Several weeks after becoming the top cop for U.S. markets last May, Jay Clayton began reading everything he could get his hands on about bitcoin, realizing it was quickly evolving from a method of payment to a global investment craze.

Since then, the Securities and Exchange Commission chairman has elevated digital currencies to the forefront of his agenda, asserting that many of the products fall under the agency's oversight. During Clayton's tenure, the SEC has unleashed its enforcement lawyers on companies that are illicitly raising money by selling digital tokens, put the kibosh on attempts to set up cryptocurrency mutual funds, and repeatedly urged investors to take more seriously the risk of getting fleeced.

Clayton's latest concern, detailed in an interview this week, is the lightly regulated exchanges where the currencies are bought and sold. With many located offshore, Clayton said, federal authorities have no insight into their operations and little recourse when things blow up for U.S. investors.

Recommended For You

“These platforms that these things trade on, they are very easily manipulated, and I don't think investors understand that,” Clayton said. While there's a thick set of regulations that exchanges must adhere to, “none of that exists” when they aren't registered with the SEC.

He said he's concluded that a number of venues should fall under the SEC's jurisdiction, which would open them up to regular surveillance and ensure they follow investor protection rules. That, of course, could slow down a red-hot market that has thrived in part because it resembles the Wild West.

Sitting at a conference table in his 10th floor office overlooking the U.S. Capitol, Clayton spoke approvingly of the digital-ledger technology underlying the coins and said the SEC isn't trying to stand in the way of progress. Yet just days after a Japanese exchange revealed it had been robbed of more than $500 million in tokens, Clayton said he was increasingly worried about fraud hitting “Main Street” investors.

“When an ordinary person loses 10, 15, 25 grand, that makes a material difference in their lives, and that's bad,” he said. “Anytime our markets are used like that, we need to be paying attention.”

