With a recession looming, cash and liquidity needs are vital for businesses. Flagging consumer demand and supply-chain disruptions are straining cash and working capital. The continued market and economic uncertainty will only extend the challenges.

The immediate crisis caused a severe liquidity crunch as banks and investors pulled out of corporate debt. However, the threat to liquidity will not dissipate even as recovery starts, because the credit markets are factoring in default and earnings risks into corporate borrowing spreads. During the first quarter, the Federal Reserve intervened repeatedly to buy corporate debt and commercial paper to inject liquidity back into the market. Even if rates remain at record lows, that risk premium will stay with us for some time.

Cash is king—even for companies that entered the year in a strong cash position.

While most companies have been focused on managing the impacts of the global coronavirus pandemic, now is the time to immediately develop and execute a turnaround strategy. This should include a sound plan for preserving cash, releasing cash tied up in working capital, taking advantage of the stimulus funding and near-zero interest rates to restructure, and potentially increasing use of debt to enhance liquidity and fund strategic growth opportunities.

Organizations that can improve their cash position by tightening up accounts receivable (A/R), accounts payable (A/P), and/or inventory processes will be better positioned to handle the difficult external environment that most companies will face in the coming months.

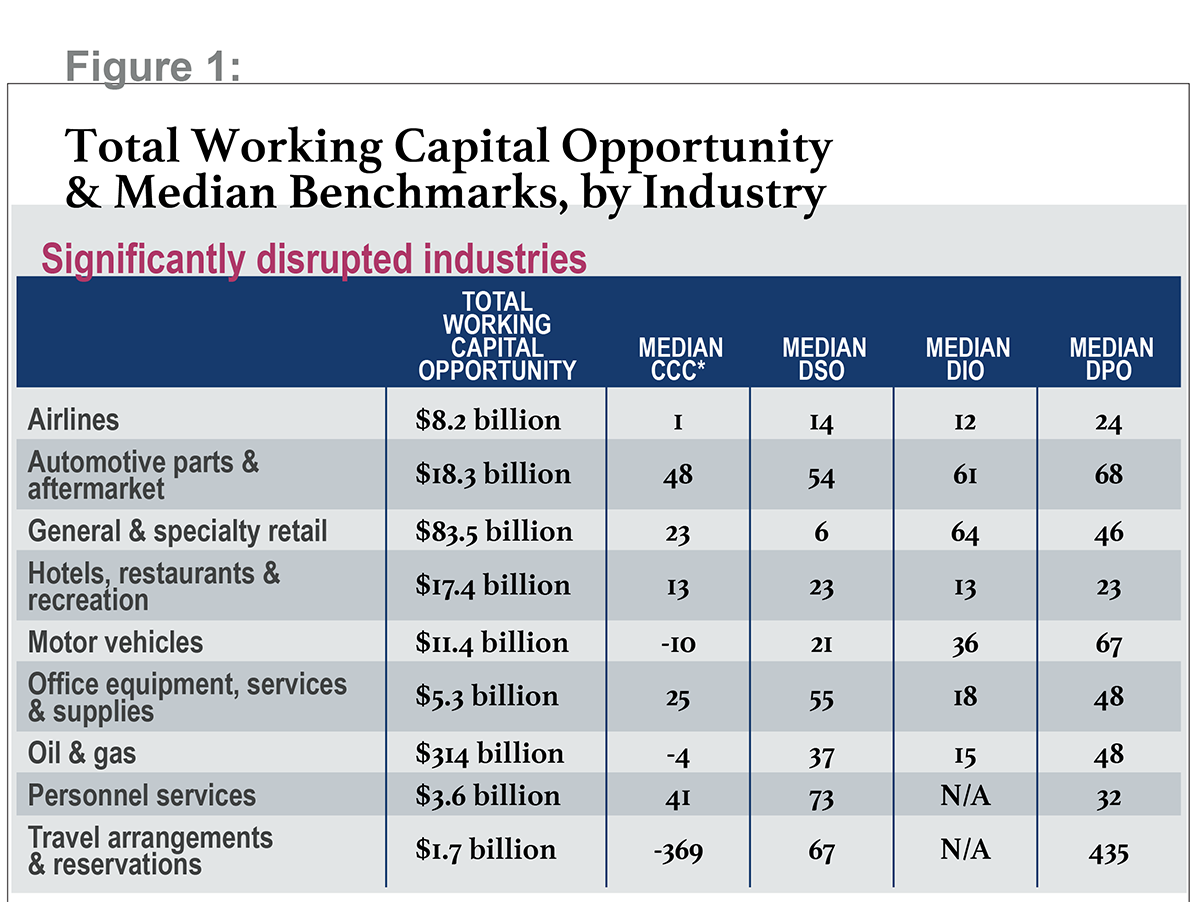

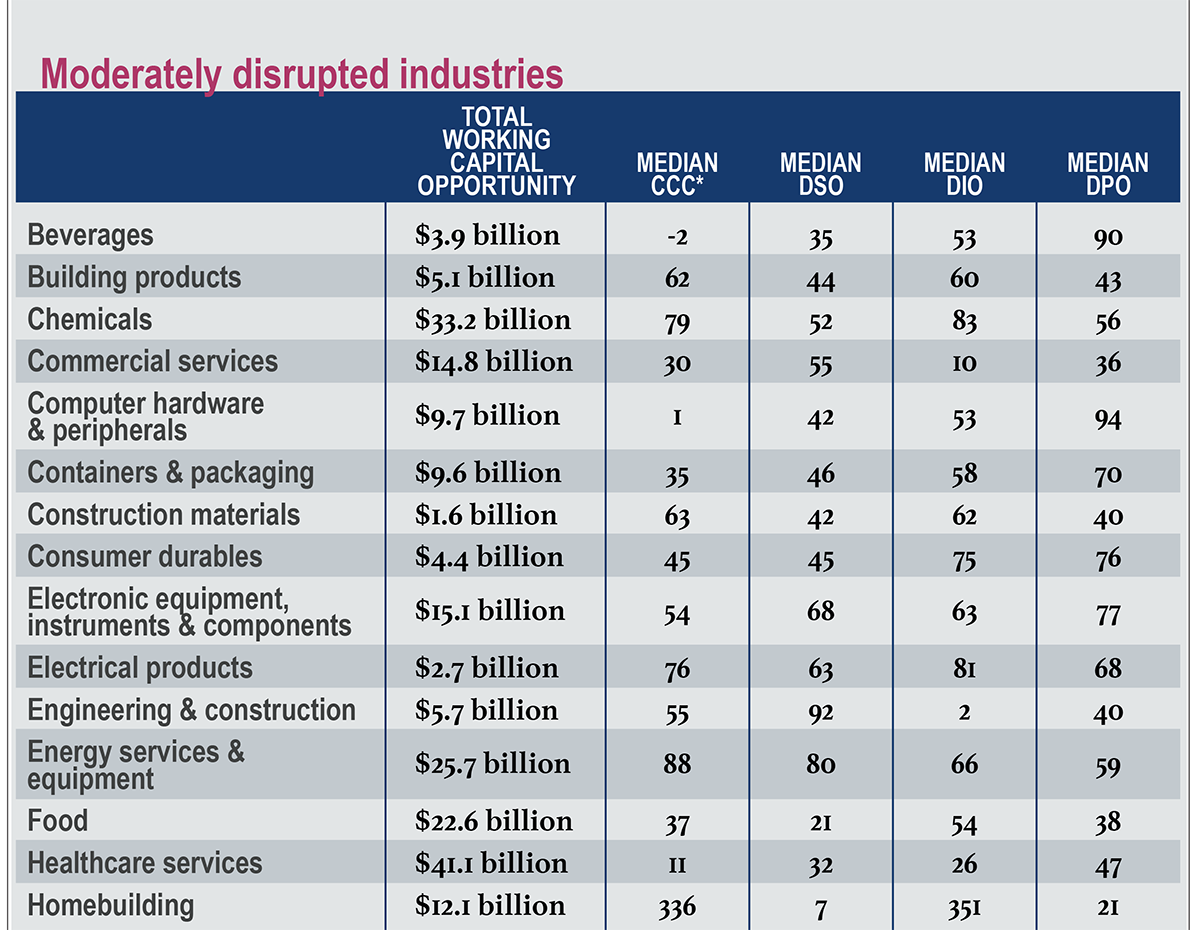

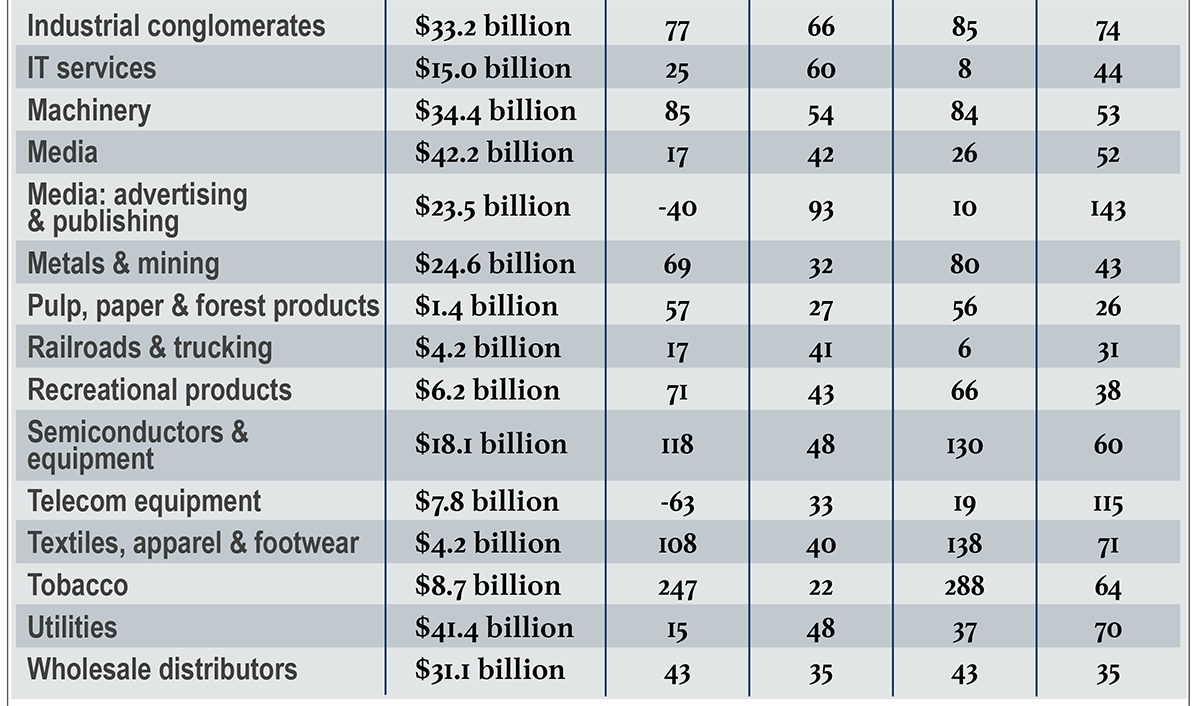

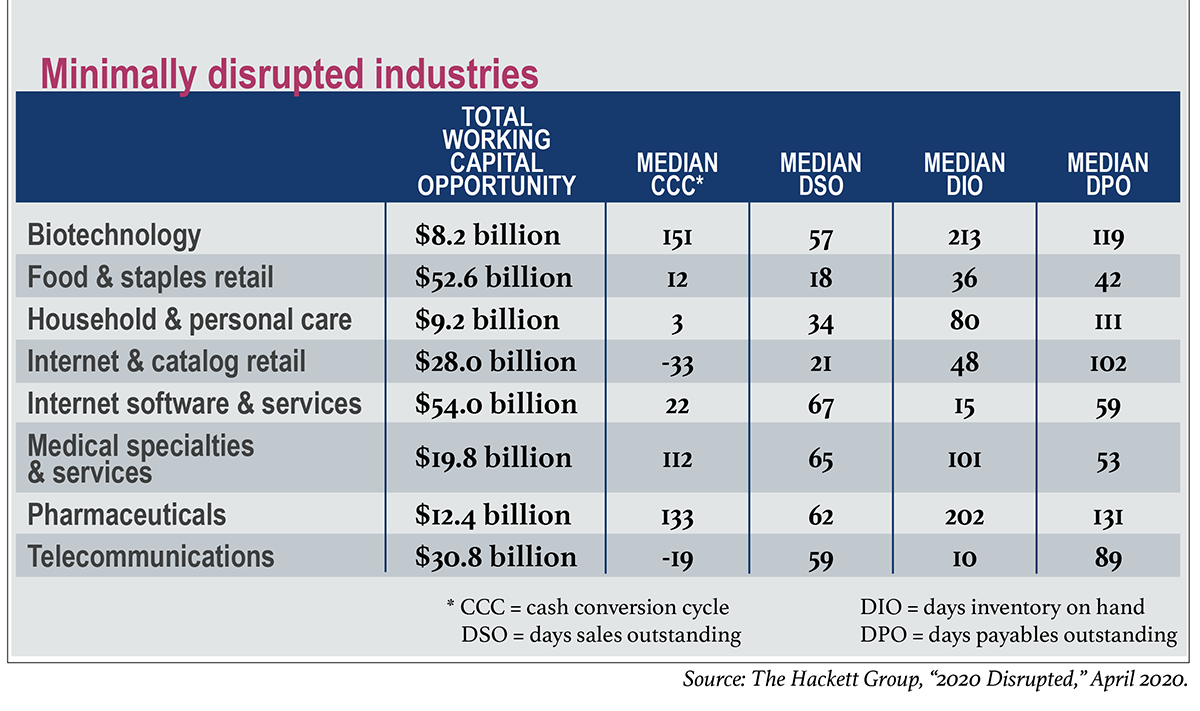

However, before making any strategic decisions at this critical moment in time, a treasury team needs a full view of its cash conversion cycle. Key to understanding the improvements with the most potential is benchmarking the company's various working capital metrics against the norm for its industry.

Industry Benchmarks for the Cash Conversion Cycle

The current crisis has had very different cash consequences across industries—and even within certain industries. For example, specialty retail has taken a hard revenue and cash hit, as its businesses have largely been shut down, at least on the bricks-and-mortar side. Meanwhile, retailers of food and staples have seen a revenue and cash boost due to consumers stocking up on essentials and, in some cases, panic buying.

