A whale in the corporate bond market is going on a diet.

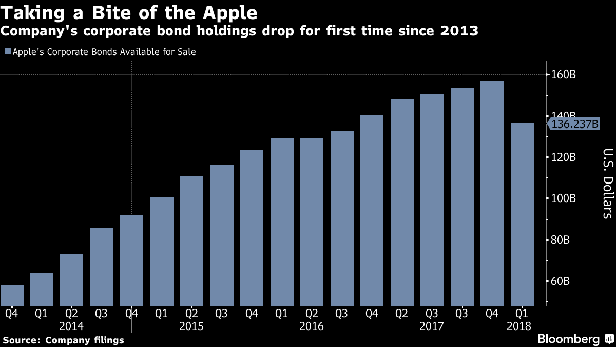

Apple Inc.'s holdings of company debt shrank in the latest quarter for the first time since 2013, as the maker of the iPhone adjusts to new tax laws. The tech company held about $136 billion of corporate bonds as of the end of March, representing about half its pile of cash and securities, according to a filing this week. Its holdings of mortgage bonds and asset-backed securities also fell, the filing showed.

Bloomberg reported in February that Apple had been pulling back on buying corporate bonds with its overseas cash, based on people familiar with the matter. Now it's showing up in the company's numbers, as its holdings of the debt fell to their lowest level since 2016. Apple may be divesting its holdings or may just be letting the securities mature without reinvesting.

Recommended For You

The new U.S. tax law is likely to end a strange debt circle that helped fuel purchases and sales of corporate bonds for years. Previously, companies with extensive profit earned overseas, like Apple and Alphabet Inc., would end up being both big buyers of corporate debt and big issuers of the obligations.

The buying stemmed from the money the companies had earned abroad that would be taxed if it were brought back to the United States. Instead, they would invest at least some of that money in short-term corporate bonds.

Those companies would also borrow in the U.S. corporate bond markets to fund share buybacks and other cash needs. Apple was the third-largest issuer of corporate bonds last year.

Under new laws, there's no benefit to keeping money overseas, meaning companies like Apple can just move profit back to the U.S. without the bond markets intermediating. The effects of that change are showing up in corporate debt markets. Prices have fallen and yields have risen for investment-grade bonds that cash-rich companies would buy, namely those with a duration of less than one year, according to data compiled by Bloomberg. And issuance for high-grade bonds has fallen 7 percent this year through Thursday, compared with the some period last year, in part because Apple hasn't sold any bonds this year.

The tech company said Monday it would start a new $100 billion stock repurchase plan and a higher dividend, according to its earnings report. It's now evolving to rely more on services and other parts of the business to drive growth as iPhone sales slow.

A representative for Cupertino, California-based Apple declined to comment.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.