A crescendo built in the financial services industry late last year, as the effective date approached for sweeping new regulations. MiFID II, the European Union's version of Dodd-Frank, has capital markets professionals and their internal compliance colleagues scrambling to position themselves on the right side of this far-reaching and comprehensive regulation.

A crescendo built in the financial services industry late last year, as the effective date approached for sweeping new regulations. MiFID II, the European Union's version of Dodd-Frank, has capital markets professionals and their internal compliance colleagues scrambling to position themselves on the right side of this far-reaching and comprehensive regulation.

Why should a U.S.-based corporate finance officer or risk manager care about a massive new regulatory framework across the Atlantic? The reason is simple: At the heart of the regulation is a mandate for investment firms to adopt “best execution” practices. Investment firms are broadly defined as any legal entity whose regular occupation or business is the provision of one or more investment services to third parties and/or the performance of one or more investment activities on a professional basis.

Corporate treasurers who interact with European financial markets and securities may be directly impacted by the new regulations. Others may be indirectly affected. In the financial markets, fiduciary responsibility is fundamental, so the pursuit of best execution is logical. The pursuit of shareholder value in the corporate world is not dissimilar from fiduciary responsibility. Therefore, it's not a stretch to imagine how the concept of best execution might apply to corporate treasurers and risk managers as well.

The good news is that MiFID II guidelines relating to increased market transparency, best execution, and the identification of explicit transaction costs represent an opportunity for treasury functions to improve the efficiency and execution of financial transactions.

What Best Execution Is Not

The term “best execution” is widely misunderstood because almost everyone is sure of exactly what it means. When the concept of best execution was first introduced in the 1980s, it referred to the pursuit of the best available price for the purchase or sale of a security in a burgeoning electronic marketplace. Over time, though, regulators in both the U.S. and the European Union realized that the concept of “best execution” is much more complicated than simply trying to get the best possible price.

Three decades ago, the technologies underpinning the capital markets—such as lower latency trading solutions, individual aggregated liquidity venues, and new algorithmic order types—gave rise to issues that had the potential to undermine a singular best-price objective. Speed and execution choice became prominent concerns.

In the early days of “best execution,” the focus was on equities, fixed income, and derivatives markets. Participants in the foreign exchange (FX) marketplace were largely left alone. After all, the FX market was huge, fragmented, and governed by a credit structure in which real money customers—corporations, pension funds, and asset managers—dealt directly with their banks on a one-to-one basis. The emergence of electronic execution platforms (ECNs) some 20 years ago did little to alter the FX trade execution experience of the corporate trader.

In the early days of “best execution,” the focus was on equities, fixed income, and derivatives markets. Participants in the foreign exchange (FX) marketplace were largely left alone. After all, the FX market was huge, fragmented, and governed by a credit structure in which real money customers—corporations, pension funds, and asset managers—dealt directly with their banks on a one-to-one basis. The emergence of electronic execution platforms (ECNs) some 20 years ago did little to alter the FX trade execution experience of the corporate trader.

That began to change about a decade ago. The global financial crisis led to two market-changing pieces of regulation: Dodd-Frank in the United States and MiFID II in the European Union. Fundamental to both was a demand that transparency be applied to all elements of capital-market activity. In 2009, the first large, public claims of pricing manipulation in the FX markets came to light. The WMR FX benchmark crisis came next, followed by a steady stream of enforcement actions. All of a sudden, participants in the foreign exchange marketplace were confronting the “best execution” challenge for the first time.

MiFID II Definition of “Best Execution”

The essential definition of best execution, as outlined in the current MiFID II guidelines and as applied to financial services firms (both buy-side and sell-side), is actually pretty clear: All sufficient effort must be taken to ensure that every trade is executed on terms most favorable to the client, and the trading party must be able to prove it. MiFID II provides an objective and a recordkeeping requirement.

The regulation tells financial services firms what information they should consider and capture from their trading activity, including price, cost, speed, likelihood of execution and settlement, etc. EU regulators even provide guidance on the evaluation procedures that financial services firms should utilize before and after a trade occurs. Beyond this guidance, however, MiFID II does not prescribe specific actions that a financial services firm can take to ensure it has achieved “best execution,” largely because best execution is a process that has no real endpoint.

