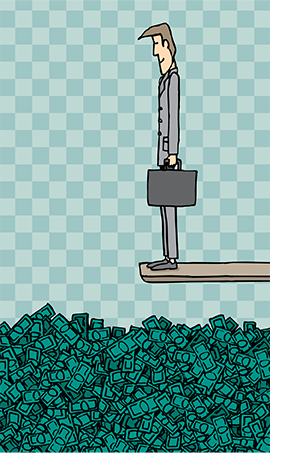

For treasurers of multinational corporations, cross-border cash pooling can be a vital tool for managing cash on a daily basis. And it makes a great deal of sense to have some members of a corporate group offer up their excess cash in order to meet the needs of the enterprise, from repayment of corporate debt to support of business units that need an influx of capital, to investment of aggregated cash balances for optimal returns. However, waters in the cash pool can turn murky when the enterprise is in distress.

For treasurers of multinational corporations, cross-border cash pooling can be a vital tool for managing cash on a daily basis. And it makes a great deal of sense to have some members of a corporate group offer up their excess cash in order to meet the needs of the enterprise, from repayment of corporate debt to support of business units that need an influx of capital, to investment of aggregated cash balances for optimal returns. However, waters in the cash pool can turn murky when the enterprise is in distress.

Because legal structures and documentation differ between physical cash pools and notional cash pools, the effects of financial distress on an organization's cash flows depends on which of these structures defines the cash pool. The differences between a physical and a notional cash pool are significant.

In a physical cash pool, participants agree to move their excess cash on a periodic basis to an entity within the corporate group called the cash pool leader. The cash pool leader concentrates excess cash from participating business units and uses those funds for the benefit of the participants. Cash pool participants with a cash deficit can receive an intercompany loan from the cash pool leader and pay interest to the cash pool leader. Participants that contribute excess cash to the pool receive interest on the funds they make available. This structure enables a company to deploy cash to the best possible effect across the enterprise. Funds advanced to the cash pool leader appear as an asset on the balance sheet in the form of intercompany loans. Similarly, funds borrowed from the cash pool leader appear as a liability, classified as intercompany loans incurred.

Continue Reading for Free

Register and gain access to:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world cas studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

*May exclude premium content

Already have an account?

Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.