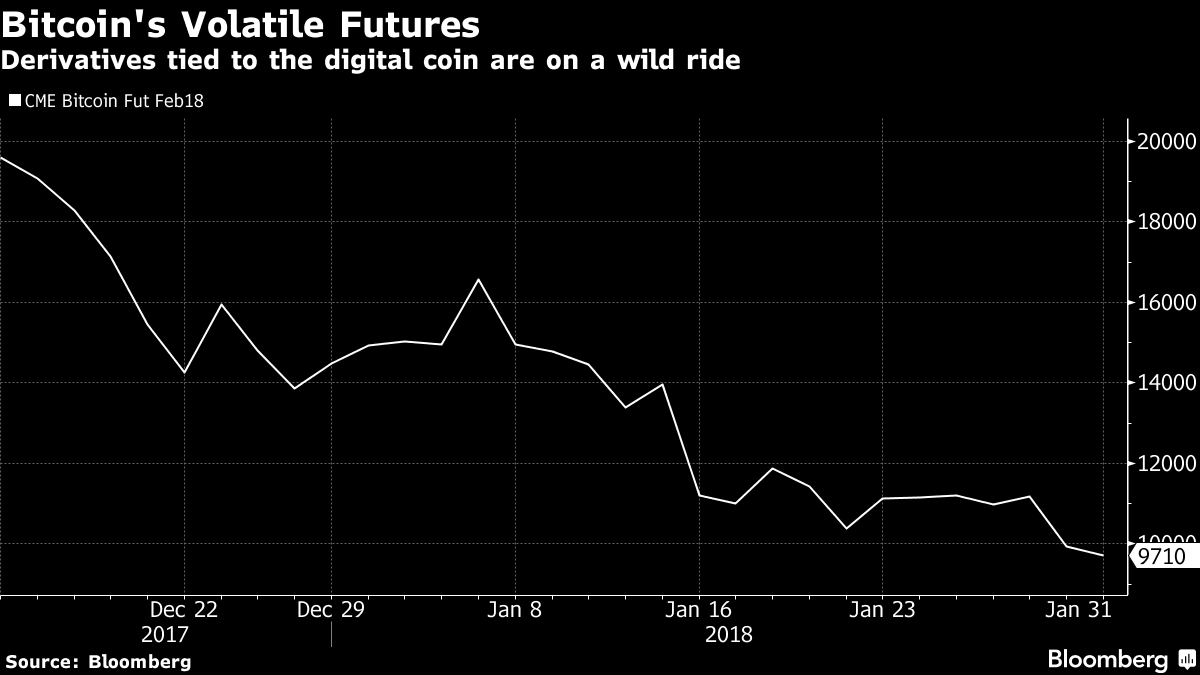

Some also think that digital currencies are a bubble that will inevitably pop. After jumping more than 1,400 percent in 2017 and minting more than a few overnight millionaires, bitcoin has lost a third of its value this year amid fears that regulators will subject the industry to more rules.

Being Washington's chief cryptocurrency skeptic is an unusual position for Clayton, a former Wall Street deals lawyer appointed by President Donald Trump. But despite his free-market credentials, Clayton has embraced a go-slow approach that has at times appeared to put the SEC at odds with the other main regulator in the area, the Commodity Futures Trading Commission.

That agency's chairman, J. Christopher Giancarlo, late last year allowed two exchanges to offer bitcoin futures, arguing the move would help the CFTC gain insight into the largely unregulated markets where the cryptocurrency is traded.

ETF Apprehension

Although many expected the futures to hasten SEC approval for mutual and exchange-traded funds based on digital coins, they have not. Instead, the agency said this month that such offerings raise a number of investor-protection questions. In the interview, Clayton made clear that he's in no hurry to sign off on the funds, saying such a move would be seen as “a tacit endorsement” that he is not yet ready to make.

Though some of the legal and jurisdictional issues are novel or are still being worked out, the CFTC claims some authority over actual digital currencies—which it classifies as commodities—and derivatives, such as futures, tied to them. The SEC is responsible for regulating securities that are comprised of digital tokens. That includes so-called initial coin offerings (ICOs), which were used to raise an estimated $3.7 billion last year even though some of the companies behind them have laid out scant business plans.

In an ICO, a firm sells digital tokens that can eventually be redeemed for goods or services. The coins can be traded in a secondary market—which the SEC says makes them securities and subject to its oversight. In the case of an ICO, that would mean filing extensive documents detailing plans for the offering. The exchange it trades on would also have to be registered with the SEC. Thus far, no trading venue or ICO has taken those steps.

At the moment, the main way the SEC is trying to ensure compliance is through its enforcement arm. Already, the agency has formed a special group to dig into potential fraud and filed several high-profile lawsuits. Just this week, the SEC sued to halt a Texas-based ICO that claimed to have raised more than $600 million using celebrities like former boxing champ Evander Holyfield to tout the offering.

'More Cases'

“We have brought cases, and if people don't change their ways, we're going to be bringing more cases,” Clayton said.

But there are limitations on the SEC's reach, a problem that's particularly vexing because there have been a spate of thefts across the globe involving hackers, who—if they could even be found—are likely to ignore U.S. subpoenas.

“If a U.S. person sends their money to a foreign country through the Internet and it gets taken, there's not much I can do about it,” he said.

For now, Clayton said, the agency has all the power it needs to regulate crypto products. He added that SEC oversight will ultimately help the industry flourish.

“There's no doubt in my mind that our regulatory framework is not holding back the promise of this technology,” Clayton said. “In fact, it could be the other way around.”

'Understanding Dangers'

Clayton also said he will continue to highlight his concerns in speeches and public comments. He's slated to testify before Senate Banking Committee next week along with Giancarlo, the CFTC chairman.

Both are also part of a special working group, set up under the Treasury's Financial Stability Oversight Council, to monitor cryptocurrencies. Officials who attended the FSOC's December meeting said they were struck by Clayton's comments on the need for the government to protect retail investors as they creep into the market.

“It's not just the public that I'm talking to; I'm talking to other regulators inside and outside the U.S.,” Clayton said. “I think that the level of understanding of the dangers in trading of these instruments has increased substantially.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.