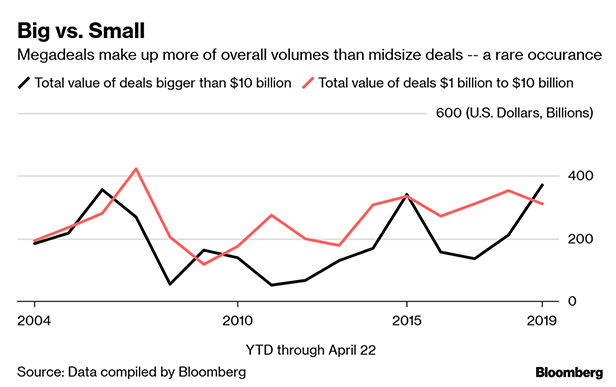

After a start to the year that's been dominated by megadeals, a shortage of bite-sized transactions has some dealmakers concerned about the health of the market for mergers and acquisitions (M&A).

Parsing the year's M&A numbers shows a top-heavy market. There have been US$370 billion of deals globally valued at more than $10 billion announced through April 22, according to data compiled by Bloomberg. That's more than the combined value of transactions worth $1 billion to $10 billion—typically the bread-and-butter of the dealmaking ecosystem.

Recommended For You

It's an unusual trend that's only shown up three times in the past 15 years: in 2006, 2009, and (by a very small margin) 2015.

Bristol-Myers Squibb Co. set the trend for 2019 by unveiling its $74 billion takeover of Celgene Corp. on the third day of the year. Bankers are bemoaning the decline in smaller deals, which at $310.5 billion in total are down about 12 percent compared with the same period in 2018, according to data compiled by Bloomberg. That drop increases to almost a third for dealmaking in North America and Europe, where the majority of activity usually takes place.

Smaller deals “are the steady-state heartbeat of the market; they speak to the health of the market,” said Anu Aiyengar, head of M&A in North America for JPMorgan Chase & Co.

Such transactions have declined because CEOs concerned about market volatility and geopolitical risk have been reluctant to use cash—the typical method of payment in smaller deals—to buy growth, she said. Private equity firms, which operate largely in this part of the market, have also curbed their activity as valuations skyrocket.

The same conditions however have helped megadeals. Of the deals bigger than $10 billion announced so far, 70 percent of the value was paid for using stock, Aiyengar said.

“In an environment where there's a lot of concern about volatility in the market, if you are using stock, you are not underwriting any price, and that facilitates these deals,” she said.

Technological disruption sweeping across industries, as well as intensifying demand from customers for global scale, are among other factors boosting big deals, said Steven Geller, head of Americas M&A and global technology M&A at Credit Suisse Group AG.

“Management teams and boards are increasingly set on becoming the number-one or -two market player, which invariably makes them look for targets that give them global growth at scale,” Geller said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.