Mexico's central bank raised its key interest rate as expected for a second straight meeting and signaled it will prioritize the peso's inflation implications rather than moves by the Federal Reserve for its future decisions.

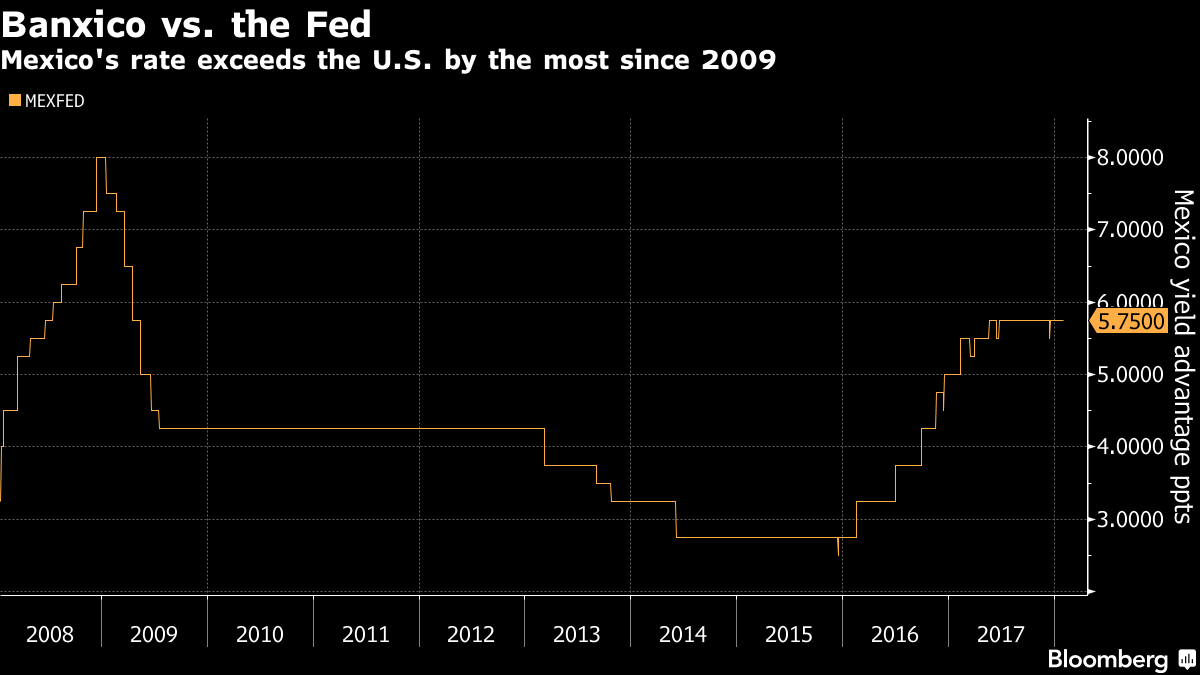

Banco de Mexico's board voted unanimously to lift borrowing costs a quarter point to 7.5 percent Thursday, a move forecasted by 23 of 26 economists surveyed by Bloomberg. Three expected no change. The decision came after consumer prices in December climbed 6.77 percent from a year earlier, more than double the central bank's 3 percent goal and the fastest pace in 16 years.

In a shift from their last meeting, policymakers indicated that the peso—in particular, the inflationary effect of its future potential weakness—would now be the first factor among those they're watching, moving their posture relative to the Fed to second. They also said they'll be ready to react in a firm and timely manner to anchor mid- and long-term inflation expectations and pushed back their forecast for convergence to their 3 percent target to the first quarter of next year.

Recommended For You

“Clearly this is not a central bank that feels comfortable with the inflation dynamics,” said Alonso Cervera, chief Latin America economist for Credit Suisse Group AG. “Going forward, Banxico may or may not hike if the Fed hikes in March. It will depend on many variables, and it's no longer a done deal.”

Inflation risks are biased to the upside, while the growth outlook has improved, the central bank said.

Inflation proved stubbornly persistent at the end of last year, quickening at a time when analysts expected it to slow, due to a weakening peso and higher gasoline and food prices. Economists expect the currency to remain volatile due to concern about Mexico's trade ties with the U.S. and the July presidential election.

In a December interview with Bloomberg TV, central bank Governor Alejandro Diaz de Leon said policymakers acknowledge the impact that high interest rates have on already sluggish economic growth, but see an even larger cost if they don't anchor inflation expectations. In minutes from its December decision, the first since Diaz de Leon took over from Agustin Carstens, the central bank said that the inflation outlook appeared more complicated and the balance of risks had worsened.

Thursday's rate hike allows policymakers to get ahead of a Fed interest-rate increase seen happening next month. Mexico's next rate decision is scheduled for April 12.

While the impact of last year's gasoline price spike has started to fade, Mexico's consumer price outlook still faces risks from potential peso weakness. After rebounding from a record low reached early in 2017, the currency again slumped in late December on concern that President Donald Trump may pull out of the North American Free Trade Agreement that binds the U.S., Mexico, and Canada, and also that leftist Andres Manuel Lopez Obrador may win the presidency.

A report earlier on Thursday showed that Mexico's annual inflation in January tumbled to 5.55 percent from a 16-year high in December. Still, economists expect consumer prices to remain above target both this year and next, according to the median forecast in a survey published by Citibanamex this week.

Banxico's decision Thursday was the first since Irene Espinosa, the former Treasurer of Mexico's Finance Ministry, was ratified to join the board as its first woman last month.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.