The Federal Reserve late Wednesday said it was launching a program to support money-market mutual funds as alarm over the coronavirus continues to cause strain in short-term funding markets.

The Money Market Mutual Fund Liquidity Facility (MMLF), established under the Fed's emergency authority, echoes a version that was set up during the global financial crisis. The Treasury Department will provide $10 billion of credit protection.

U.S. Treasury Secretary Steven Mnuchin said in a statement that the fund will "enhance the liquidity and smooth functioning of money markets, support the flow of credit to hard-working Americans, and help stabilize the broader financial system."

Earlier Wednesday, the Treasury Department had proposed to temporarily guarantee money-market mutual funds with taxpayer dollars as part of its coronavirus stimulus plan, according to a document obtained by Bloomberg News.

"Money-market funds are common investment tools for families, businesses, and a range of companies," the Fed said in its statement. "The MMLF will assist money-market funds in meeting demands for redemptions by households and other investors, enhancing overall market functioning and credit provision to the broader economy."

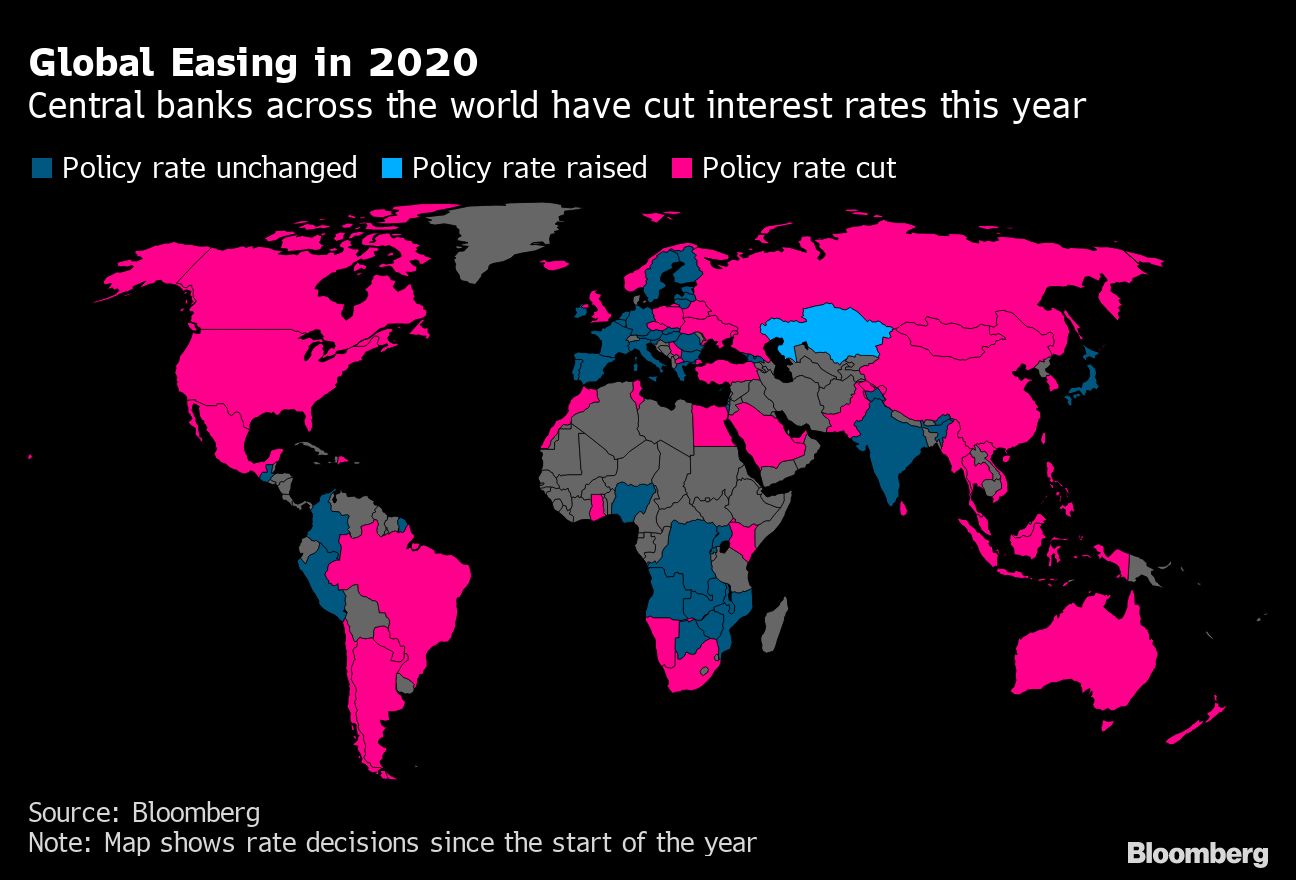

The Fed's action comes hours after the European Central Bank's late-night emergency decision to launch an extra emergency bond-buying program worth 750 billion euros (US$820 billion) to calm markets and protect the Eurozone economy. Also, at the same time as the Fed announcement, the Reserve Bank of Australia said it was cutting its benchmark rate by a quarter point, to 0.25 percent.

