At the height of last summer, New York Federal Reserve PresidentJohn Williams temporarily roiled markets when he argued thatcentral banks running low interest rates should act boldly toinoculate their economies against unfolding ailments.

|"When you only have so much stimulus at your disposal, it paysto act quickly to lower rates at the first sign of economicdistress," he said in a speech that the NewYork Fed later clarified was not meant to be a policy signal. Youwant to "vaccinate against further ills."

|As Williams and his colleagues prepare for a monetary policymeeting next week, the mounting economic impact of the coronavirusis turning his academic theorizing into a practical considerationfor policy: Should the Fed cut interest rates to zero? And, if so,how soon should it act?

|

The argument for such a move, sooner rather than later is basedon research like that of Williams, which contends that centralbanks should not conserve their ammunition when rates are near zeroand economic threats arise.

|The argument for a more cautious approach rests on the hugeuncertainties surrounding the spread of the virus and its effectson the economy, as well as the scope of any measures from the Trumpadministration.

||

Decision Complicated by Lack of Data

"They have literally no data as to the economic impact of thecoronavirus," said Justin Weidner, an economist at Deutsche BankSecurities Inc. The bank currently forecasts 50 basis points (bps)of cutting this month, with the possibility of more as Fedofficials see additional data.

|"It is hard to say 'Use all of your ammunition' when you don'tknow what you are shooting at or what the scope of the fiscalresponse is," he said.

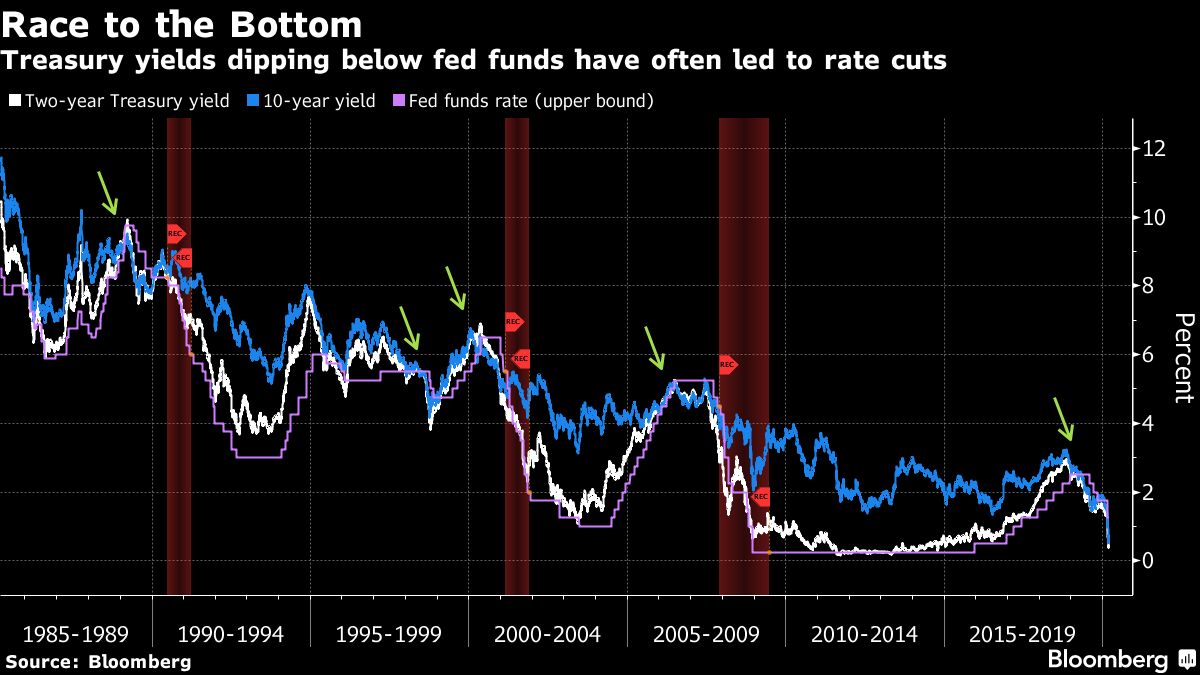

|After an emergency half-percentage-point reduction lastweek, the Fed's target range for the overnight interbank ratestands at just 1 percent to 1.25 percent.

|Traders in the federal funds futures market are betting that thecentral bank will lower rates by at least another half point at itsMarch 17-18 meeting.

|A number of Fed watchers—Michael Feroli of JPMorgan Chase &Co., Jan Hatzius of Goldman Sachs Group Inc., and former U.S.central bank governor Laurence Meyer, to name a few—predict thatrates are headed to zero.

|Feroli, who sees that happening at the Fed's next meeting if notbefore, invokes research like Williams' as justification for hiscall. "The reason for a maximally aggressive move at the nextmeeting has its roots in the optimal control literature, whichrecommends moving quickly when the effective lower bound oninterest rates looms," JPMorgan's chief U.S. economist said in aMarch 9 note to clients.

|In his July 2019 speech, Williams said his work shows that theFed can magnify the impact of its limited interest rate ammunitionby acting quickly. It can also enhance its monetary policyfirepower bykeeping rates lower for longer once they've been cut.

|Hatzius sees the Fed getting to zero in two steps, with ahalf-point cut both this month and next. The Goldman Sachs chiefeconomist expects that to be accompanied by action by othermonetary authorities, including the European Central Bank and theBank of England, as policymakers battle a contraction in the worldeconomy.

|

In laying out the rationale for the Fed's March 3 emergency ratecut, Chairman Jerome Powell said it was partly designed to avoid atightening of financial conditions that could hurt the economy.

|Unfortunately for Powell and the Fed, financial conditions havegotten tauter since then, as the stock market has cratered. Behindthe plunge: more bad news on the virus and the lack of action byother policymakers to aid the economy.

|After days of playing down coronavirus risks, President DonaldTrump's administration is moving toward a package of support,including a possible payroll tax cut. But that hasn'tstopped the president from beating on the Fed and pressing it tocut rates more.

Our pathetic, slow movingFederal Reserve, headed by Jay Powell, who raised rates too fastand lowered too late, should get our Fed Rate down to the levels ofour competitor nations. They now have as much as a two pointadvantage, with even bigger currency help. Also, stimulate!

|— Donald J. Trump (@realDonaldTrump) March 10, 2020

|

An Unconventional Economic Crisis

Amherst Pierpont chief economist Stephen Stanley said themonetary policy playbook put forward by Williams and others ismeant to deal with a conventional recession that can be combatedthrough easier monetary policy. The shock from the virus isdifferent.

|"This isn't an interest rate problem," he said. "People aregoing to stay home because they're afraid of getting sick" nomatter how low rates are.

|Stanley, who expects the Fed to reduce rates by a half-pointnext week, also sees downsides to the central bank moving tooaggressively: It risks fueling the feeling among investors that itis running out of ammo. "The closer they move to zero, the moreintense that feeling becomes," he said.

|—With assistance from SophieCaronello.

|Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.