Just when you thought it was safe to go back into the credit market waters, fresh data comes along for the bears to sink their teeth into.

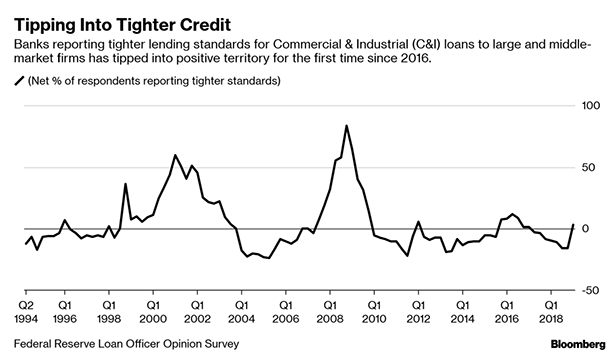

The Federal Reserve's “Senior Loan Officers Survey,” released earlier this week, showed banks tightened lending standards over the past three months at the fastest rate since the middle of 2016, according to Citigroup Inc. strategists. They warn of an unhealthy turn for businesses accustomed to easy-money loans, with expansion plans on ice and debt loads becoming harder to service.

The surprise tightening has sparked a wave of analyst commentary, given the survey is generally considered a leading indicator for economic growth in the United States, even prompting Citi analysts to revise their default forecast.

Recommended For You

“The news from the Fed's senior loan officers' survey was especially disheartening since bankers are clearly tightening up” commercial loans, the firm's credit strategists Michael Anderson and Philip Dobrinov wrote in a note to investors following the report.

Citi's model now projects a 12-month trailing default rate for 2019 of 4.6 percent, compared with a forecast made in early December—during the depths of the credit market selloff—of just 2.7 percent.

While still low by historical standards, the uptick underscores how a change in the flow of credit can impact the wider economy and might go some way towards explaining why the Federal Reserve signaled a pause on rate hikes after last year's intense bout of market volatility.

“A moderate net share of banks reported increasing the premiums charged on riskier loans to large and middle-market firms and a modest net share of banks reported doing so for loans to small firms,” according to the survey.

Overheating in commercial lending has long worried some analysts who believe that banks have substituted commercial credit in place of the easy mortgage loans extended before the financial crisis. They saw a bubble building in C&I lending and its collapse engulfing the wider economy as banks recalculated risk premiums.

“That bursting could be occurring now,” Peter Cecchini, global chief market strategist at Cantor Fitzgerald LP, wrote after the survey was published.

See also:

Still, a slump in bank lending has caused consternation before only to swiftly fade away. In early 2017, shortly after the last tightening of lending standards, analysts fretted the worst growth rate in about six years, only to see loans rapidly recover and climb to a fresh record.

“The survey was conducted from Dec. 21 to Jan. 7, a period of unusual market volatility,” concluded the Citi credit strategists. “Consequently, the results were probably skewed by the market, but it's notable that a worsening economic outlook was the most often-cited factor leading to the shift in lending terms. This leads us to believe that officers saw something beyond the market.”

Here's what others are saying:

Mark Holman, CEO, Twentyfour Asset Management: “The Fed is now clearly on hold, and once it has digested the survey data, it should also conclude that any forward-looking tightening by the commercial banks essentially removes some of the need for tightening by the central bank itself. On balance then, the Fed should be more dovish after reading this.”

Tobias Levkovich, Chief U.S. Equity Strategist, Citigroup Inc.: “While it is premature to assume that things get worse, the data does suggest some wariness now is more appropriate and could provide the Fed with even more flexibility and patience. Tightening of the business credit backdrop clearly is not good news. The SLOS typically leads human, working capital, and physical investment by nine months—and, thus, it is signaling that Q4/2019 may show softer industrial activity, thereby acting as meaningful restraint on S&P 500 earnings trends.”

Andrew Hunter, Senior U.S. Economist, Capital Economics: “There are some reasons for concern, as the recent tightening in lending standards suggests that loan growth will drop back again over the coming months. At the same time, rising corporate credit spreads resulted in a collapse in bond issuance at the end of last year. Although spreads have started to drop back, they remain elevated by past standards. Higher borrowing costs and tighter lending standards look set to weigh on business investment this year.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.