Flip phone or smart phone? DVD or streaming video? These choices seem obvious today, but the viability of every new technology remains questionable until adoption reaches a tipping point that convinces people and industries to embrace change. Virtual cards are now approaching that tipping point.

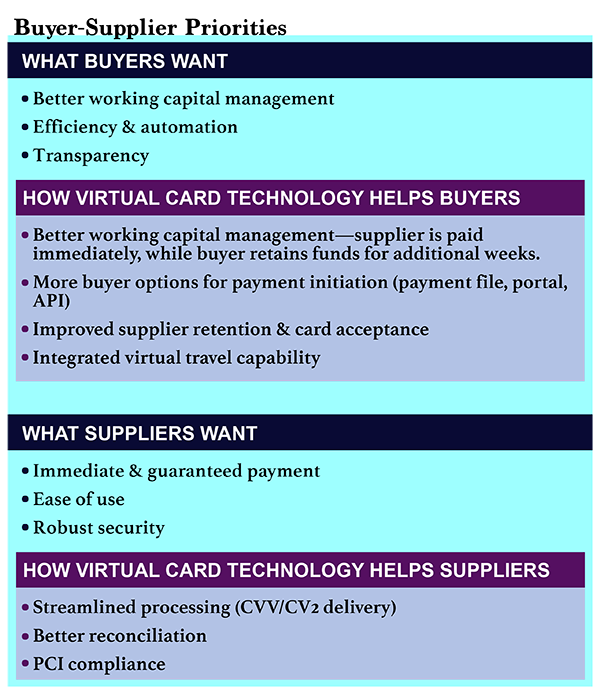

To understand the advantages and ongoing evolution of virtual cards, consider what drove adoption of physical commercial cards in the first place. For the buying organization, commercial cards streamline the payment process, provide greater control over how and where purchases can occur, provide transparency into purchase activity post-transaction, and reduce expenses associated with paper check processing. Commercial cards also have value for suppliers, as they provide immediate and guaranteed access to funds, simplified processing, and valuable remittance data not necessarily available with paper checks, wire transfers, or ACH payments.

Virtual cards offer the same benefits as commercial cards, but “without the plastic”—in other words, without a physical credit card present to facilitate the transaction. A virtual card payment can be initiated in either of two ways: First, buyers can receive and approve invoices through their company's typical payment processes, but then pay using a static virtual card account, a 16-digit account number that is dedicated to one specific supplier. The other option is to generate a dynamic, single-use 16-digit number for each transaction. In either scenario, the account is not funded until the buyer approves payment for the invoice.

Large national banks and many regional banks in the U.S. offer virtual card payments. Growth in the financial technology marketplace has produced many third-party solutions that integrate virtual card technology into payment platforms. To date, a limited number of institutions are able to support virtual card payments outside of North America.

Virtual cards can offer five key advantages over traditional corporate payment cards:

- Versatility. Virtual cards give buyers and suppliers more choices for payment delivery and processing. In the most common approach, the buyer funds the card and the card system generates an email notifying the supplier that payment is ready. The supplier then “pulls” funds from the card. In recent years, straight-through processing (STP) has enabled a buyer to initiate payment, fund the card account, and then “push” the transaction through the card network and into the supplier's pre-designated demand-deposit account. The virtual card system then generates an email notifying the supplier that a payment has been made.

- Flexibility. In addition to the pull and push models, virtual cards offer optional data files to buyers, to aid with reconciliation. A virtual card payment can also be specified “exact-match” for a given transaction, which means the buyer can require the supplier to accept only the specific amount funded on the card. This approach can help prevent partial payments and potential reconciliation issues. Alternatively, buyers may choose to pay multiple invoices through a single lump-sum payment, enabling the supplier to accept the lump sum or several smaller payments from the single-card transaction.

- Control. Buyers can preapprove payments to known suppliers, limiting transactions to those that meet specified criteria around payment value, number of permissible transactions, and payment timing. Virtual card transactions can also increase suppliers' confidence about PCI compliance, since virtual card account information is retrieved via a secure email or URL, eliminating the need to store account information.