When the SEC and FINRA tackled the definition of “best execution,” they made it clear that both broker-dealers and asset managers (fiduciaries) are obligated to consider and constantly re-evaluate alternatives to the trading options they are currently using, in light of the goal of achieving best execution for “the client.” The regulators' intent was to signal that every trading participant is responsible for:

- identifying its execution alternatives,

- trying out those alternatives,

- evaluating them in the context of other alternatives, and

- utilizing several of those options.

Best execution is impossible to achieve if a trading participant continues using the same process blindly, to the exclusion of alternatives. So the regulators said: “You can't just do the same thing perpetually”; “You can't use only one or two alternatives”; and “You certainly can't be compliant if you do nothing.” For example, a fiduciary—and, by analogy, a corporate—that executes FX transactions directly with a bank counterparty on a disclosed basis needs to consider alternative execution strategies, such as executing anonymously on an ECN platform that sources liquidity from multiple market participants or employing execution algorithms that search for execution outcomes based on certain strategies.

The word “best” suggests a singular, unparalleled process. But the actions demanded by the regulators require every trading participant to utilize multiple alternatives so that it can constantly evaluate them, replace those that are no longer working optimally, and continue to benchmark the alternatives against one another. This constant evaluation proves the fiduciary commitment of the trading participant when representing its client's interests.

While most corporations may not be directly regulated by MiFID II, the company that pursues this type of “best execution” in its FX transactions stands to reap significant benefits. In the FX marketplace, achieving the best available price is a fleeting quest affected by factors like market impact and fill rates (how much of a large order gets executed immediately at a particular price). It's impossible to know for certain whether the exchange rate at which a company's currency trade is executed is the best available at the moment the trade is executed, which is why wise treasurers are continuously re-evaluating their trading alternatives.

Best Execution Is a Journey

The concept of best execution as a journey, not a destination, may be frustrating for FX market participants. Corporate finance officers and risk managers are not speculators. Their responsibility is to execute FX trades that support the funding of, or payment for, activities their organization undertakes in other countries. Corporate treasurers are largely passive risk managers, but they are still risk managers with a fiduciary responsibility.

The regulations that have been introduced to rein in bad behavior and promote transparency in the financial markets have fundamentally interfered with everyone's status quo. The demands of best execution are forcing financial services firms to change the way they do business and are raising the bar globally for market participants, including corporate treasurers and risk managers. The journey they must embark on requires their aggressive attention and engagement. Passive risk management activities must be transformed into a process that is actually the destination. The result of this journey will drive greater efficiency, and the benefits of best execution will enable all market participants to reduce execution risk and ultimately lower their cost of execution.

The process diagram in Figure 1 shows the journey corporate treasurers and other FX market participants should follow to achieve best execution outcomes and adhere to the guidelines included in the FX Global Code (of conduct) issued earlier this year by the Global Foreign Exchange Committee.

The process diagram in Figure 1 shows the journey corporate treasurers and other FX market participants should follow to achieve best execution outcomes and adhere to the guidelines included in the FX Global Code (of conduct) issued earlier this year by the Global Foreign Exchange Committee.

The five elements in the journey to best execution are:

1. Search

For some corporations and financial institutions, looking at trading alternatives comes naturally. For others, it's a whole new challenge. The largest, most sophisticated corporations may already use multiple trading alternatives, have both ISDA and prime brokerage credit arrangements, and have embraced technology fully. However, a surprising number of companies still use voice orders, trade with a limited number of counterparties, and rely on the “request for quote” option when they do use technology.

This part of the journey requires businesses to be open to different alternatives. For example, over the past several years, banks have built and begun offering real money customers, such as corporates, algorithmic FX trading platforms that access a variety of liquidity pools. These bank FX algorithmic platforms are an example of the type of alternative that corporations must consider—among others—if they are going to comply with the best execution process.

2. Selection

To follow the best execution roadmap in Figure 1, a treasurer or risk manager must consider multiple trading alternatives. Reliance on just one or two alternatives does not provide enough variety to allow for an adequate evaluation when that part of the best execution journey occurs. An adequate selection process must include an assortment of different trading choices to allow for future comparison.

