Some of the largest U.S. technology companies pushed for a corporate tax overhaul in 2017 by suggesting they would go on hiring sprees and boost the economy. Just over a year after getting what they wanted, data show these firms gave most of their huge tax savings to investors.

The top 10 U.S. tech companies spent more than $169 billion purchasing their shares in 2018, a 55 percent jump from the year before the tax-law changes, according to data compiled by Bloomberg. The industry as a whole authorized the greatest number of share buybacks ever recorded, totaling $387 billion, according to TrimTabs Investment Research. That's more than triple the amount in 2017.

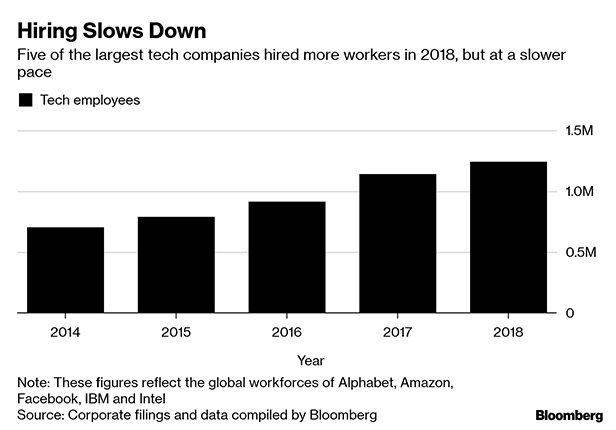

Spending on research and development climbed slightly. Capital expenditures overall rose because Alphabet Inc. and Facebook Inc. almost doubled spending in that category. Apple Inc. and its partners have yet to bring manufacturing back to the United States, as President Donald Trump had hoped. And there was no surge in tech hiring, according to data compiled by Bloomberg.

Recommended For You

“The companies making these hiring promises don't have any signed agreement with any government on any level,'' said Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy (ITEP), a think tank that has criticized the new law. “They're just promises. They're going to be pretty loose and unenforceable, and they want them to be that way.''

Buying back stock improves a company's earnings per share and increases the value of the holdings of shareholders, including insiders. But stock repurchases aren't so great for the economy when compared with other potential uses of that money, including hiring more workers.

The U.S. has given up hundreds of billions of dollars in corporate tax revenue for the promise of other benefits. A year in, the results don't show much of a payoff. Buybacks are already being targeted by some politicians. U.S. Senator Chris Van Hollen, a Democrat from Maryland, threatened to introduce legislation that would make it more difficult for executives to sell stock right after their companies announce they'll repurchase shares. Senator Marco Rubio, a Republican from Florida, said he wants to crack down on the tax benefits companies get from buybacks.

“Buybacks are one factor driving economic inequality in the U.S., as top corporate executives tend to benefit disproportionately from them,'' David Santschi, director of liquidity research at TrimTabs, wrote in a recent report.

Trump signed the Tax Cuts and Jobs Act into law in the final days of 2017. It cut the corporate tax rate from 35 percent to 21 percent. For profits held overseas, there was a special rate of 15.5 percent on cash and 8 percent on non-liquid assets, meant to encourage companies to bring the money back to the U.S. Once back, the theory went, the companies would invest it domestically, boosting the economy.

On the whole, U.S. companies ended up saving 30 percent in tax expenses in 2018, according to ITEP. Tech companies were the main beneficiaries of the cash repatriation provision. Before the law, the largest overseas cash hoards among U.S. companies were held by Apple, Microsoft Corp., Cisco Systems Inc., Oracle Corp., and Alphabet.

While it's still too soon to measure the full consequences of the law, there are signs it will miss its stated goals. Trump said it would bring $4 trillion in overseas cash back to the United States. Corporate America repatriated $665 billion in 2018, according to the Commerce Department, and tech sector stock buybacks ate up more than half of that. Trump said the corporate tax cuts would spur so much economic activity that they would pay for themselves. But economic growth hasn't improved: 2.3 percent year-over-year growth in the final quarter of 2017 versus 2.2 percent in Q4/2018.

Bloomberg analyzed 2018 spending by 10 of the largest U.S. tech companies: Alphabet, Amazon.com Inc., Apple, Cisco, Facebook, Intel Corp., International Business Machines Corp., Microsoft, Oracle, and Qualcomm Inc. The study looked at six common uses of corporate cash: buybacks, dividends, hiring, acquisitions, capital expenditures, and research and development. The 2018 statistics were compared with previous years.

Apple, Microsoft, Cisco, Oracle and Qualcomm have fiscal years that don't follow calendar years. They haven't yet disclosed employee numbers for the end of 2018. For the remaining companies, worker ranks grew 8.7 percent in 2018, versus 24 percent the year before.

