European debt markets have suddenly become more appealing to some big American corporations again, spurred in part by monetary policy changes.

Several American household names have recently crossed the pond to issue debt in Europe. Companies such as Altria Group Inc., Coca-Cola Co., Ford Motor Credit Co., and International Business Machines Corp., among others, together have sold almost 18 billion euros (US$20.2 billion) in so-called reverse Yankee bonds this year.

“We have shifted from what was a buyers' market, to the extent that there was buying back in December and November, to very much an issuers' market now,” says Morgan Stanley strategist Srikanth Sankaran. He points out that investors who had moved to the sidelines have now re-entered the market, allowing for “surprisingly strong” liquidity in European credit markets.

The debt sales have been well received. Colgate Palmolive Co., for example, was seven times oversubscribed, allowing for a 25 basis point (bps) spread tightening from initial price thoughts, considered a floor for pricing.

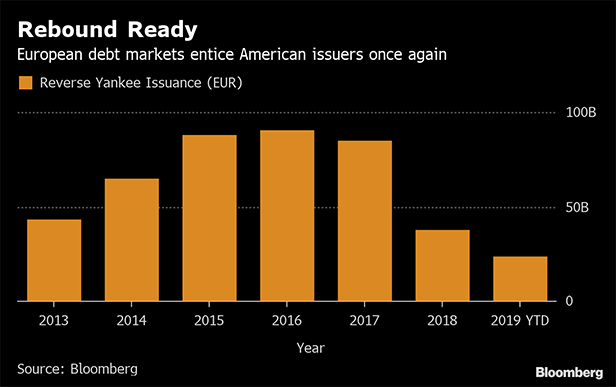

The recent spike in reverse Yankee issuance is nothing out of the ordinary, according to Hans Mikkelsen, Bank of America's head of U.S. high-grade credit strategy, who says, “We are rebounding from levels of last year to levels that are more natural.” He points to the lower borrowing costs in Europe and issuers' desire to create a balance between assets and liabilities abroad as catalysts.

Since 2012, 10-year German bunds have yielded less than 10-year U.S. Treasuries, contributing to a cheaper credit environment when compared with the United States. Partly as a result, euro issuance in the five years that followed also jumped. That being said, 2018 saw a drop-off in reverse Yankee issuance, begging the question of why.

Europe had a more volatile funding environment compared with the U.S. last year, amid political risks and the slowing of quantitative easing. The European Central Bank (ECB) announced this morning that it will keep rates at record lows for longer, to help stimulate economic growth. Its recent patient stance has helped tighten spreads and decrease yields in the Eurozone.

With the ECB's prior bond buying program, supply in euro-denominated debt left for private investors dropped, creating more demand for new issues. The reverse Yankee issuers that do choose to access euro debt markets are mainly investment-grade, multinational companies that are feeding the appetite to own high-quality corporate debt. This is especially the case as U.S. growth, although slowing, is still a bright spot compared with other regions of the world.

What Comes Next?

As some American companies turn abroad for funding, foreign issuance in U.S. dollars is also declining. So far, 2019 has seen only 5 percent of debt in the U.S. investment-grade market (excluding financials) come from Yankee issuers, compared with an average of 13 percent last year.

The opportunity that the Eurozone offers for issuers to borrow at lower rates while diversifying their investor base may continue. “I think we're going to see quite active reverse Yankee deals at least for the time being,” says Mikkelsen.

High cash balances in investor portfolios and patient central banks are keeping corporate bond yields low, says Sankaran, who also expects some degree of reverse Yankee issuance to continue in the near term.

American issuers also have the option of exchanging proceeds back into dollars. The five-year cost to convert payments from euros into dollars using cross-currency basis swaps has cheapened, providing an additional incentive to issue abroad.

Gennadiy Goldberg, a strategist at TD Securities based in New York, says the key driver for the divergence between the euro and U.S. dollar has been tightening in the cross-currency basis swaps at the end of 2018.

“The widening in cross-currency basis we saw over the early part of the year has certainly slowed, so for the moment, I would expect to see ample euro issuance to continue. However, if the cross-currency basis continues to widen, as it did earlier in the year, then dollar supply could become more attractive relative to the euro,” Goldberg said in an interview.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.