Insurance analysts say modest rate increases for property andcasualty risks will extend into 2013, as the overall economicenvironment is not expected to change dramatically in the comingyear.

| In a research note, Keefe, Bruyette & Woods says theP&C insurance market environment is expected “to be pretty muchthe same as what we've seen in 2012—modest rate increases but notmuch improvement in underlying underwriting profitability andpersistent low interest rates that continue to weaken investmentreturns.”

In a research note, Keefe, Bruyette & Woods says theP&C insurance market environment is expected “to be pretty muchthe same as what we've seen in 2012—modest rate increases but notmuch improvement in underlying underwriting profitability andpersistent low interest rates that continue to weaken investmentreturns.”

In its “Nine Month 2012 P&C Industry Review,” ALIRTInsurance Research, LLC, says it expects “gentle premiumincreases,” but notes there are factors at play that “may wellmoderate price increases going forward.”

|“A market that experiences gentle premium increases may be thebest outcome for all stakeholders as carriers' financial stabilityis sustained, capacity/coverage remains plentiful, and buyers donot face painful 'sticker shock' at renewal,” says ALIRT.

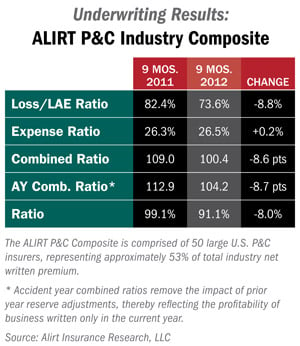

|Examining its composite index of 50 P&C insurance companiesrepresenting 51 percent of the market, ALIRT says composite surplusrose close to 9 percent over the first nine months of this year duepartly to operating earnings of $12 billion and net capital gainsof $15 billion. The composite surplus stands at $312 billion.

|The combined ratio improved to 100.4, nine points better thanthe same period last year. The accident-year combined ratio was104.2, also nine points better than 2011, reflecting lowercatastrophe losses over the first nine months of this year.

|ALIRT says Superstorm Sandy will certainly have an impact onfourth-quarter results, especially for mid-Atlantic regionalinsurers. The analysts also expect the U.S. government to reexaminerisk in the face of losses due to this year's drought.

|“Catastrophe risks will be more-carefully evaluated asunderwriters grapple with less-predictable weather patterns acrossthe entire U.S.,” says ALIRT.

|However, the P&C industry's balance sheets are strong andsurplus is “well above pre-2008 levels,” the year the financialcrisis began. ALIRT also notes that after seven years of a softmarket, there is “clear momentum behind price firming.”

|In its analysis, KBW says that while insurers can expect theirinvestment results to “remain under pressure for the foreseeablefuture,” underwriting results will “slowly improve” due to “modestrate increases.” But KBW says the “long sought after hard marketwill remain elusive.”

|This will be the case, says KBW, until excess capital iseliminated and the industry faces balance sheet pressure.

|“The income statement-driven market firming we see today shouldkeep things moving in the right direction, but we believe theindustry needs to see significant balance-sheet erosion for P&Cmarket conditions to truly harden,” says KBW.

|KBW adds that “current market conditions may persist foryears…”

|Adding its thoughts, Swiss Re released its “Global re/insurancereview 2012 and outlook 2013/14” study that generally mirrored thecomments of ALIRT and KBW.

|Rates are expected to modestly increase next year, says SwissRe. However, rate increases of this year are “not enough tocompensate for decreasing investment yields.”

|Reserve releases are expected “to dry up” next year “supportinga stronger pace of price increases, particularly in the casualtylines.”

|“The expected price increases in the casualty lines will likelybe gradual due to weak economic environment and fiercecompetition,” says Thomas Holzheu, one of the authors of the SwissRe report in a statement.

|PropertyCasualty360

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.