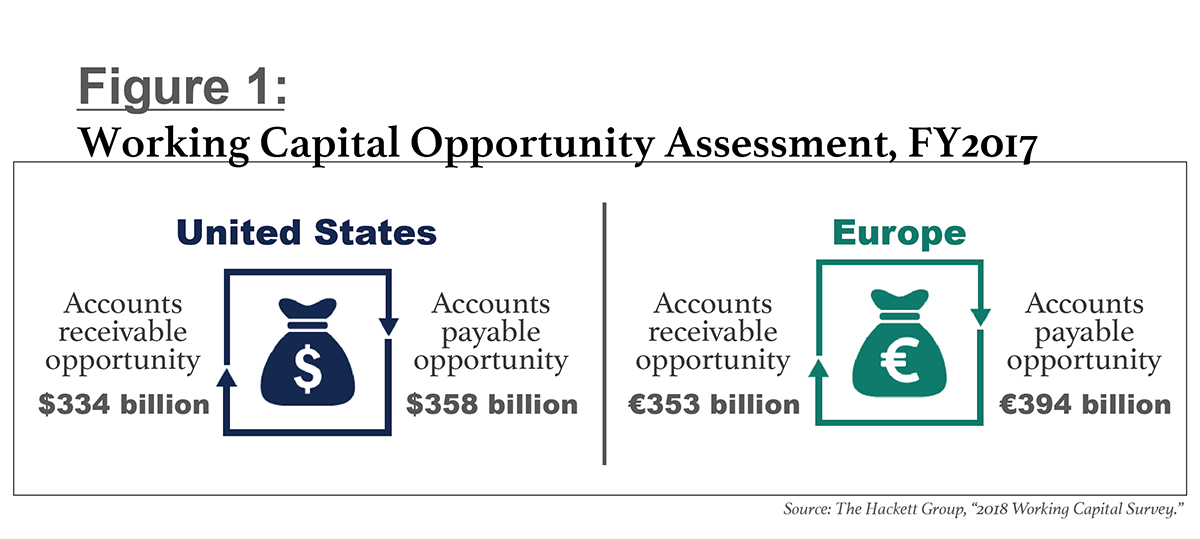

The Hackett Group's “2018 Working Capital Survey” reveals a massive opportunity to free up over $1.5 trillion in cash across the United States and Europe. (See Figure 1, below.) This opportunity is cash tied up in receivables and payables. In the United States, the receivables and payables opportunities represent $334 billion and $358 billion, respectively. The opportunities in Europe are a similar size.

Accessing this cash to show a healthy balance sheet is the primary driver for year-end gamesmanship, also known as the “dash for cash.” The result may well meet market and shareholder expectations and have a positive impact on share price. However, playing the year-end game is successful only for the short term.

Companies that access this cash and improve their cash conversion cycle over the long term reap greater rewards. They achieve sustained working capital performance and a subsequent increase in profit. Every seven-day reduction in the cash conversion cycle yields a 1 percent improvement in margin. For a company with EBITDA (earnings before interest, tax, depreciation, and amortization) of 5 percent, that equates to a roughly 20 percent increase in profit.

The challenge for companies, then, is two-fold: How do we release cash from receivables and payables? And then how do we sustain working capital at an optimal level?

Most companies invest substantially more time and effort addressing this challenge at the end of every quarter and fiscal year than they do during the rest of the year. Closing the books at the end of a fiscal year is stressful, and at that point, many companies believe it is too late to take actions that could release significant cash before closure. Instead, they resort to tactics that provide a temporary boost in cash. The two most popular are to delay payments to suppliers and to negotiate earlier billing or payments with customers in exchange for discounts. Unfortunately, these moves usually come back to haunt them during the following year's first quarter—and the cycle repeats.

Look Beyond the Temporary Fixes

Temporary fixes may produce short-term results, but they rarely lead to sustained improvement. Think about starting a fitness program. If your goal is simply to get fit for the holiday party, then how likely are you to work out regularly in the new year? If your goal, however, is to adopt a healthy lifestyle, then you are thinking about how to maintain that new exercise routine on an ongoing basis.

Sound working capital management is, in fact, a lot like adopting a healthy lifestyle. It is possible to launch a short-term dash for cash that reduces working capital in the current year and sets the right foundation for keeping it off the books. The key to achieving this dual goal of quick results and ongoing improvement is to focus on high-impact activities that have a direct link to the underlying processes at the core of working capital management. Organizing these activities in a formal dash-for-cash initiative can help raise awareness and maintain focus on the importance of managing cash across the organization.

