President Donald Trump has signed an anti-government shutdown bill that will eliminate $12.7 billion in Affordable Care Act health insurer fee taxes for 2019.

President Donald Trump has signed an anti-government shutdown bill that will eliminate $12.7 billion in Affordable Care Act health insurer fee taxes for 2019.

The new “Extension of Continuing Appropriations Act, 2018″ (ECAA) will also:

- Give the federal government official permission to spend money, and continue with normal operations, until Feb. 8.

- Extend funding for the Children's Health Insurance Program for six years.

- Push the scheduled start date of the ACA Cadillac plan tax, or 40% excise tax on high-cost employee health benefits packages, back to 2022, from 2020.

- Suspend collection of the ACA medical device tax for two years.

Congressional Budget Office analysts have predicted the health insurer tax and Cadillac plan provisions will reduce federal revenue by a total of about $29 billion over 10 years.

A summary of the bill posted last week is available here.

The main difference between the version posted last week and the version signed into law is that the version signed into law has a shorter appropriation extension period.

The previous government spending appropriation act expired at midnight on Friday. The federal government had started the process of shutting down part of its operations.

The Vote

Congressional leaders packaged the ECAA bill as an amendment to H.R. 195, a minor Federal Register printing cost reduction bill.

Members of the House approved one version of the ECAA bill last Thursday, with most Republicans voting for the bill and most Democrats opposing it. That version would have extended the federal government's spending appropriation through Feb. 16.

When the ECAA bill arrived in the Senate, many Democrats and some Republicans tried to slow passage, in an effort to persuade Republican leaders to add other provisions, such as help for children brought to the United States illegally.

Senate leaders ended up working out a deal that shortened the appropriations extension period and calls for Republicans to continuing working with the Democrats on some other issues.

Members of the Senate today ended up passing the ECAA bill by a 78-18 vote, with strong support from both Republicans and Democrats.

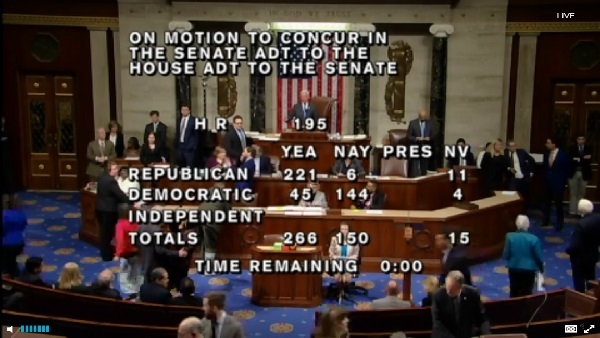

Members of the House quickly approved the amended version of the bill by a 266-150 vote. The final version attracted more votes from Democrats than the original version.

Reaction to Health Insurer Fee Suspension

Drafters of the ACA added the health insurer fee, or health insurer tax (HIT), because they thought the ACA individual coverage “shared responsibility” requirement, or coverage ownership mandate, would lead to windfall profits for health insurers.

Supporters of the health insurer tax thought the tax would be a good way to use a portion of the windfall profits to compensate for ACA program costs.

The National Association of Health Underwriters and many employer groups, including the U.S. Chamber of Commerce, formed the Stop the HIT coalition to fight the tax.

Elena Tompkins, the coalition's executive director, said in a statement that the temporary suspension of the tax will be good for U.S. small businesses and their employees, but she pointed out that, at this point, health insurers still face health insurer tax bills for 2018.

“We urge Congress to continue to advance solutions that will provide relief from the HIT in 2018 and protect millions of small businesses from this misguided tax,” Tompkins said.

Reaction to Cadillac Plan Tax Delay

Economists have argued for years that a tax on high-cost health benefits packages, or even an explicit cap on the group health tax exclusion, can be a powerful tool both for raising government revenue and enlisting employers in the fight to cut benefits costs. Economists say limiting or capping group health tax benefits will give large, sophisticated employers an incentive to apply their ingenuity to reforming the U.S. health care delivery and finance systems.

Once members of Congress began talking about putting the tax into the ACA, which was drafted in 2009 and signed into law in 2010, employers and labor groups fought back. Opponents have argued that the tax would punish the employers that try the hardest to offer employees great benefits.

Annette Guarisco Fildes, president of ERISA Industry Committee, said in a statement that her group has been fighting the Cadillac plan tax since 2009, when lawmakers added it to early drafts of the Affordable Care Act.

ERIC will continue to fight for permanent repeal, Fildes said.

James Klein, president of the American Benefits Council, said in a statement of his own that the ECAA will have an immediate effect on employers, because typical large employers make benefits decisions 18 months to 24 months in advance.

Before the ECAA bill passed, “employers were reluctantly considering curtailing benefits or increasing workers' out-of-pocket costs to meet the prior 2020 deadline,” Klein said.

From: ThinkAdvisor

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.