The debate about replacing the Federal Reserve's key interest rate has begun.

Spurred by declining volumes and the dominance of a few participants in the market for fed funds, the central bank has started discussing potential alternative policy benchmarks as it seeks firmer control over the nation's short-term interest rates.

While the deliberations have been largely overshadowed in recent weeks by speculation over a shift in the Fed's tightening trajectory and the fate of its $4.1 trillion balance sheet, where these conversations lead could have dramatic consequences for financial markets. Federal Open Market Committee (FOMC) members brought up two potential alternatives at last month's meeting, and they could hardly be more different. What's more, some strategists say a policy-targeting pivot could come as soon as next year.

Recommended For You

“The Fed knows that fed funds is flawed,” says Mark Cabana, head of U.S. interest-rate strategy at Bank of America Corp. “It's probably fatally flawed in their mind, and in the market's mind.”

For most, fed funds is synonymous with the central bank's target rate—yet it's actually much more. It's a market where financial firms make overnight loans to one another from the reserves they keep on deposit at the Federal Reserve Bank of New York—ostensibly to ensure that they can meet critical overnight reserve requirements.

To control the effective fed funds rate—and, in turn, U.S. money-market rates broadly—the Fed, prior to the financial crisis, used open-market operations to manipulate the scarcity of reserves available to be lent on any given day. The market's dynamics changed, however, when quantitative easing measures intended to safeguard the economy created vast new bank reserves, lessening the need for firms to tap interbank liquidity.

Still, changes enacted at around the same time kept the market intact. New laws gave the Fed the power to pay some, but not all, institutions interest on excess reserve deposits (IOER) kept at the central bank. Those without access opted to lend below the IOER rate, creating an attractive arbitrage opportunity for certain firms, which could borrow near the effective rate and park the cash at the New York Fed at IOER, pocketing the yield differential.

The onset of the Fed's balance-sheet unwind has slowly begun to drain liquidity from the financial system, to the point where many in the market are suggesting bank reserves are once again poised to become scarce. In addition, a surge in Treasury-bill issuance—and a corresponding increase in yields—has helped push other key short-term rates higher, especially in the market for repurchase agreements.

As these short-term assets became more attractive alternatives to lending reserves to other banks, the availability of funding has lessened, putting upward pressure on the fed funds rate. Not only has it forced policymakers to take unprecedented steps to try and get the rate back toward the middle of the central bank's target range, but it effectively eliminated arbitrage opportunities from the market, fueling a further decrease in volume.

Turnover that once ran in the hundreds of billions of dollars a day has plunged to an average $64 billion this quarter, according to New York Fed data. It's left the Federal Home Loan Banks—a group of government-sponsored lenders—as the dominant players in the market, unintentionally giving them outsized influence over where the fed funds rate settles.

“The fed funds market is not so much a real market anymore,” says Scott Skyrm, vice president at Curvature Securities, a broker-dealer that focuses exclusively on the repo market. “It used to be a huge market where banks loaned cash to each other. Now it's really just the home loan banks.”

Alternative Targets

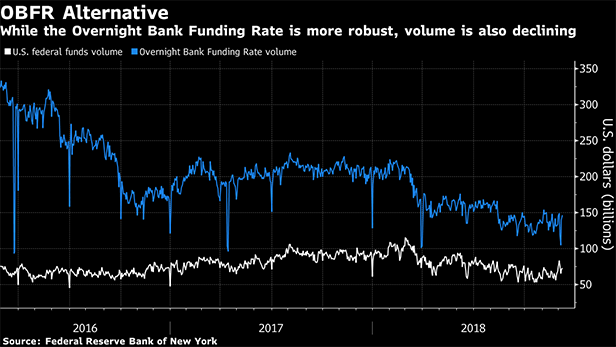

Policymakers, at their Nov. 7–8 meeting, suggested that the overnight bank funding rate (OBFR) could potentially supplant fed funds as the target policy rate. Its appeal is plain to see.

Published by the New York Fed, the unsecured benchmark adds euro-dollar transactions—which are largely banks borrowing from non-bank financial institutions, like money-market mutual funds—to the volume of daily fed funds transactions that go into the calculation of the effective fed funds rate, roughly doubling the daily turnover.

Still, OBFR volumes have also been sliding in recent months, partly as a result of shifts in dollar-funding activity by large non-U.S. banks. While the Fed is in the process of incorporating figures on onshore wholesale borrowing activity into the reference rate, which could potentially make it a more robust indicator of bank funding costs, data collection began only in October.

FOMC participants said last month that the similarity between OBFR and the fed funds rate likely means there wouldn't need to be significant changes in the way they conduct monetary policy were the central bank to make that transition. Yet some members also wanted to explore the possibility of using a secured rate.

That would seem to open the door for SOFR, the secured overnight financing rate introduced earlier this year by the New York Fed in an effort to ultimately wean markets off their reliance on LIBOR.

Strategists had already speculated that the Fed may seek to adopt the rate as its benchmark, in part to facilitate the transition from the beleaguered London interbank offered rate (LIBOR). In addition, repo trading underpinning SOFR is significantly deeper and has a broader set of market participants than both fed funds and OBFR.

See also:

- LIBOR's Heir Presumptive Prepared to Take on Bank Bond Market

- Goldman Sachs Anticipates 'Really Painful Transition' Away from LIBOR

- LIBOR Challenger Embraced in Debut Commercial Paper Transaction

Should policymakers want to continue using a market rate for the target, “we see a repo rate as the preferred choice, given that the repo market is very large and liquid and has essentially no credit risk,” Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics, wrote in a note published Dec. 3.

Yet SOFR has also proven more volatile than fed funds, given that it tends to react to price swings tied to Treasury-bill issuance, as well as month- and quarter-end supply variations. SOFR last week reached the highest level since it was introduced in April, amid a spike in the overnight repo market. That may diminish its effectiveness as monetary-policy tool under the current operating regime.

2019 Pivot

Even though the Fed is only in the early stages of its framework discussion, Bank of America's Cabana and Wrightson ICAP LLC Chief Economist Lou Crandall say the central bank could have a new policy benchmark as soon as next year.

“It's possible to have a new rate by the end of 2019,” Cabana said. “The way the Fed will likely do this is if they are targeting a range of money-market rates and looking at fed funds, OBFR, and secured funding rates to make a determination of policy. It won't be as specific to fed funds.”

Not everyone agrees. Despite its flaws, fed funds is likely to remain the central bank's preferred rate for now, given OBFR's limitations and the dramatic changes to Fed communication that would be necessary to transition to a repo-based rate, according to Barclays Plc strategist Joseph Abate.

“The Fed is tied to the funds rate now, as the funds rate is first of all seen as a measure of liquidity, and more importantly pressure in the rate is seen as an indication of the Fed's future policy path,” Abate says. “If that doesn't change, then—and this is a philosophical question—does it matter that there is volume underneath it? It hasn't mattered up until now because there is volume.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.