It is critical that the trading choices selected provide precise recordkeeping/time stamping information for future analysis. And there is no point in selecting a trading alternative if that choice cannot provide the information necessary to track performance as measured against every metric, not just price. For example, corporates should have the ability to evaluate their FX transactions against a reliable third-party benchmark, and they should have access to information that shows the available prices and liquidity in a market before and after their trade execution, for analytical purposes. Thus, the selection process must be thoughtful and take into account all the elements of the best execution journey.

3. Utilization

When a corporate treasurer has selected an appropriate set of FX trading alternatives, he or she should be sure to allocate trading volume in a manner that facilitates the evaluation process that is fundamental to best execution. Large orders should not simply be channeled to a particular trading option based on legacy practice, nor should small orders. The use of different order types and algorithms should also be utilized to create a data set for future evaluation.

The regulators do not prescribe how long an organization should take to reach a decision regarding the attractiveness of any FX alternative. The point here is that a corporation must use multiple trading alternatives to position itself to meet best execution standards, and use them over a long enough time to allow for proper evaluation.

Once the best execution journey begins, two things become abundantly clear: First, this journey is not in a self-driving car. The FX market participant is completely responsible for its own journey. Getting around the process cycle takes commitment, energy, and constant engagement. And second, the journey never ends—the journey is the destination.

4. Evaluation

Regulators in the financial markets have provided clear guidance for the evaluation process in the best execution journey, and a variety of commercial third-party tools have sprung up to perform the pre-trade and post-trade elements of a proper evaluation.

Post-trade transaction cost analysis (TCA) was their initial focus. A niche industry sprung up to evaluate trades executed by real money customers. Not surprisingly, some TCA products are better than others, but at this stage it is not clear that the TCA process is much more than a “check the box” for many corporations and financial firms. The providers of high-quality TCA tools offer real value in the evaluation of alternative trading venues, while less-sophisticated solutions can actually have the opposite effect.

As corporate treasurers conduct evaluations of their trading choices, they must also measure their own ability to perform an effective evaluation. Does the company have enough information? Are decision-makers able to interpret the information they receive from third parties? The regulatory message is crystal clear: The corporation or financial firm is solely responsible for the evaluation; it cannot pass off responsibility to a third-party provider of TCA.

The MiFID II regulation requires investment firms to perform a pre-trade market check before each trade they execute. This exercise must be systematic and embedded in the firm's trading policies and practices. Looking at a quote on a subscription screen does not meet the regulator's requirement. On the buy-side, the FX Global Code guides trade execution, suggesting that protecting the client's trading intention and identity is a best practice. Then, once a trade is completed, MiFID II requires an analysis of the adequacy of the trading outcome. TCA tools can do a good job of supporting these post-trade analyses.

Evaluation is an area in which it makes sense for corporate treasurers to follow the roadmap that the financial services industry has developed for best execution. This end-to-end trade evaluation process depends on access to relevant data and the analytics to decipher that information. A corollary to this access is robust recordkeeping that can be referenced at any time in the future. Given the challenging requirements of the evaluation portion of the best execution journey, it is imperative that a company chooses trading alternatives that help meet the fulsome demands of the best execution standards. Perhaps this is obvious, but an adequate evaluation can be performed only if trading alternatives provide the data and analytics to allow that evaluation to take place.

5. Reflection

Best execution guidelines do not, in an absolute sense, dictate the outcome of the evaluation process. The new MiFID II regulation does not judge; it places that burden squarely on the shoulders of the financial services firms. The regulators merely demand that such judgments be made soundly and consistently. By analogy, if a corporate treasurer determines that a combination of algorithm-based execution platforms and single-dealer executions delivers the best trading outcome, then he or she merely needs to document the results to answer the question “How so?”

That said, the best execution journey requires a commitment to ongoing review. The reflection portion of the journey may be the quickest, since it requires a look backward to study the outputs from the evaluation process: What factors were considered regarding anonymous vs. disclosed executions? Were pre-trade analytics employed systemically? And how well did the market participant execute as analyzed by robust TCA?

Coming out of this judgment phase, the FX market participant is obligated to begin its best execution journey anew. What new trading alternatives have appeared recently or in the past year? What has the organization learned through the evaluation process that encourages it to seek out other trading venues or approaches?

