Bankers have a message for America's debt-laden companies: Raise money now, because things could get a lot worse.

The gradual reopening of businesses after months-long shutdowns, and a pickup in manufacturing activity, have given investors reason for optimism in recent weeks. But underwriters who cater to heavily indebted corporations are offering their clients a bleak preview of what may lie ahead.

The long list of worries includes a new wave of coronavirus contagion in the fall, an extended period of double-digit unemployment, a spike in defaults, and a slower-than-expected economic recovery as businesses around the globe adapt to the realities of prolonged social distancing.

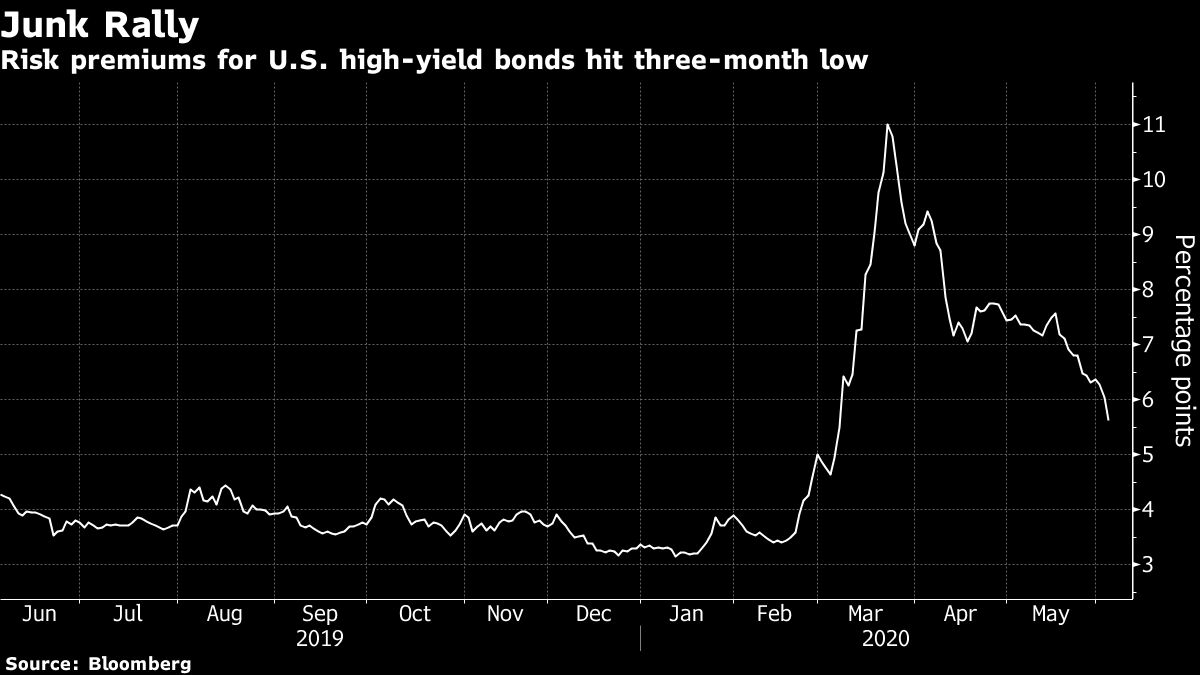

Of course, pitching bond sales to companies is part of the job description, and corporate treasurers expect nothing less from bankers whose bonuses are tied to how many deals they do. Still, the grim warnings to stockpile cash reflect how the rally that credit markets have enjoyed since the Federal Reserve took action may be obfuscating an economic picture still fraught with risks.

"We are telling virtually every private equity firm and issuer out there they ought to get to market," said Peter Toal, global co-head of fixed-income syndicate at Barclays Plc, one of the major underwriters of loans and bonds for highly leveraged companies.

The bankers' private warnings to clients underscore the publicly visible stampede for cash across corporate America. Debt sales by blue-chip companies are running at a record pace this year, while issuance of junk bonds—those rated below investment grade—reached almost $44 billion in May, the third-busiest month on record.

The Fed's support has even allowed many of the companies hardest hit by the coronavirus outbreak to tap markets in recent weeks. Yet borrowers that rely on junk debt are the most exposed to the ebbs and flows of credit markets, as they risk seeing their access to capital cut off when volatility spikes.

Bracing for a 'Tough Winter'

Barclays is hardly the only big player in the market encouraging company executives to take advantage of today's benign credit environment. Bankers worry that even if businesses reopen and consumers resume spending, the U.S. economy could go through a rough few quarters and underperform investors' expectations.

"If we have a tough winter and your company is not in good shape through the spring of next year, this is a good time to take care of that," said Richard Zogheb, head of global debt capital markets at Citigroup Inc.

Uber Technologies Inc. sold $1 billion of bonds last month, even as it finished the first quarter with over $8 billion of cash and nearly $1 billion of short-term investments. While its business has been gutted by the coronavirus, the company had told investors that it expected to end the year with over $4 billion in cash in its worst-case scenario.

Executives moved ahead with the debt raise last month partly because of concerns that as states start to reopen for business, investors could be disappointed by a languid pickup in economic activity, according to a person with knowledge of the deal. A representative for Uber declined to comment.

See also:

- A Tsunami of Loan Modifications Is on the Horizon

- How to Ride High on the Loan-Modification Wave

- A Shrewd Bond Maneuver

- Locking in Low Interest Rates

- Strengthen Your Cash Position in the Covid-19 Crisis

- Lease Modifications Rising Due to Economic Uncertainty

For many companies, the focus remains squarely on making sure they have enough cash on hand to withstand a prolonged slump in revenue. But bankers are also urging companies that have already taken care of their immediate liquidity needs to refinance maturing debt and, in some cases, accumulate cash for investments or small acquisitions.

Ardagh Group SA, one of the world's largest producers of bottles and cans for the beverage industry, has already tapped the market three times since the pandemic took hold. Its first deal replaced short-term bank funding and beefed up its balance sheet, while the last two allowed the company to refinance existing debt at lower interest rates.

Tenet Healthcare Corp., a hospital operator, sold its second bond in as many months on Tuesday to bolster cash reserves and repay existing debt. Royal Caribbean Cruises Ltd. and Univision Holdings Inc. are also selling debt again within weeks of previous offerings.

Encouraging companies to come to market to repay debt also has another benefit for banks: It frees capital tied up in loans, allowing lenders to redeploy that cash elsewhere.

U.S. companies borrowed hundreds of billions of dollars of short-term debt from banks beginning in early March, but many have subsequently sold bonds to repay those borrowings, allowing the lenders to make that cash available to other clients.

"The bond market has been so open that a large number of our bridge loans have been refinanced" already, said Citigroup's Zogheb. "That's given us an opportunity to look at acquisitions."

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.