- Cost efficiency. Virtual cards provide enhanced remittance data that's easily integrated into accounting and enterprise software platforms. Processing an invoice from a known supplier through the buyer's standard accounts payable (A/P) review processes captures remittance data in bulk. Once the invoice is approved for payment, the card transaction is triggered. This process reduces manual effort within the payment workflow, improving productivity of both the buyer's A/P department and the supplier's accounts receivable team.

- Better fraud protection. Both buyers and suppliers are concerned about payment fraud—and with good reason. According to a recent survey by the Association for Financial Professionals (AFP), 78 percent of all businesses have fallen victim to payment fraud. Two unique features of virtual cards help reduce fraud exposure: First, the payment has already been approved through the buyer's standard A/P processes before the actual virtual card payment request is made. And second, if a payment is processed via a single-use virtual card, the card account number is tied to that specific transaction and must be executed within a specific time frame.

APIs and Automation Bring New Possibilities

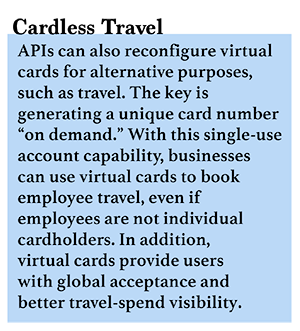

Application programming interfaces (APIs) enable corporate treasury systems to connect to banking platforms. At one time, a company had to plug in to the bank and follow bank protocols in order to use a bank payment product. Now APIs enable organizations to integrate banking services into their finance processes in ways that optimize convenience and efficiency.

APIs can be used to pull information from the bank's virtual card system into the company's front-end treasury software, and to push out card payments. Such integration streamlines invoice payments, on-demand purchasing, and front-end call center communications.

APIs can be used to pull information from the bank's virtual card system into the company's front-end treasury software, and to push out card payments. Such integration streamlines invoice payments, on-demand purchasing, and front-end call center communications.

APIs can also deliver requests for new virtual accounts in real time and provide secure access to account details, including the 16-digit account number, expiration date, and CVV/CV2. APIs continue to evolve, and they're poised to support the further transformation of virtual cards.

Preferred Payments as a Working Capital Management Strategy

Many companies are seeking to improve working capital through payment automation. With virtual card technology, organizations can pay suppliers today and not settle up with their issuing bank for many days or weeks, deploying capital in other ways in the meantime. Additionally, buying organizations that use virtual card payments benefit from time and cost savings associated with processing paper checks.

The key to working capital management with virtual card payments is supplier enablement. Working with their A/P departments, organizations are able to gain a data-rich view of their supplier portfolio and supplier payment trends, uncovering opportunities to streamline the procure-to-pay cycle. By analyzing historical payment data, organizations can best target suppliers most likely to convert to virtual card. From this segmentation, more specific outreach strategies can be defined. Often, organizations will offer preferred supplier status as an incentive to accept a virtual card over a paper check.

Consider the example of a buyer that purchases copy paper from three different suppliers. One of the three suppliers is willing to accept a virtual card for future payments, while the other two insist on receiving either paper checks or ACH payments. The buyer may choose to shift more purchase volume to the supplier that accepts virtual card payments, to gain the working capital benefits, while the preferred supplier benefits from faster and more efficient payments.

A supplier's interest in virtual cards will depend on its organization type and size. The benefits may be obvious for large supplier organizations since they can scale cost savings and efficiencies by integrating virtual card payment acceptance into their accounting or enterprise software platforms. But most buyers have diverse supplier portfolios made up of organizations of varying sizes, payment types, and terms.

Understanding your suppliers' incentives—from cost and time savings to improved cash flow—can help your company lay a foundation for migrating suppliers to virtual cards. Once suppliers satisfy basic card requirements, such as accepting credit cards for invoice payments and keeping card information on file, a treasurer can look at ways to build a virtual card program that will bring significant benefits to both parties in the transaction.

Understanding your suppliers' incentives—from cost and time savings to improved cash flow—can help your company lay a foundation for migrating suppliers to virtual cards. Once suppliers satisfy basic card requirements, such as accepting credit cards for invoice payments and keeping card information on file, a treasurer can look at ways to build a virtual card program that will bring significant benefits to both parties in the transaction.