When Best Execution Processes Make for Better Trade Outcomes

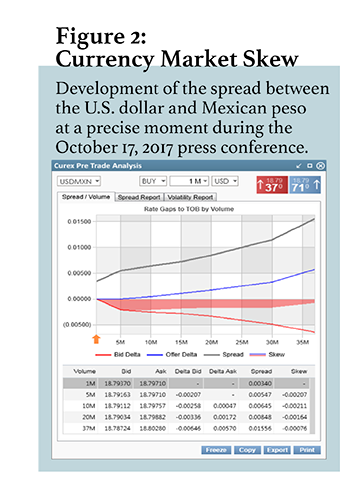

On October 17, 2017, the senior representatives of the United States, Canada, and Mexico who are leading NAFTA renegotiations held a press conference following the completion of their fourth week-long session. The news conference lasted approximately 20 minutes and included statements from each country's official. In the course of these statements, eagerly awaited by many in the FX trading community, the participants revealed that numerous “unconventional challenges” had arisen during this fourth session that would require creative solutions and extended intercessions. Minister Freeland from Canada warned that any result which would roll back 23 years of trade progress would cause fundamental harm to North American industries, particularly the automotive industry. The take-away from this news conference was that the parties still had a long way to go in their effort to “modernize” NAFTA.

As the press conference progressed, the currency relationships between U.S. dollar (USD), Canadian dollar (CAD), and Mexican peso (MXN) became more volatile. For any corporate treasurer needing to transact in those currencies, real-time knowledge of the market's movement would have been extremely valuable. One pre-trade analytical tool revealed the market skew shown in Figure 2.

As the press conference progressed, the currency relationships between U.S. dollar (USD), Canadian dollar (CAD), and Mexican peso (MXN) became more volatile. For any corporate treasurer needing to transact in those currencies, real-time knowledge of the market's movement would have been extremely valuable. One pre-trade analytical tool revealed the market skew shown in Figure 2.

As Figure 2 illustrates, prices skewed significantly in favor of the offered side of the market reflecting increased interest in selling USD against MXN. A company needing to sell USD against MXN would want to do so as aggressively as possible, to sell their interest in front of an increasingly weak USD market. If the company's treasurer followed best execution principles, his or her pre-trade market check would have revealed the information in Figure 2. Having direct access to this data—without calling a bank and disclosing trading interest—would have been critical for a corporate treasurer interested in achieving a best execution outcome.

While this illustration relates to a singular event, the process of best execution, if followed consistently, will always allow the corporate treasurer to have pre-trade market intelligence, as well as a post-trade perspective to better understand the quality of every trade completed and to inform them of how to improve their executions going forward.

It's Time to Start the Best Execution Journey

Following the process that is the best execution journey will absolutely deliver benefits to every corporate treasurer and risk manager. By following the five-phase process, an FX market participant will achieve greater efficiency through access to better intelligence, and that will result in lower total costs in FX executions.

This point about total costs is important. FX market participants are too often unaware of the market impact of their trading choices. Market impact—price changes caused by execution performance—is a real economic cost of execution. This hidden but real cost can occur because of information leakage and even front-running. And the information leakage may be the direct result of the execution choice made by the FX market participant. Is the company executing by voice, creating execution delay? Is it using requests for quotes (RFQs), which reveal its trade intention and size? Is it trading anonymously? Is it executing on a venue in which its trade can be rejected? A corporate treasurer who follows the best execution processes described in this article will take a significant step to avoid those costs.

Adopting the best execution process delivers outcomes that will build confidence whenever an FX execution is required. Taking a systematic approach supports a reliable, sustainable, and transparent protocol that alleviates performance pressure and supports better risk management. Best execution in FX, and in every asset class, is a journey that requires commitment and attention. The regulations coming out of the financial marketplace have provided a map that every market participant should follow. Corporate treasurers and risk managers should embrace this journey.

James L. Singleton is the chairman and CEO of Cürex Group, a New York City-based institutional foreign exchange execution services and data analytics company.

James L. Singleton is the chairman and CEO of Cürex Group, a New York City-based institutional foreign exchange execution services and data analytics company.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.