The Bank of England's (BOE's) monetary policy committee didn't miss an opportunity to surprise with a triply hawkish move on Thursday. Not only did it lift the bank rate to 0.5 percent, as was widely expected, but four of the nine members voted for a double rate hike of 50 basis points (bps).

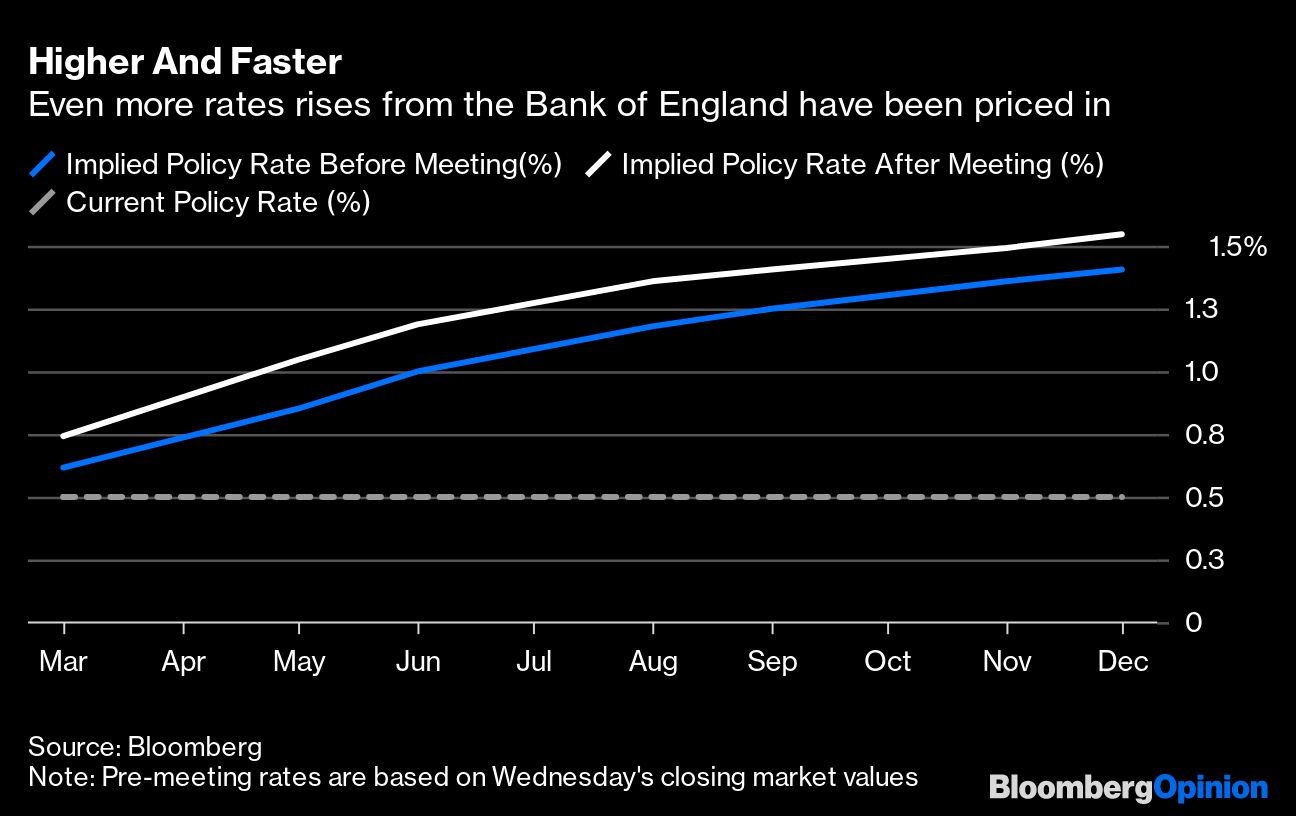

The pound rose initially against the euro but swung weaker after a more hawkish European Central Bank (ECB) meeting. Two-year gilt yields jumped 16 bps with a slightly smaller gain further out the curve. Sterling money markets are fully pricing in a 25 bps hike at both of the next two meetings, projecting official rates as high as 1.5 percent by yearend, triple their current level.

Continue Reading for Free

Register and gain access to:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world cas studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

*May exclude premium content

Already have an account?

Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.