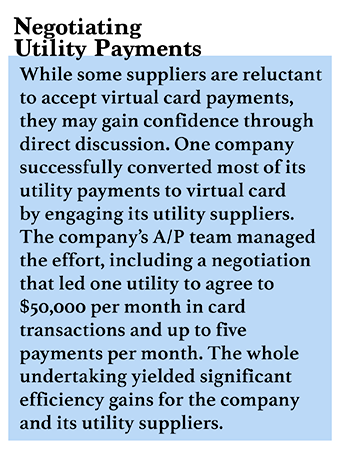

However, corporate treasurers and A/P teams need to understand that card acceptance is not a one-size-fits-all proposition. The optimal payment method may vary from one supplier to the next. Virtual cards can be very effective at maximizing payment automation. A best practice for buyers is to structure payment terms in their contracts so that virtual card acceptance is required, or at least viewed as a preferred payment type. Additionally, buying clients may want to leverage discounted interchange programs (supported by some issuers) to drive larger or cost-averse suppliers to card.

Companies that successfully steer suppliers to virtual card payments generally follow three steps:

- Classify suppliers, starting with A/P spend. While some suppliers may be easily convinced to accept virtual cards, there may be room to convert others by negotiating terms and setting unique parameters. Many companies rank their suppliers using granular data, such as high-level merchant category codes (MCC—a four-digit number assigned by card networks to a business based on the goods or services offered by the business) or North American Industry Classification System (NAICS) industry codes, such as maintenance/repair/operations (MRO), construction, and legal.

- Analyze spend to shed light on how each supplier is transacting with the company. This exercise also helps identify specific suppliers that receive payments via multiple methods. This helps to define where there are opportunities to consolidate payment methods. Many companies define their migration goals and timelines, such as migrating 20 percent of their suppliers to virtual card within 12 months.

- Launch a new strategy using the baseline analysis from steps 1 and 2 as a foundation. It's crucial to involve senior management and peers to gain feedback, buy-in, and approval. Most companies create a supplier communication plan and gather metrics on a regular basis to track progress.

A best practice would be to establish a baseline communication about preferred payment types to be shared with any new supplier as it begins to interact with the business. As part of a larger payment-terms strategy, positioning virtual cards as a preferred payment type up front (before any transactions occur) is a solid way to promote payment automation. Additionally, buyers should regularly examine their A/P spend by payment type, looking for additional opportunities to convert check payments to card.

The Card Landscape

Virtual card issuers offer a broad range of payment features and technological sophistication, from push/pull and exact-match transaction processing to API connectivity that can drive new levels of automation for a buying organization. Companies seeking the most flexible virtual card program should evaluate issuers on three basic areas:

Supplier pricing strategies—An issuer that provides alternative pricing may open up lines of communication with suppliers, especially those that are sensitive to standard interchange rates.

Technology infrastructure—Issuers should offer evolving API capabilities, as well as standard send-payment notifications via email, or “pull payments,” and supplier-processed STP “push payments.”

Program support—Ongoing supplier enablement and retention services are critical for migrating suppliers to virtual cards. They should include on-boarding, education, support service, and ongoing data analysis.

Because virtual cards are on the leading edge of payment technology, integrating these evolving solutions into the payment toolkit means embracing change. That change may require effort, but the benefits can be substantial, from budget and operational efficiency to supplier goodwill, discounts, and revenue sharing. Looking to the future can transform treasury and A/P departments from cost centers into strategic functions that make their companies more competitive and differentiated in their markets.

Jeannette L. Bugg is global head of B2B card and payables solutions for Bank of America Merrill Lynch. She and her team manage the end-to-end strategy and delivery for Bank of America Merrill Lynch's business-to-business commercial card and payables offerings. Bugg regularly works with clients, card networks, merchant acquirers, and fintechs to establish innovative ways to build value to organizations and the payments industry as a whole.

Jeannette L. Bugg is global head of B2B card and payables solutions for Bank of America Merrill Lynch. She and her team manage the end-to-end strategy and delivery for Bank of America Merrill Lynch's business-to-business commercial card and payables offerings. Bugg regularly works with clients, card networks, merchant acquirers, and fintechs to establish innovative ways to build value to organizations and the payments industry as a whole.

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.