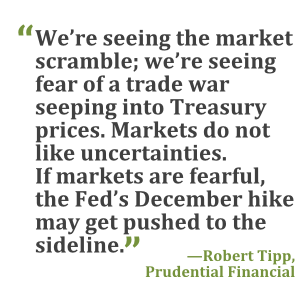

Treasuries plunged, with 30-year bond yields climbing the most since at least 1977, amid concern that a Donald Trump administration and a Republican-led U.S. Congress will unleash a wave of spending to boost the U.S. economy, triggering a surge in inflation.

Adjusted for current yield levels, which are close to historical lows, the magnitude of the day's rise hasn't been exceeded in data compiled by Bloomberg going back to February 1977. Benchmark U.S. 10-year yields rose above 2 percent for the first time since January as a bond-market measure of inflation expectations climbed to the highest since July 2015. A gauge of the yield curve steepened as longer-dated debt underperformed.

The plunge marked a turnaround from earlier in the day when U.S. debt led a global rally in government bonds during Asian trading hours as it became clear Trump had pulled off an electoral upset. The initial safe-haven bid gave way to expectations that Trump, who pledged during his campaign to cut taxes and outlay as much as $500 billion on infrastructure, would embrace policies that could widen the budget deficit and accelerate the pace of price gains.

The plunge marked a turnaround from earlier in the day when U.S. debt led a global rally in government bonds during Asian trading hours as it became clear Trump had pulled off an electoral upset. The initial safe-haven bid gave way to expectations that Trump, who pledged during his campaign to cut taxes and outlay as much as $500 billion on infrastructure, would embrace policies that could widen the budget deficit and accelerate the pace of price gains.

Continue Reading for Free

Register and gain access to:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world cas studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

*May exclude premium content

Already have an account?

Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.