Corporate America's love affairwith all things blockchain may be cooling.A number of softwareprojects based on the distributed-ledger technology will be wounddown this year, according to Forrester Research Inc. And somecompanies pushing ahead with pilot tests are scaling back theirambitions and timelines. In 90 percent of cases, the experimentswill never become part of a company's operations, the firmestimates.Even Nasdaq Inc., a high-profile champion of blockchainand cryptocurrencies, hasn't moved as quickly as hoped. Theexchange operator, which talked in 2016 about deploying blockchainfor voting in shareholder meetings and private-company stockissuance, isn't using the technology in any widely deployedprojects yet.“The expectation was we'd quickly find use cases,”Magnus Haglind, Nasdaq's senior vice president and head of productmanagement for market technology, said in an interview. “Butintroducing new technologies requires broad collaboration withindustry participants, and it all takes time.”|

Corporate America's love affairwith all things blockchain may be cooling.A number of softwareprojects based on the distributed-ledger technology will be wounddown this year, according to Forrester Research Inc. And somecompanies pushing ahead with pilot tests are scaling back theirambitions and timelines. In 90 percent of cases, the experimentswill never become part of a company's operations, the firmestimates.Even Nasdaq Inc., a high-profile champion of blockchainand cryptocurrencies, hasn't moved as quickly as hoped. Theexchange operator, which talked in 2016 about deploying blockchainfor voting in shareholder meetings and private-company stockissuance, isn't using the technology in any widely deployedprojects yet.“The expectation was we'd quickly find use cases,”Magnus Haglind, Nasdaq's senior vice president and head of productmanagement for market technology, said in an interview. “Butintroducing new technologies requires broad collaboration withindustry participants, and it all takes time.”|Hype Versus Reality

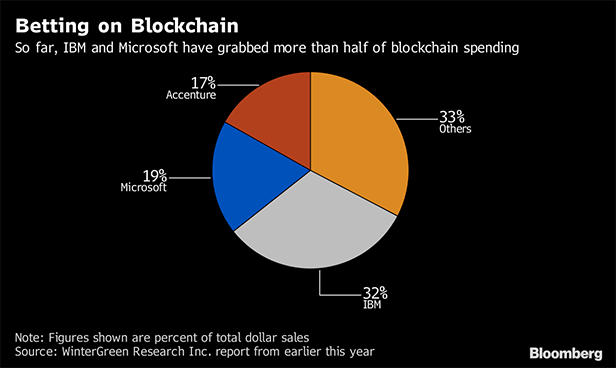

Blockchain is designed to provide atamper-proof digital ledger—a groundbreaking means of trackingproducts, payments, and customers. But the much-ballyhooedtechnology has proven difficult to adopt in real-life situations.As companies try to ramp up projects across their businesses,they're hitting problems with performance, oversight, andoperations.“The disconnect between the hype and the reality issignificant—I've never seen anything like it,” said RajeshKandaswamy, an analyst at Gartner Inc. “In terms of actualproduction use, it's very rare.”That could be bad news for makersof blockchain software and services, which include IBM andMicrosoft. They're aiming to make billions on cloud services thathelp run supply chains, send and receive payments, and interactwith customers. Now their projections—and investors'expectations—may need to be tempered.“Blockchain is supposed to bean important future revenue stream for IBM, Microsoft, and othersin equipment sales, cloud services, and consulting,” said RogerKay, president of Endpoint Technologies Associates. “If itmaterializes more slowly, analysts will have to make downwardrevisions.”IBM, which has more than 1,500 employees working onblockchain, said it's still seeing strong demand. But growingcompetition could affect how much it can charge clients, accordingto Jerry Cuomo, vice president of blockchain technologies atIBM.Microsoft also remains upbeat. “We see tremendous momentum andprogress in the enterprise blockchain marketplace,” the companysaid in a statement. “We remain committed to developingcutting-edge technology and working side-by-side with industryleaders to ensure business of all types realize this value.”So far,IBM and Microsoft have grabbed 51 percent of the more than $700million market for blockchain products and services, WinterGreenResearch Inc. estimated earlier this year. For a large swath of companies,blockchain remains an exotic fruit. Only 1 percent of chiefinformation officers said they have any kind of blockchain adoptionin their organizations, and only 8 percent said they are inshort-term planning or active experimentation with the technology,according to a Gartner study. Nearly 80 percent of CIOs said theyhave no interest in the technology.Many companies that previouslyannounced blockchain rollouts have changed plans. ASX Ltd., whichoperates Australia's primary national stock exchange, now expectsto have a blockchain-based clearing and settlement system at theend of 2020 or the beginning of 2021. Two years ago, the companywas aiming for a commercial blockchain platform within 18 months.An exchange spokesman said “there's been no delay,” as the companyhadn't announced the exact launch date until recently.Another earlyadvocate, Australian mining giant BHP Billiton Ltd., said in 2016that it would deploy blockchain to track rock and fluid samples inearly 2017. But it currently doesn't “have a blockchainproject/experiment in progress,” according to spokeswoman JudyDane.But there could be more of an uptick next year, according toblockchain-backing organizations. “It's not on a steep ramp-upcurve at all,” said Ron Resnick, executive director of EnterpriseEthereum Alliance (EEA), comprised of about 600 members such asCisco Systems Inc., Intel Corp., and JPMorgan Chase & Co. “Idon't expect that to happen this year. They are still testing thewaters.”|

For a large swath of companies,blockchain remains an exotic fruit. Only 1 percent of chiefinformation officers said they have any kind of blockchain adoptionin their organizations, and only 8 percent said they are inshort-term planning or active experimentation with the technology,according to a Gartner study. Nearly 80 percent of CIOs said theyhave no interest in the technology.Many companies that previouslyannounced blockchain rollouts have changed plans. ASX Ltd., whichoperates Australia's primary national stock exchange, now expectsto have a blockchain-based clearing and settlement system at theend of 2020 or the beginning of 2021. Two years ago, the companywas aiming for a commercial blockchain platform within 18 months.An exchange spokesman said “there's been no delay,” as the companyhadn't announced the exact launch date until recently.Another earlyadvocate, Australian mining giant BHP Billiton Ltd., said in 2016that it would deploy blockchain to track rock and fluid samples inearly 2017. But it currently doesn't “have a blockchainproject/experiment in progress,” according to spokeswoman JudyDane.But there could be more of an uptick next year, according toblockchain-backing organizations. “It's not on a steep ramp-upcurve at all,” said Ron Resnick, executive director of EnterpriseEthereum Alliance (EEA), comprised of about 600 members such asCisco Systems Inc., Intel Corp., and JPMorgan Chase & Co. “Idon't expect that to happen this year. They are still testing thewaters.”|Seeking Standards

One reason behind the delays: Most blockchain vendors don't offercompatible software. Companies are worried about being beholden toone vendor—an issue the EEA group hopes to resolve by settingstandards.The organization will launch its certification testingprogram for blockchain software in mid-2019, Resnick said. Rivalindustry effort Hyperledger, which represents companies such asIBM, Airbus SE, and American Express Co., is preparing to connectits blockchain software to a popular platform calledKubernetes.Most blockchains also can't yet handle a large volume oftransactions—a must-have for major corporations. And they shineonly in certain types of use cases, typically where companiescollaborate on projects. But because different businesses have toshare the same blockchain, it can be a challenge to agree ontechnology and how to adopt it.Many companies also are simplyworried about being the first to deploy new technology—and thefirst to run into problems.“They want to see other people failfirst—they don't wanna be a guinea pig,” said Brian Behlendorf,executive director of Hyperledger. “It's just the nature ofenterprise software."

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.