The U.S. central bank should follow through on gradually raising interest rates to more normal levels, though “how high rates will ultimately need to rise depends on economic growth,” said Federal Reserve Bank of Richmond President Thomas Barkin.

“It is difficult to argue that lower-than-normal rates are appropriate when unemployment is low and inflation is effectively at the Fed's target,” he said Wednesday in Roanoke, Virginia as he described the case for further gradual rate hikes. “In addition, we don't want to risk the credibility of our commitment to low and stable inflation.”

Barkin, 56, is a voter this year on the rate-setting Federal Open Market Committee (FOMC). The former senior executive at global consulting firm McKinsey & Co. took the Richmond Fed's helm in January. His public comments on monetary policy, which place him in the center of the consensus on the FOMC, were his most substantive on the topic since he became a central banker.

Recommended For You

U.S. central bankers next meet on Sept. 25 and 26 after leaving rates unchanged last week. Investors are pricing in an almost certain probability that the FOMC will raise the benchmark lending rate another quarter point to a range of 2 percent to 2.25 percent.

“It is easy for me to imagine that we will get to a place where we will want to pause a little longer and look around,” Barkin told reporters after the speech. “It is also easy for me to imagine that we will continue on the pace. It depends a lot on how the data comes out.”

The U.S. economy added 157,000 jobs in July, the Labor Department reported Friday, while a measure of annual wage gains held steady at a 2.7 percent increase. Inflation is around the Fed's 2 percent target, with the headline measure rising 2.2 percent in June and 1.9 percent minus food and energy.

Longer-Run Growth

Barkin noted that the longer-run growth rate of the economy is challenged by slow population growth and a decline in the labor force participation rate as people retire. He said the Richmond Fed forecasts a 2 percentage point drop in participation over the next five years, and productivity is rising around a 1.25 percent pace. In a slow-growth environment, “interest rates are likely to be lower,” he said.

“The gradual path we are on seems like a sensible one to me and I am supportive of it, which I describe as raising rates at a measured pace and looking around and seeing what you see in the data,” Barkin said.

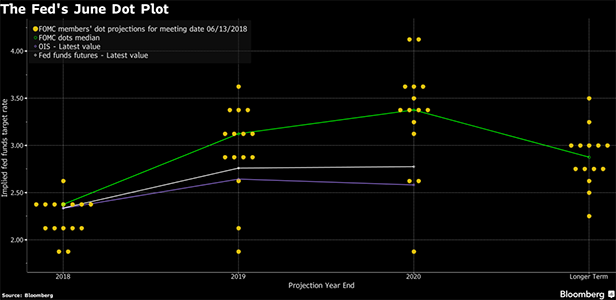

Some Fed policymakers have argued for raising rates until they reach the so-called neutral level, where policy is neither supporting nor hindering growth. Officials put neutral at 2.9 percent, according to their median projection in June. But there is a range of views around that estimate, and Barkin said it was hard to pin it down to a precise number.

Raising rates too far could hurt growth, though “given the strength of the underlying economy and the recent additional fiscal stimulus, the risk of normalization is reduced,” he said.

The Richmond Fed district includes several large export-oriented industries, particularly in South Carolina which is home to the largest BMW plant in the world. Barkin said the impact of tariffs on the broader U.S. economy isn't very large yet, though “tariff concerns are making people more nervous.” The main channel where it could have an impact is business spending, he said.

“The contacts I talk to are very interested where the tariff conversation” is going to end up, Barkin said. “It is very expensive to reconfigure a supply chain. People are hesitant until they figure out where things are going to land to make those big investments.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.