These are global numbers, too. So it's unclear how many of these jobs were created in the United States. Gardner, from ITEP, said tech companies may not be hiring as many workers as they are seeking because of the difficulty in finding people who have the right skills for technical jobs. Other measures of tech job growth tell a similar story. IT employment in the U.S. grew 2.6 percent in 2018, versus 4.4 percent a year earlier, according to government data compiled by CompTIA, a tech industry trade group.

Research and development (R&D) spending by the 10 tech companies in the Bloomberg study rose 17 percent last year—a slight uptick from the 15 percent increase in 2017. The acceleration was largely driven by Alphabet and Amazon, which have invested heavily in cloud computing.

Capital expenditures surged in 2018 as Alphabet and Facebook nearly doubled this type of spending, which includes computers for their huge data centers. That helped boost the overall metric to 40 percent growth, from 23 percent the year before.

However, the amount of cash tech giants used for mergers and acquisitions collapsed in 2018, after swelling in 2017.

Showing Shareholders Love

Tech giants spent a combined $50 billion on dividends last year. Dividend growth was one percentage point higher than the previous year, but smaller than the acceleration in 2016.

Those same 10 companies spent more than $169 billion on buybacks last year, up from $109 billion in 2017. The final number will rise as some of the companies with off-year fiscal calendars disclose more information about their repurchases.

In many ways, these results were foreseeable. In 2004, President George W. Bush spearheaded a corporate tax holiday in the U.S. that allowed companies to pay 5.25 percent, rather than the standard 35 percent rate, on overseas profits that they returned to the U.S. The administration pitched it as a jobs booster, but it was followed by large share repurchases.

The 2004 law explicitly forbade companies from using the money for buybacks, but they shuffled funds, repurchasing shares with money they had previously earmarked for other expenditures and using their new source of cash to pay those expenses.

After Trump won the 2016 election, some tech companies saw another chance. IBM CEO Ginny Rometty wrote to the president-elect, stating that his proposal to cut taxes on businesses and their repatriated overseas earnings would prompt companies to invest domestically.

“Your tax reform proposal will free up capital that companies of all sizes can reinvest in their U.S. operations, training and education programs for their employees, and research and development programs,'' Rometty wrote.

IBM cut 16,000 workers on a global basis last year, and its R&D budget declined. Capital expenditures increased by less than $166 million, or 5 percent. Buybacks were relatively unchanged.

Oracle also lobbied hard for the tax law. The software maker has since poured cash into stock buybacks and dividends—recently giving the go-ahead to repurchase about $10 billion of shares each quarter. In previous years, the company authorized share repurchases of more than $10 billion about once a year. This helps concentrate the ownership of company co-founder Larry Ellison. It also supports the stock price and earnings per share metrics at a time when the company is struggling to grow its cloud-computing business.

“While the company is rewarding shareholders with its capital return program, we believe Oracle is significantly underinvesting in R&D compared to peers, at the expense of revenue and operating income growth,” Christopher Eberle, an analyst at Nomura Instinet, wrote in a recent note.

Soon after the 2017 tax act, Apple said it would contribute $350 billion to the U.S. economy over five years, including a plan to open a new campus. The amount included some investments that were already planned. While Trump has tried to pressure the company to bring manufacturing back to the U.S., that hasn't happened yet. Instead the iPhone maker pledged to invest $5 billion in the manufacturing efforts of its partners, up from $1 billion previously. The company also gave $2,500 restricted stock unit bonuses to each of its non-executive employees.

Apple authorized a $100 billion buyback in May and spent $73 billion on repurchasing shares in 2018. Apple said its U.S. workforce grew by 6,000 last year, to 90,000.

Apple's largest manufacturing partner, Foxconn, promised to create 13,000 jobs at a U.S. facility as early as 2022, winning its own huge tax breaks from Wisconsin. It has waffled on the pledge, and it's unclear whether all of those manufacturing jobs will ever materialize.

Cisco CEO Chuck Robbins was upfront about the tax reform. In November 2017, he said his company would “obviously” pursue stock buybacks and dividends, as well as more mergers and acquisitions and investments in innovation centers.

In the time since, Cisco decreased its capital expenditures, according to data compiled by Bloomberg. The networking giant's R&D expenses rose by less than $300 million, or 4.5 percent, and the company hired 346 additional people worldwide from the end of fiscal 2017 to Dec. 31, 2018. Cisco's buybacks, however, jumped by almost $14 billion.

Not every major tech company focused last year on returning money to shareholders. Amazon announced no buybacks and paid no dividends, and the company's workforce grew 14 percent in 2018 versus 66 percent growth the previous year.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.