Ongoing Emergency Actions

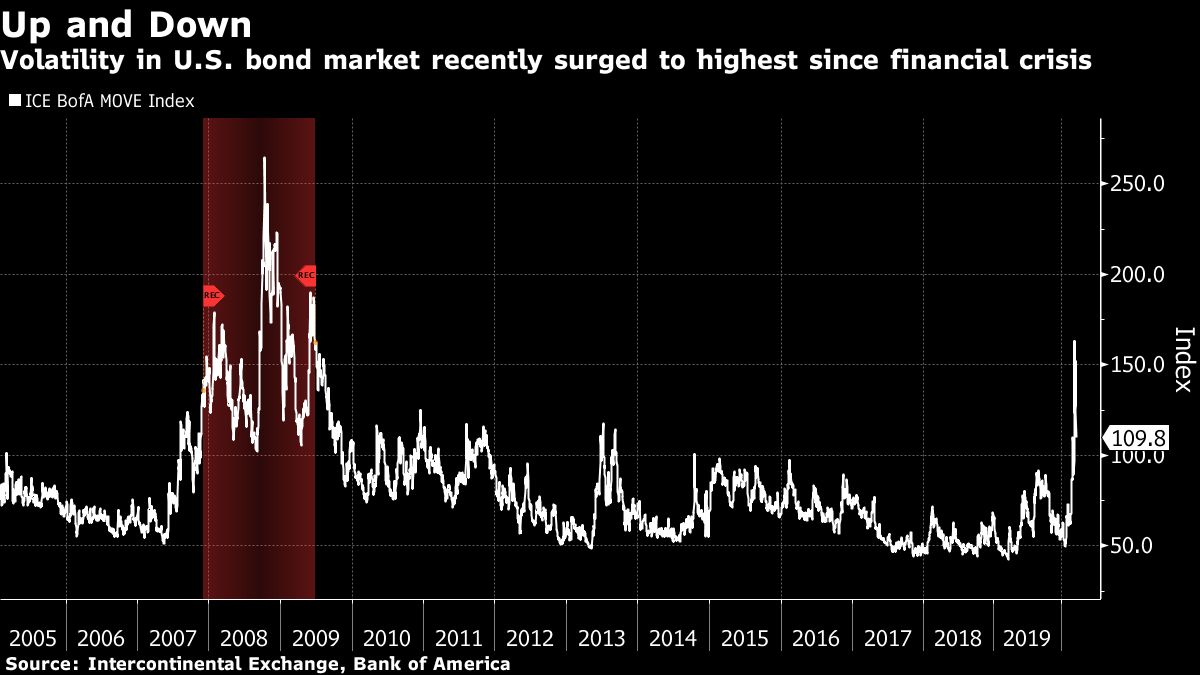

The Fed's dramatic late-night step was the central bank's third emergency lending facility in two days, after the Fed on Tuesday unleashed measures to support the commercial paper market and primary dealers, to ensure credit keeps flowing in the U.S. economy. On Sunday, the Fed slashed interest rates nearly to zero and said it would buy at least $700 billion in securities to soften the blow from the virus that has Americans hunkered down to avoid infection.

Money-market funds essentially provide credit to everything from banks through repurchase agreements to corporations through purchases of commercial paper. They are a critical link in the chain of short-term financing where companies borrow and lend outside the formal banking system.

The launch of the Fed's program to support money-market funds is a "game-changer," said Priya Misra, global head of interest rates strategy at TD Securities. The facility "couldn't come a moment sooner," she said. "It provides a much-needed outlet to money funds to get liquidity."

With Wednesday night's action, the central bank is trying to carve a firebreak around this financing, and the vehicle is somewhat complimentary to the Commercial Paper Funding Facility, which also aims to protect non-bank short-term funding.

It will be administered by the Federal Reserve Bank of Boston.

The Historical Perspective

In the U.S., money funds have been under stress as investors have rushed into cash. Households, businesses, and other institutions use money funds to park cash they may need in the short term. Reforms to the industry that passed in 2016 forced a tiering of investments into funds with differing levels of safety and segregated retail customers from institutional.

Steps similar to those taken Wednesday were also taken during the global financial crisis to shore up money funds when a run on them helped cripple credit markets. Under Treasury Secretary Henry Paulson, the department guaranteed more than $3 trillion of fund holdings against losses for almost a year using its Exchange Stabilization Fund.

Money-market mutual funds proved a crucial weak spot in 2008 after the industry's largest fund, the Reserve Primary Fund, suffered losses on debt issued by investment bank Lehman Brothers. When its share price fell below the stable $1 promised to customers, investors began scrambling out of most other money funds, forcing their managers into a fire sale of assets.

—With assistance from Alister Bull.

See also:

- MMF Opportunity in Volatile Markets

- Key Source of Corporate Cash Is Seizing Up

- Fed Unleashes Emergency Loan Facilities

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.