Following are seven steps to take prior to year-end to address immediate needs. When approached in the right way, these steps can also improve the underlying processes and build a sound foundation for continuous working capital improvement.

1. Focus collections activity on the top customer invoices due before year-end. To support long-term working capital health: Use a segmentation exercise to tailor the collections efforts and strategic collection techniques to customers' payment behaviors.

2. Identify the top supplier invoices due for payment before year-end, and look for opportunities to extend payment terms. To support long-term working capital health: Review payment-term strategy with vendors, and re-negotiate or adjust terms to support cash flow and compliance needs.

3. Target resolution efforts at the top disputed customer invoices. To support long-term working capital health: Investigate root causes of disputes and nonpayment to identify common issues that give customers an excuse to withhold payment. Often such disputes are the result of internally controllable factors, such as pricing and discount policies.

4. Review payment setup to ensure that no supplier invoice above a predefined threshold value is paid in advance, especially if the due date is after year-end. To support long-term working capital health: Review payment routines with the aim of eradicating early payments by implementing best-practice techniques, such as payment runs, a payment-terms model, and/or a payment clock. These actions can improve both cash flow and process efficiency.

5. Ensure that year-end plans take into account first-quarter needs and offer customers the option to accept year-end deliveries to maximize sales potential while reducing buffer inventory. To support long-term working capital health: Explore new solutions—for example, an online planning tool—for sharing information with key customers about their needs. Such systems can help improve planning and timely deliveries without increasing inventory levels.

6. Define practical targets for each of the actions in the previous points, and set rewards that are clearly linked to achieving the targets. To support long-term working capital health: Establish a clearly defined set of operational and management key performance indicators (KPIs) and targets linked to corporate working capital objectives. Then identify the level of monthly, incremental, ongoing performance needed to meet those goals.

7. Measure progress of these actions using a simple set of reports that provide clear visibility of progress toward year-end results. To support long-term working capital health: Install effective reporting that monitors working capital performance accurately and provides management with visibility into the effects of process changes on working capital (i.e., focused beyond year-end).

Aligning treasury, finance, accounts payable, and accounts receivable staff around these steps will reinforce desired year-end results, as well as provide a foundation for lasting working capital excellence. This approach helps encourage the right staff behaviors, shift supplier and customer habits, and produce KPIs that provide management with the visibility they need to manage working capital on a continuous basis.

Set Targets to Avoid Falling Back into Old Habits

The temptation to drop the ball and resort to old ways of working will always be there. In fitness, converting new practices into a sustainable, healthy lifestyle requires teamwork, collaboration, and reasonable targets. Working capital improvement requires the same type of steadfast resolution.

Short-term targets should be challenging but also realistic. These targets should be based on a thorough analysis of the company's processes and performance, and quantified opportunities to improve working capital to free up cash within the organization. The goal should be to make structural changes that will steadily improve performance over time. Once on the right track, a finance team will find the results to be self-sustaining as the new lifestyle becomes part of the company's DNA.

See the sidebar:

It's possible to get out of the cycle of temporary fixes focused solely on short-term cash needs and begin building a healthier approach to working capital management. More specifically, a treasury and finance team can begin taking actions between now and the end of 2018 to tap into that significant working capital opportunity and deliver tangible cash improvement.

If approached properly, these actions will not only improve the company's current cash position, but also establish a cash culture that lays the foundation for continuous working capital improvement and excellence.

Liselore Kolff is a working capital consultant with more than four years of experience delivering successful projects globally. Since joining The Hackett Group in 2017, she has worked on projects in the offshore, construction, pharmaceutical, biotechnology, and life science industries. Her areas of expertise are supply chain management, operations, and accounts receivable management. She holds master's and bachelor's degrees in industrial engineering and management from the University of Groningen, Netherlands, specializing in product and process technology.

Liselore Kolff is a working capital consultant with more than four years of experience delivering successful projects globally. Since joining The Hackett Group in 2017, she has worked on projects in the offshore, construction, pharmaceutical, biotechnology, and life science industries. Her areas of expertise are supply chain management, operations, and accounts receivable management. She holds master's and bachelor's degrees in industrial engineering and management from the University of Groningen, Netherlands, specializing in product and process technology.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.