President Donald Trump is giving many businesses an unexpectedbenefit on top of lower taxes and regulatory relief: He's helpingto restore their pricing power.

|By pouring hundreds of billions of dollars of tax cuts and extragovernment spending into an already stretched economy, Trump isfostering an environment where firms such as conglomerate 3M Co.can raise prices because demand for their products is strong.

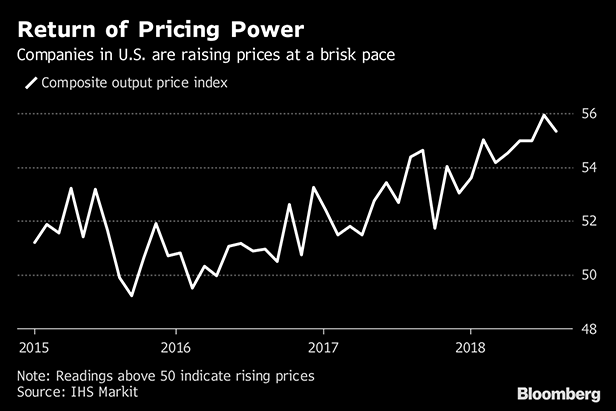

|“The power is with the seller,” said Chris Williamson, chiefbusiness economist at consultants IHS Markit Ltd.

|That's a turnaround from the past decade, when executives oftenbemoaned their inability to lift prices because of their fear ofsacrificing sales. The shift will help them pad profits that arealready surging thanks to lower taxes.

|It's also good news for Federal Reserve Chairman Jerome Powelland his colleagues, who have struggled to lift inflation to their 2 percenttarget and hold it there. Policymakers took note of reports ofa return of pricing power at their July 31 to August 1 meeting,according to the minutes of that gathering released last week.

|

|

Effect on Labor

The news might not be so welcome to workers, who've had troublewinning bigger wage gains in spite of unemployment near amultidecade low. Faster price rises already are eroding whatpurchasing power they have—a point that some Democratic opponentsof Trump have made as November congressional electionsapproach.

|Average hourly earnings adjusted for inflation fell 0.2 percentin July from a year earlier, notching the weakest reading since2012.

|The political debate highlights the chicken-or-egg question atthe heart of the inflation process that's been noted by MorganStanley Chief U.S. Economist Ellen Zentner and others: Which comesfirst—stepped-up price increases or bigger pay hikes?

|Some economists argue that rising prices come first, ascompanies seize opportunities to buttress their bottom lines whendemand is strong. Workers then seek higher wages to make up for thepurchasing power they've lost to rising inflation.

|Others contend that wages lead the way as a tight job marketprompts companies to boost salaries for coveted workers. Firmsfollow that with price increases to cover growing wage bills,boosting inflation in the process.

|Complicating the picture this time around are the tariffs that Trump has slapped on a variety ofimports from China and elsewhere. Those are raising costs forbusinesses and putting pressure on them to hike their prices inresponse.

|Data due Thursday are expected to show that inflation picked upin July. The personal consumption price index that the Fed targetsprobably rose 2.3 percent in July from a year earlier, the most inmore than six years, according to the median estimate of economistssurveyed by Bloomberg News. After stripping out volatile food andenergy costs, the core index probably rose 2 percent in July,versus 1.9 percent in June.

|Recent business surveys suggest that companies see greater scopefor boosting prices. Non-manufacturing firms told the PhiladelphiaFed this month that they expect to raise prices 3 percent in thecoming year, up from a 2 percent increase they forecast in May.

||

'Very Happy'

A separate survey of both manufacturing and non-manufacturingcompanies by IHS Markit found that their average selling pricesrose at the fastest rate of the nine-year-old expansion in Julybefore the pace eased a bit in August. That mirrors 3M'sexperience. In the second quarter, the St. Paul, Minnesota-basedmaker of everything from Post-it notes to copper cabling reportedthe biggest increase in its U.S. selling prices in more than fouryears.

|3M is “highly confident that our price increases will more thanoffset whatever we see for raw material headwinds for the year,”including from higher tariffs, CFO Nicholas Gangestad told WallStreet analysts on July 24.

|Sealed Air Corp., the maker of Bubble Wrap and other packagingmaterials, also is finding it can raise prices without a bigbacklash from its customers.

|“Where I've been very happy with the company's success is ourability to pass along price increases to our customers for ourrelevant input cost,” William Stiehl, CFO of the Charlotte, NorthCarolina-headquartered firm, told analysts on Aug. 7.

|Of course, not every company is raising prices. Walmart Inc.,the world's biggest retailer, has been holding the line onprices—or in some cases reducing them—even as its consumer-staplessuppliers raise theirs.

|“There is obviously some cost inputs rising. We've got risk oftariffs and transportation costs, etc.,” Dan Binder, vice presidentof investor relations for the Bentonville, Arkansas-based company,said in an Aug. 16 earnings call. “This is all in our plan. We arenot going to get beat on price.”

|Such worries about losing out, though, may fade if the economycontinues to grow solidly and consumer demand remains strong on theback of Trump's fiscal stimulus.

|“The tightening labor market and tightening product market willshow through in a gradual pick-up in inflation,” said Peter Hooper,chief economist for Deutsche Bank Securities.

|From: Bloomberg

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.