Likewise, the level of opportunity available to boost cash flows by working capital varies by industry. Some industries with smaller working capital opportunities under normal conditions may now face significant disruption and ongoing economic uncertainty. For example, automotive parts demand has been disrupted by consumers' self-isolation and vehicle manufacturers' production halts. Organizations in the auto parts sector may be sitting on inventory piles with payables due, while they watch revenue decline and worry that demand may still be disrupted for months to come.

Airlines have experienced a massive decline in international and domestic travel. To some degree, the impact is mitigated by reductions in their fuel purchases and labor costs, but treasury teams in the airline industry are still having to figure out how to cover A/P with drastically lower revenue and A/R.

Even industries that have experienced only minimal disruption may find it necessary to address their working capital opportunities at this particular moment in time, due to expectations that they will face challenges in the near future. For example, although demand for medical specialties and services has increased, these organizations must be able to manage future inventory and sourcing needs as non-pandemic demand patterns re-establish themselves. These medical providers also face challenges in collecting receivables from healthcare systems that may be cash-deficient due to costs incurred during the coronavirus crisis.

Railroads and trucking organizations have seen revenues increase due to the need to redirect shipments of essential products and groceries. Looking ahead, though, they will need to be careful that customers are in a position to pay open balances and that A/R balances do not become overdue.

The first place to start in identifying immediate-term working capital opportunities for your organization is to benchmark the different elements of your cash conversion cycle (CCC) against those of comparable organizations. (See Figure 1.)

How to Effect Working Capital Changes During This Crisis

A well-designed working capital management program can free up cash that may be critical in enabling the company to weather the economic turbulence of the next several quarters. Working capital improvements can also help instill sustainable practices that benefit the organization over years, not just months—including the ongoing ability to optimize cash needed for strategic growth.

