more accurate sense than ever before of the CEO-to-worker pay gap. According to the AFL-CIO, the average S&P 500 chief executive officer got $13.1 million in 2016, compared with about $37,000 for the average worker, a 347-to-1 ratio. The worker figure in that calculation is based on Bureau of Labor Statistics national sampling data. Now, such ratios will be based on actual company payrolls.

2. Which companies must comply, and by when?

Publicly traded U.S. companies must disclose the ratio in regulatory filings for fiscal years starting on or after Jan. 1, 2017. Because executive compensation is always reported in the fiscal year after it's paid, most businesses will reveal their ratios for the first time in 2018. Small public companies and investment firms are exempt.

3. What fallout should we expect?

The disclosures will likely fuel the debate on U.S. income inequality. Some companies and directors are worried about how the media will characterize their ratios. Others are more concerned with how employees will react, especially the half that earns below the median wage, and how the information might affect negotiations with unions. These worries led business groups to lobby Republican lawmakers in 2017 to scrap the pay ratio, arguing that it was too difficult to calculate.

4. How hard is it to determine the median employee's pay?

The bigger the company, the harder it gets. Global companies often have separate payroll systems in different countries and pay employees in various currencies. Workforces consist of a mix of full-time and part-time people and contractors. Some workers get pension contributions, bonuses, profit-sharing plans, and other benefits in addition to salaries. As a result, the U.S. Securities and Exchange Commission, the agency implementing the rule, granted companies some discretion to ease the burden.

5. What sort of discretion?

Because workforces tend to change over the course of a year, companies can use the number of employees they have on any single day within three months of the most recent fiscal year-end. They may exclude all contractors and a share of non-U.S. workers (but no more than 5 percent of the total workforce). All part-time employees, however, must be counted, even if they make far less than most full-timers. The SEC also said companies don't have to include non-salary compensation, such as 401(k) contributions and profit-sharing plans, as long as excluding them doesn't substantially change the median pay figure. And once the median employee's pay has been pinpointed, the company can use that as the benchmark for as many as three years.

6. How comparable will the ratios be?

Comparisons could be misleading. Some won't capture nuances, such as how a company calculated median worker pay. Investment banks, whose employees tend to be well-compensated, may come out looking better than companies reliant on part-timers making close to minimum wage, such as retailers, even if the bank chief makes far more than the retailer CEO. Executive-pay figures also can vary by several million dollars from one year to the next, which will affect the ratio even if median pay doesn't move.

7. How did the rule come about?

It was championed by Senator Robert Menendez, a New Jersey Democrat with strong union ties. He hoped forcing companies to reveal the gap between typical workers and CEOs would help restore “sanity to runaway executive pay” and give investors a glimpse of how employees are treated. CEO pay in the U.S. has soared while wages for many Americans have barely budged in decades.

8. How much will investors care?

Some public pension funds and labor unions have been vocal proponents of the ratio. But there's scant interest among some of the biggest institutional investors. The ratio will “perhaps do more to inflame than to inform,” Vanguard Group Inc.'s Glenn Booraem, who oversees the firm's governance efforts, said at a 2017 conference. At the same event, Donna Anderson, T. Rowe Price Group Inc.'s head of corporate governance, said the pay ratio is “not an institutional investor issue—it's a local newspaper issue.”

9. Why did it take so long to put the rule in place?

While the pay ratio is merely 18 lines in the 2,300 page Dodd-Frank Act, it became one of the law's most controversial provisions. The SEC was flooded with comment letters and lobbying efforts as business groups, companies, and executives weighed in. This delayed the rule-making process. The agency finally voted to approve the rule in 2015.

10. Do other countries have similar requirements?

U.K. Prime Minister Theresa May has proposed rules requiring companies to publish the pay ratio between CEOs and their average British employees by June. A German lawmaker in the European Parliament is seeking to force banks in the European Union to disclose pay ratios. In 2013, Swiss voters rejected a proposal to bar executives from getting paid more in a month than their lowest-paid workers would in a year, which would have capped the ratio at 12-to-1.

See also:

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.