The global economy continues to recover following the Great Recession, and with it, the treasurer's strategic value to the organization is evolving toward efficiently managing working capital, to meet the expanding liquidity needs of their growing companies.

The global economy continues to recover following the Great Recession, and with it, the treasurer's strategic value to the organization is evolving toward efficiently managing working capital, to meet the expanding liquidity needs of their growing companies.

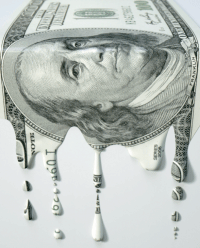

The question "where's my cash?" was, of course, top of mind for the vast majority of CFOs and treasurers during the financial crisis. However, as many organizations have continued to accumulate record cash balances since then (corporates' cash holdings increased 78 percent from 2008-2013, compared to just 27 percent from 2000-2008), treasurers are not only tasked with safeguarding cash. There is now also a common mandate to become a more strategic business partner, to ensure corporate free cash flow and liquidity goals are realized.

With many U.S. corporations currently facing the challenge of large offshore cash balances, a renewed focus on strategic cash flow forecasting has accelerated in corporate finance departments throughout America as they attempt to meet their domestic financial obligations without taking on additional third-party debt or repatriating offshore cash (with the tax implications). As a result, working capital management has become the key focus for CFOs to challenge their treasury, FP&A and corporate controller teams to minimize the working capital cycle and therefore improve free cash flow.

Continue Reading for Free

Register and gain access to:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world cas studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

*May exclude premium content

Already have an account?

Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.