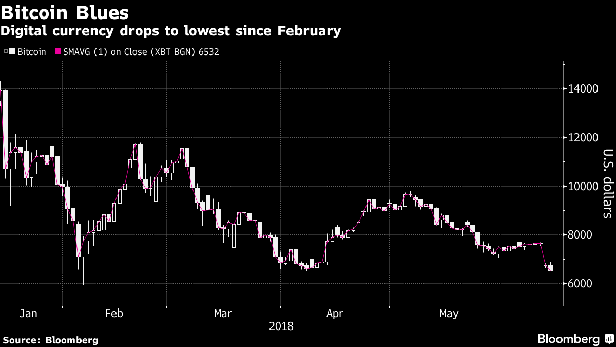

Cryptocurrencies have been besetby a string of bad news. Most recently was the “cyber intrusion” onthe South Korean cryptocurrency exchange Coinrail this past weekendthat appeared to result in a loss of an unknown quantity of digitalcurrency. Bitcoin slumped 12 percent on Monday.Exchanges have comeunder growing scrutiny around the world in recent months amid arange of issues including thefts, market manipulation, and moneylaundering. Back in May, the sector found itself under increasinggovernment scrutiny when the Justice Department opened up acriminal probe into illegal trading practices that can manipulatethe price of bitcoin and other cryptocurrencies.

Cryptocurrencies have been besetby a string of bad news. Most recently was the “cyber intrusion” onthe South Korean cryptocurrency exchange Coinrail this past weekendthat appeared to result in a loss of an unknown quantity of digitalcurrency. Bitcoin slumped 12 percent on Monday.Exchanges have comeunder growing scrutiny around the world in recent months amid arange of issues including thefts, market manipulation, and moneylaundering. Back in May, the sector found itself under increasinggovernment scrutiny when the Justice Department opened up acriminal probe into illegal trading practices that can manipulatethe price of bitcoin and other cryptocurrencies.|

“The relative size of this user group raises questions,” SusanEustis, president of WinterGreen Research Inc., said in an email.“As cryptocurrency venues have come under growing scrutiny aroundthe world in recent months—amid a range of issues including thefts,market manipulation, and money laundering—the base of the bitcoinappeal has eroded.”Skeptics have remained vocal. Bitcoin got nolove from two of the world's wealthiest men, Bill Gates and WarrenBuffett, with the latter calling the currency "probably rat poisonsquared” last month.In China, the Communist Party-run People'sDaily reported on June 7 that the country will continue to crackdown on illegal fundraising and risks linked to Internet finance,quoting central bank officials. The nation's cleanup of initialcoin offerings (ICOs) and bitcoin exchanges has almost beencompleted, the newspaper said, citing Sun Hui, an official at theShanghai branch of the central bank.

Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.