Maybe the third time Jerome Powell will getlucky.

|The Federal Reserve chairman looked close to pullingoff a soft landing of the ebbing U.S. economy twice thisyear—at the start of May and the end of July.

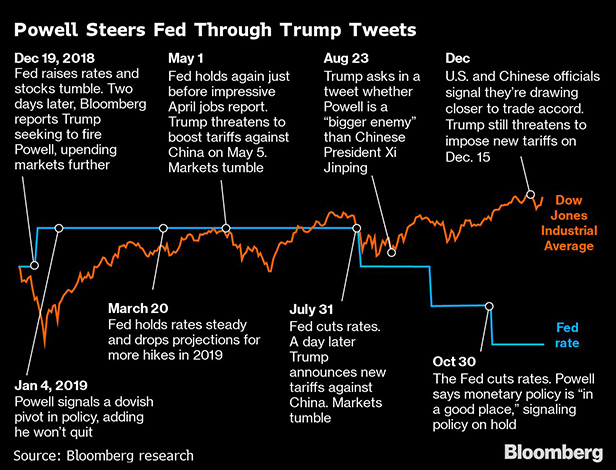

|Each time, though, he saw his plans blown off course via anescalation of trade tensions by President Donald Trump.Things were bad enough in August that Powell delayed his vacationby a day to assess the fallout.

|As he approaches his third year as Fed chairman, Powell isagain sounding confident that the U.S. economyand monetary policy are in a good place, calibrated to help extendthe record-long U.S. economic expansion.

|Reflecting his contentment, Powell and his colleagues areexpected to leave interest rates unchanged on Wednesday aftercutting them at three consecutive meetings. And they're keepingtheir fingers crossed that Trump will decide not to follow throughon his threat to impose more tariffs on Chinese imports on December15.

|

See also:

- Assessing the Impact of the Fed's Interest Rate EndGame

- Interest Rate Response for Small and MidsizeCompanies

- Incorporating Expectations into HedgingDecisions

|

"The jury is still out, but it's very much looking like a softlanding," said Princeton Universityprofessor Alan Blinder, who served as Fed vice chairmanfrom 1994 to 1996, the last—and arguably only—time the central bankcooled off the economy without crashing it into recession.

|A recessionprobability model developed by Bloombergeconomists puts the odds of a contraction in the next 12 months atabout one-in-four, down from close to one-in-two a year ago whenfinancial markets were spooked by what even some Fed insiders admitwas a poorly executed December rate increase.

|"One can argue that at the end of 2018 they were a little slowto recognize that things had turned," former Fed ViceChairman Donald Kohn said. But Powell "correctedit within weeks" by signaling that the Fed was putting furtherhikes on hold.

|How things go from here is critical not only for Powell'slegacy, but also for the reputation of the politically independentcentral bank as it faces an onslaught of criticism from thepresident.

||

The Trump-Powell Dynamic

Trump has a lot riding on Powell's ability to keep the economypurring. A 2020 downturn would probably imperil his chances ofwinning re-election in November.

|At the heart of the interplay between Trump and Powell is aparadox. Fed insiders insist that Powell has turned a deaf ear toTrump's demands that he gin up growth by slashing rates. But afterincreasing rates four times in 2018, the central bank reversedcourse this year, acting quickly to shelter the economy fromTrump's trade squalls and slow global growth.

|"They've inadvertently encouraged the trade war" byanesthetizing the markets with preemptive rate cuts,said Ethan Harris, head of global economic research forBank of America Corp.

|The reductions have also raised questions about the Fed'ssusceptibility to political pressure.

|"I worry that the committee will be thought of as lessindependent and less credible because they eased rates this yearafter the president criticized the Fed," said YaleUniversity professor William English, a former senioreconomist at the central bank who nevertheless supported the ratecuts.

|Going into 2020, Powell has suggested that enough is enough.He's said it would take a "material reassessment" of theFed's outlook for moderate growth, a strong labor market, andinflation around 2 percent for it to move again.

|Trump isn't satisfied with thatstance, telling Powell in a rare sit-down on Nov.18 that the central bank should push rates belowzero.

|He also argued that the Fed's monetary policy was hurting U.S.manufacturing exporters by elevating the dollar—even though thegreenback is little changed from when Trump was elected and U.S.companies have expressed more concern about trade strains thaninterest rates.

….My only question is, who isour bigger enemy, Jay Powell or Chairman Xi?

|— Donald J. Trump (@realDonaldTrump) August 23, 2019

Trump's assault on the Fed is not limited to angry tweets.Earlier this year, he asked White House lawyers to explore hisoptions for removing the central bank chair. He's also floated thepossibility of nominating economists sympathetic to his views totwo open positions on the Fed board.

|

To protect the Fed's flank, Powell has continued to frequent thehalls of Congress. Since taking over as Fed chair in February 2018,he's met or spoken by telephone with lawmakers more than 170 timesoutside of his appearances before Congressional committees.

||

Fed Gets an A-Plus… for Now

As part of a wide-ranging strategic review, the Powell Fed hasalso reached out to a cross-section of Americans—fromsmall-business owners to food bank managers—to get their feedbackon how the central bank is doing.

|"I would give him an A-plus" on handling the political dimensionof the job, said Kohn, who is now a senior fellow at the BrookingsInstitution. "He's built a moat around the Fed through hiscommunication with Congress and the public."

|Indeed, when Powell appeared at a chamber of commerce meeting inProvidence, Rhode Island, last month, more than 700 local businessleaders gave him a prolonged standing ovation as he took the stage.His message to them was upbeat: "At this point inthe long expansion, I see the glass as much more than halffull."

|By allowing unemployment to fall to around half-century lows,Powell is helping to spread the benefits of the economic upswing tothose less well-off, in the process bolstering the Fed's reputationon Capitol Hill.

|The question now for Powell—and Trump—is whether the Fed chiefcan keep the economy on a roll.

|Allianz SE chief economic adviser MohamedEl-Erian worries the Fed has become too beholden tofinancial markets and wasted precious monetary ammunition bylowering rates in October.

|"It wouldn't surprise me if the markets start pressuring the Fedto cut again" as it becomes clear that trade tensionsaren't going away even if Trump reaches a mini-deal with China, said El-Erian, who isalso a Bloomberg Opinion columnist.

|But the way Fed insiders see it, they didn't cut rates in 2019merely to keep markets happy any more than they bowed to Trump'sconstant hectoring. Instead, they were seeking to protect theeconomy from the fallout from Trump's tariff battles.

|The dynamic in 2020 may be much the same. The economy's fate,central bankers believe, hinges largely on whether Trump can makeprogress on trade—or at least avoid making things more fraught.That, in turn, will determine what they do with interest rates.

|"The outlook is very much held hostage to the degree ofuncertainty coming from trade policy," said JuliaCoronado, the founder of MacroPolicy Perspectives in New York and aformer Fed board economist.

||

|

Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.