We recommend starting with seven near-term imperatives that can help every organization put to work the excess cash in its cash conversion cycle.

1. Enhance cash visibility. To manage and control cash, you will need clear visibility into the operations that generate and affect your levels of cash on hand. Increase your routine forecasting frequency to daily, so that management better understands the company's overall cash position in this volatile environment. Additionally, report cash metrics on a daily basis.

2. Revisit the organization's upcoming capital investments. Determine which of your planned short-, medium-, and long-term investments will be needed to manage and enable your turnaround strategy for the remainder of this year and beyond. Consider whether other planned investments could be delayed until the external environment becomes somewhat more stable.

3. Take advantage of free, low-interest, and no-interest cash. With the government stimulus programs and the ultra-low interest rate environment, this is a good time to look at available lines of credit and interest rates, and then to model scenarios to determine whether you can pay down maturing debt. Consider taking on greater balance sheet leverage to enhance liquidity in the face of volatility and/or to fund strategic growth initiatives.

4. Extend payables. Strike a balance between extending payables to benefit your own cash flows, and ensuring that you take care of your supplier base. Focus on updating supplier risk assessments and mapping supplier payment terms to confirm that you are taking care of your most critical suppliers. Review goods receipts, invoice timing, and payment runs, and eliminate early payments in any situations where early-pay discounts aren't clearly superior.

5. Expedite receivables. Focus on reducing overdue receivables; putting in place (or improving) robust processes for managing customer credit risk exposure and write-offs; enhancing customer payment terms; and addressing the high levels of unbilled receivables that are likely in your future, by enacting quicker and more frequent billing, as appropriate.

6. Re-evaluate inventory levels and turns targets. Assess current supply-chain drivers, including inventory buffers and excess stocks, to identify immediate quick wins. Address further opportunities for accelerating inventory turns across the end-to-end supply chain. Stay vigilant by forecasting demand and supply requirements daily. Continuously monitor customers' and suppliers' financial health using detailed demand and supply forecasts by business/product line and geography.

7. Consider alternative mechanisms for supply-chain financing. Introduce supply-chain finance offerings, including payment terms discounting, to inject liquidity into the supply chain.

Taking the Deep Dive

Beyond these immediate-term imperatives that apply across the board, companies in industries with a large working capital opportunity may gain significant liquidity benefits by following our Rapid Cash Release Framework.

Companies preparing for the continued volatility that is reasonable to expect for at least the next couple of quarters need to ensure that they are exhausting every available means of improving liquidity as their revenues decline and borrowing costs rise. For many organizations, extracting cash from inefficient working capital processes can be a key element in shoring up liquidity in preparation for the bumpy ride ahead.

See the sidebar:

See also:

- Boosting Working Capital Management in a Downturn

- Thinking Outside the Working Capital Box

- How to Make Your 'Dash for Cash' Sustainable

Craig Bailey is an associate principal of strategy and business transformation for The Hackett Group. He has 20 years of industry and consulting experience, with an emphasis on working capital and supply chain optimization across five continents.

Craig Bailey is an associate principal of strategy and business transformation for The Hackett Group. He has 20 years of industry and consulting experience, with an emphasis on working capital and supply chain optimization across five continents.

Angela Caswell-LaPierre is a principal of strategy and business transformation with The Hackett Group. She has particular expertise in leading and integrating global business services operations, global finance transformation projects, enterprisewide transformation management offices, global SAP ERP system implementations, process engineering, change management, and enterprise cost reduction programs.

Angela Caswell-LaPierre is a principal of strategy and business transformation with The Hackett Group. She has particular expertise in leading and integrating global business services operations, global finance transformation projects, enterprisewide transformation management offices, global SAP ERP system implementations, process engineering, change management, and enterprise cost reduction programs.

Sean Kracklauer is a principal of strategy and business transformation with The Hackett Group. Over the past 20 years, he has advised Global 1000 businesses on strategy, organizational structure, and process redesign.

Sean Kracklauer is a principal of strategy and business transformation with The Hackett Group. Over the past 20 years, he has advised Global 1000 businesses on strategy, organizational structure, and process redesign.