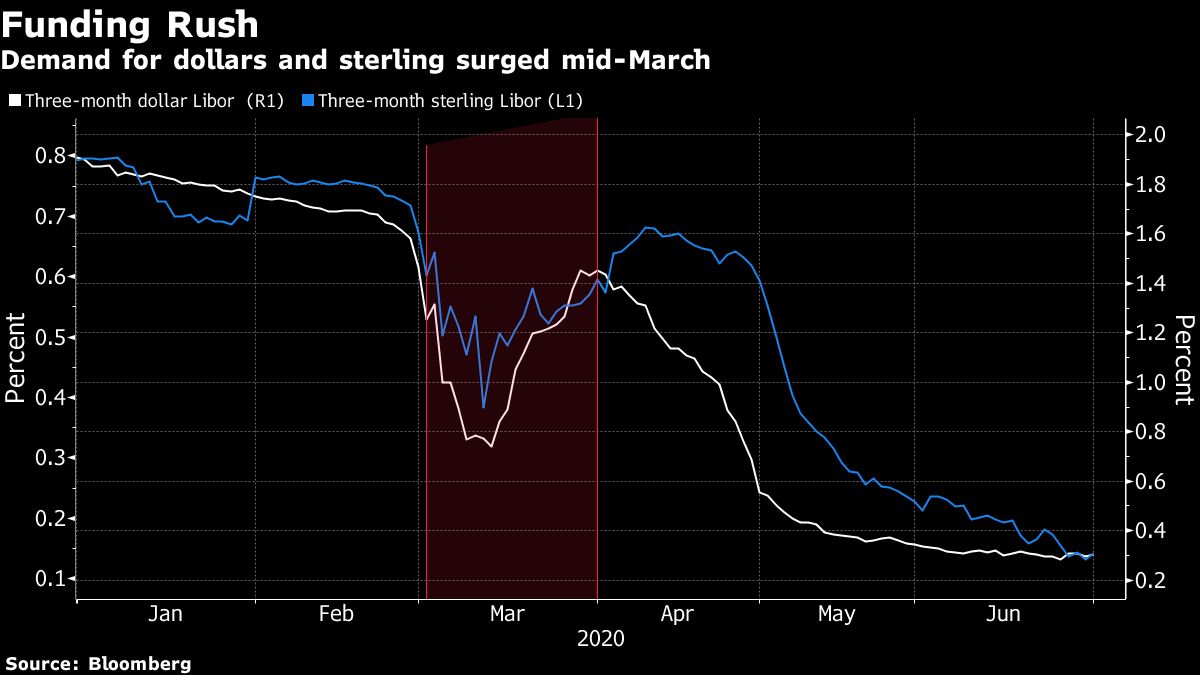

A spike in LIBOR rates at the height of the coronavirus crisis drove up financing costs and offset the benefits of interest-rate cuts, the Financial Stability Board (FSB) said.

The board, which monitors the global financial system, said the rate's weaknesses were underscored during the financial turmoil. It urged firms and countries to ditch the rate on time at the end of 2021.

"The increase in the most widely used LIBOR rates in March put upward pressure on the financing cost of those paying LIBOR-based rates," the FSB said in a statement. "For those borrowers, this offset in large part the reductions in interest rates in those jurisdictions where central banks have lowered policy rates."

The high-level argument against LIBOR follows growing international pressure to retire the rate, which underpins trillions of dollars in financial assets. For decades, the London Interbank Offered Rate (LIBOR) served as a benchmark set daily by banks to determine interest rates on everything from student loans and mortgages to derivatives and credit cards, though it has since been discredited by manipulation scandals.

The FSB's statement raises questions about the overall effectiveness of interest-rate cuts by the Bank of England (BOE) and the U.S. Federal Reserve designed to stimulate their economies earlier this year.

See also:

- Showdown in the LIBOR Corral

- 'Zombie LIBOR' Threatens Market's Complacent View

- The Short Road from LIBOR's Death to 'Armageddon'

- Shrodinger's LIBOR Refuses to Leave Its Box

Three-month dollar LIBOR rose more than 70 basis points (bps) in the second half of March after dropping to a four-year low as demand for the greenback rose sharply. The funding rate for equivalent sterling LIBOR rose about 20 bps in the same period. However, the U.S. successor for LIBOR, the Secured Overnight Financing Rate (SOFR), suffered its own turbulence.

"It's fair to say that the crisis also underscored problems with the U.S. replacement," said Christoph Rieger, head of fixed-rate strategy at Commerzbank AG. He said that while SOFR "has been rather relatively well-behaved during the crisis, and especially over the last couple of months, at least in terms of level and volatility, just the decline in volume could become a concern."

Regulators began phasing out the LIBOR benchmark after European and U.S. banks were found to have manipulated rates to benefit their own portfolios. Those efforts stumbled as market participants shifted attention away from the transition and toward surviving the crisis.

The BOE in May delayed plans to encourage banks to abandon the benchmark. The same month, U.S. policymakers turned to LIBOR as the benchmark for their $600 billion Main Street Lending Program, which will buy debt from potentially hundreds of companies.

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.